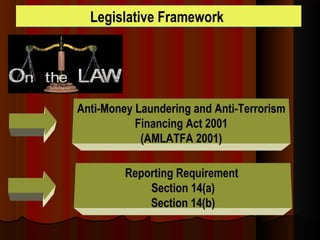

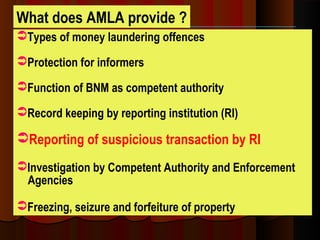

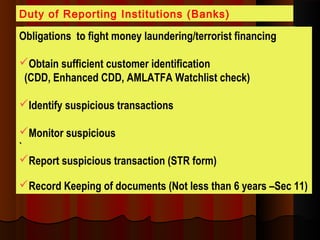

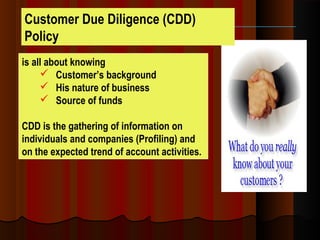

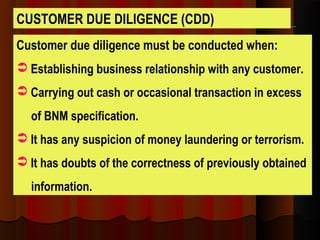

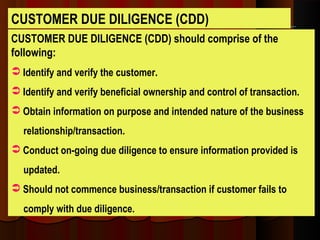

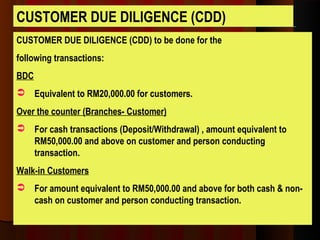

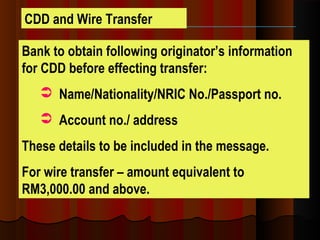

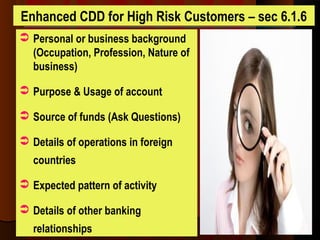

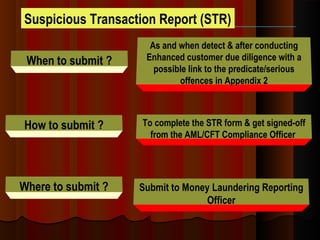

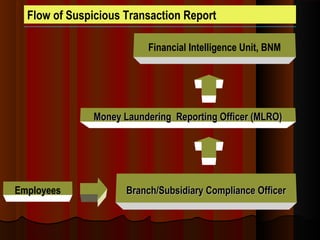

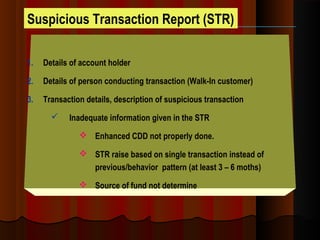

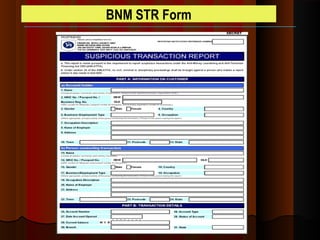

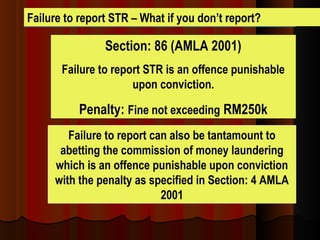

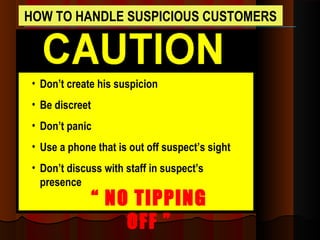

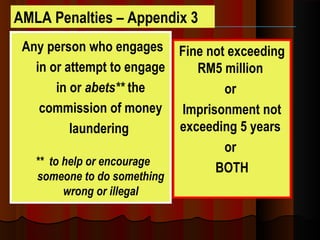

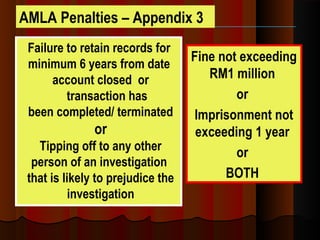

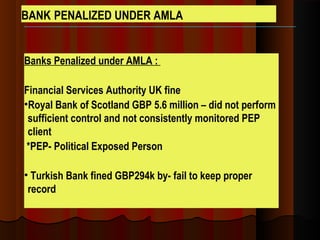

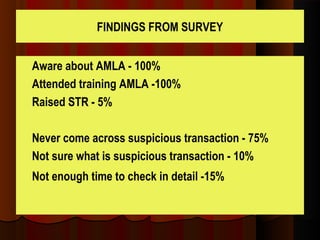

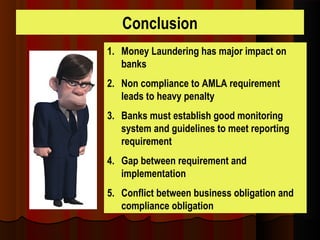

The document discusses money laundering and the obligations of reporting institutions under Malaysia's Anti-Money Laundering and Anti-Terrorism Financing Act 2001 (AMLATFA). It defines money laundering as disguising illegally obtained cash or property to make it appear legitimate. It outlines risks like reputational damage for institutions that don't comply with AMLATFA. Key obligations include conducting customer due diligence, identifying suspicious transactions, and reporting them to the authorities. Failure to comply can result in fines or imprisonment.