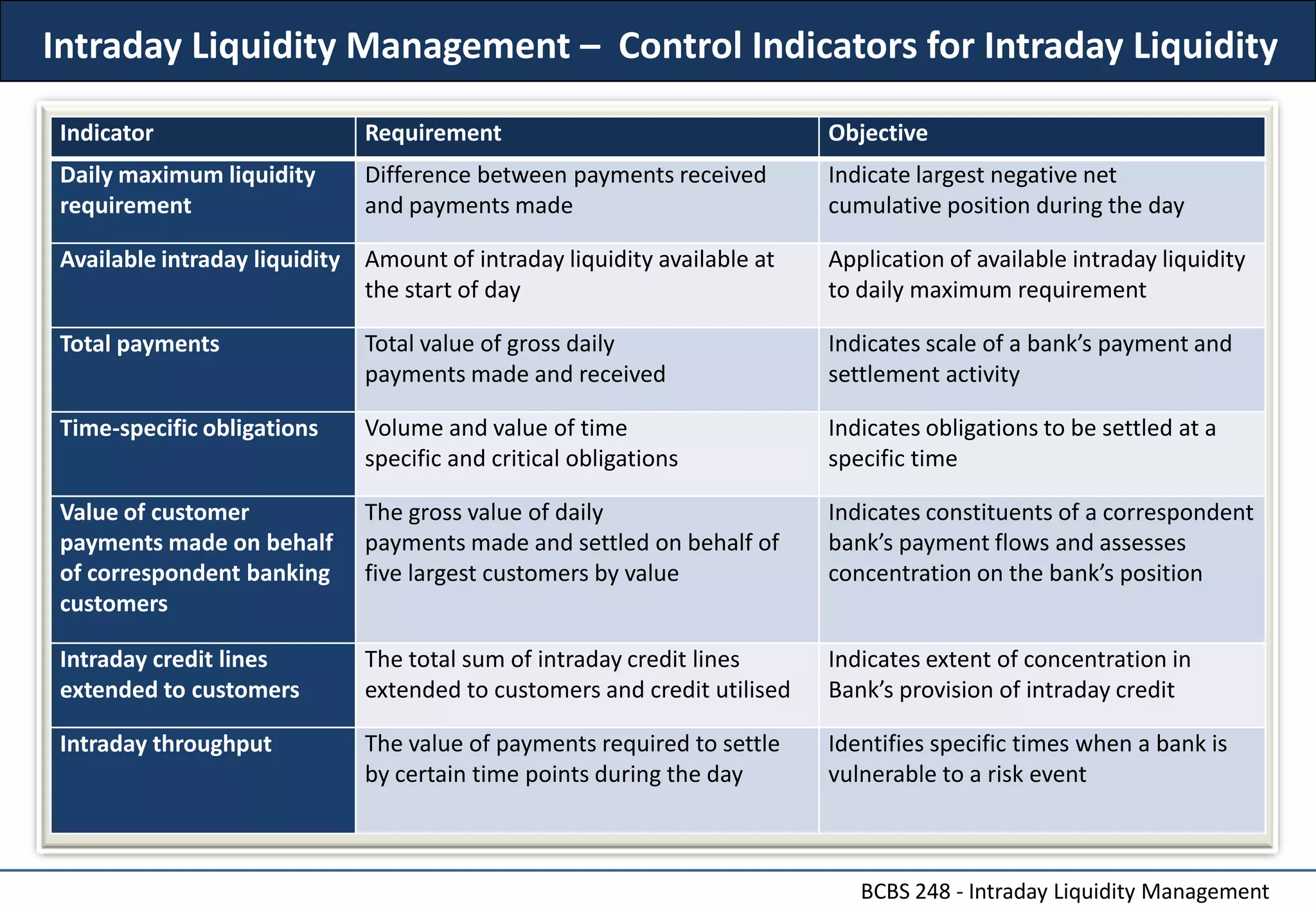

