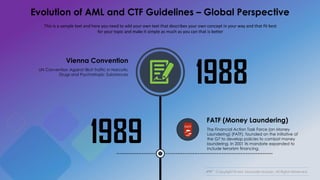

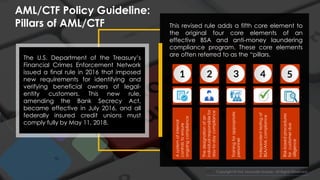

Money laundering and terrorist financing guidelines have evolved over time through various international conventions and organizations seeking to combat these financial crimes (1). Key events included the 1988 UN Drug Trafficking Convention and the 1989 Financial Action Task Force on money laundering (2). Guidelines also evolved at the national level, such as Bangladesh's first anti-money laundering law passed in 2002 (3). Proper policies, procedures and programs are needed by financial institutions to comply with regulations and mitigate risks, starting with an overarching AML/CTF policy endorsed at the highest levels.

![Copyright © Md. Moulude Hossain. All Rights Reserved.

01

STRUCTURING

Often known as smurfing,

whereby cash is broken into

smaller deposits of money,

used to defeat suspicion of

money laundering.

02

BULK CASH SMUGGLING

Pysically smuggling cash to

another jurisdiction and

depositing it in a financial

institution, such as an

offshore bank

03

CASH-INTENSIVE BUSINESSES

Business typically expected to

receive a large proportion of its

revenue as cash uses its

accounts to deposit criminally

derived cash

04

TRADE-BASED LAUNDERING

Under- or over-valuing

invoices to disguise the

movement of money.

Money Laundering - Methods

05

SHELL COMPANIES & TRUSTS

Trusts and shell companies

disguise the true owners of

money. Trusts and corporate

vehicles, depending on the

jurisdiction, need not disclose

their true owner.

06

ROUND-TRIPPING

Money deposited in a

controlled foreign corporation

offshore, preferably in a tax

haven where minimal records

are kept, and then shipped

back as a foreign direct

investment.

07

BANK CAPTURE

Money launderers or

criminals buy a controlling

interest in a bank, preferably

in a jurisdiction with weak

money laundering controls,

and then move money

through the bank without

scrutiny.

08

CASINOS

An individual walks into a

casino and buys chips with

illicit cash. The individual will

then play for a relatively

short time.

09

OTHER GAMBLING

Money is spent on gambling,

preferably on high odds

games. One way to minimize

risk with this method is to bet

on every possible outcome

of some event that has many

possible outcomes,

10

BLACK SALARIES

A company may have

unregistered employees

without written contracts

and pay them cash salaries.

Dirty money might be used

to pay them.

11

TAX AMNESTIES

Those that legalize

unreported assets and cash

in tax havens.

12

TRANSACTION LAUNDERING

Merchant unknowingly

processes illicit credit card

transactions for another

business[19]. It is a growing

problem[20][21] and

recognized as distinct from

traditional money laundering](https://image.slidesharecdn.com/moneylaunderingandterroristfinancinginanutshell-chapterone-190328164914/85/Money-Laundering-and-Terrorist-Financing-in-a-Nutshell-Chapter-One-6-320.jpg)