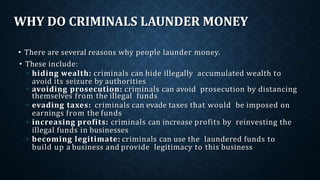

Money laundering refers to the process of making illegally gained money appear legal. It involves three stages: placement, layering, and integration. Criminals launder money to hide wealth from authorities, avoid prosecution, evade taxes, increase profits by reinvesting funds, and provide legitimacy to businesses. Common criminals that launder money include drug dealers, mobsters, terrorists, corrupt politicians, embezzlers, and public officials. They employ techniques like structuring deposits, connected accounts, and investment products. Banks can prevent money laundering by reporting suspicious activities, knowing customers, maintaining records, and cooperating globally and through organizations like FATF.