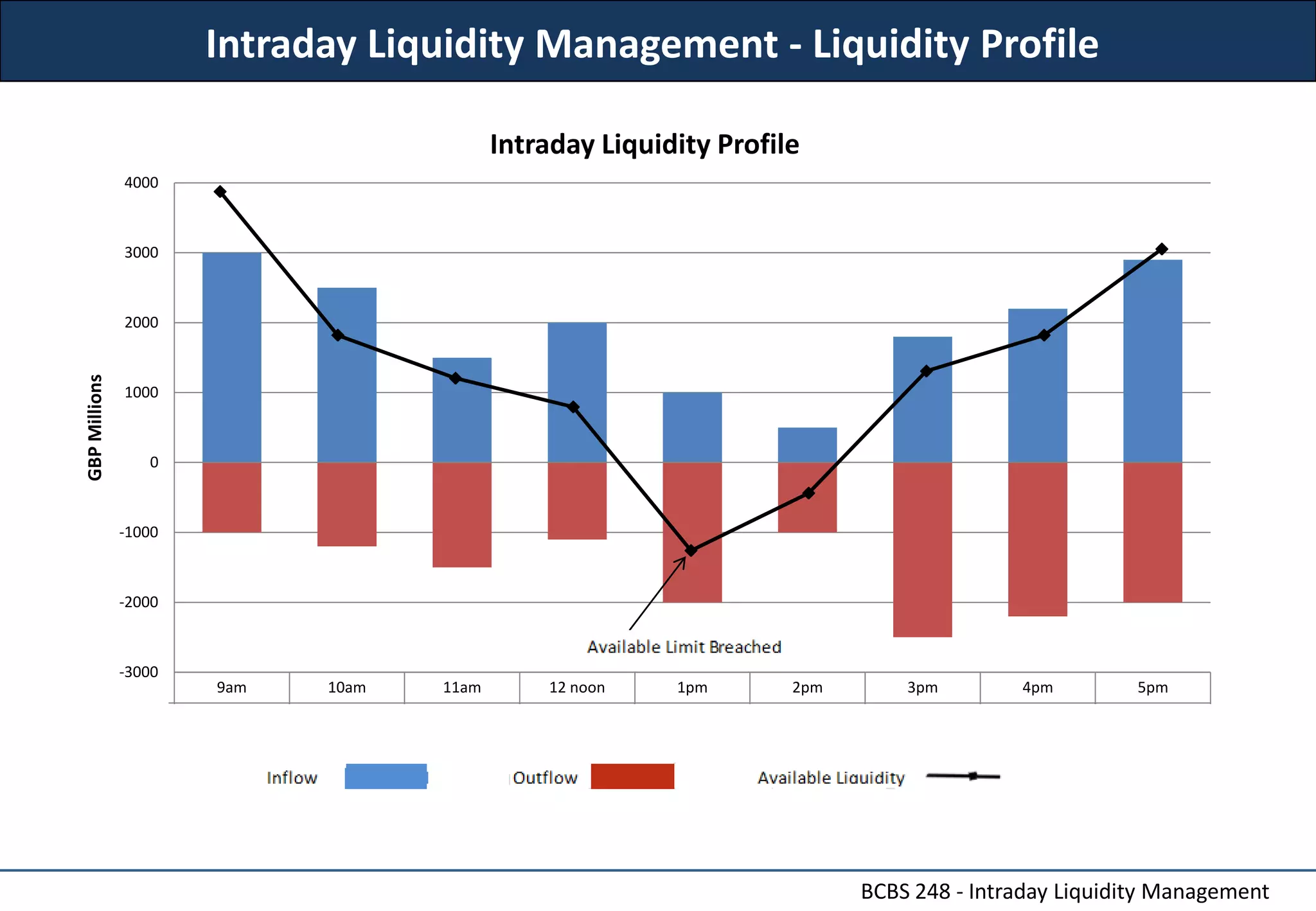

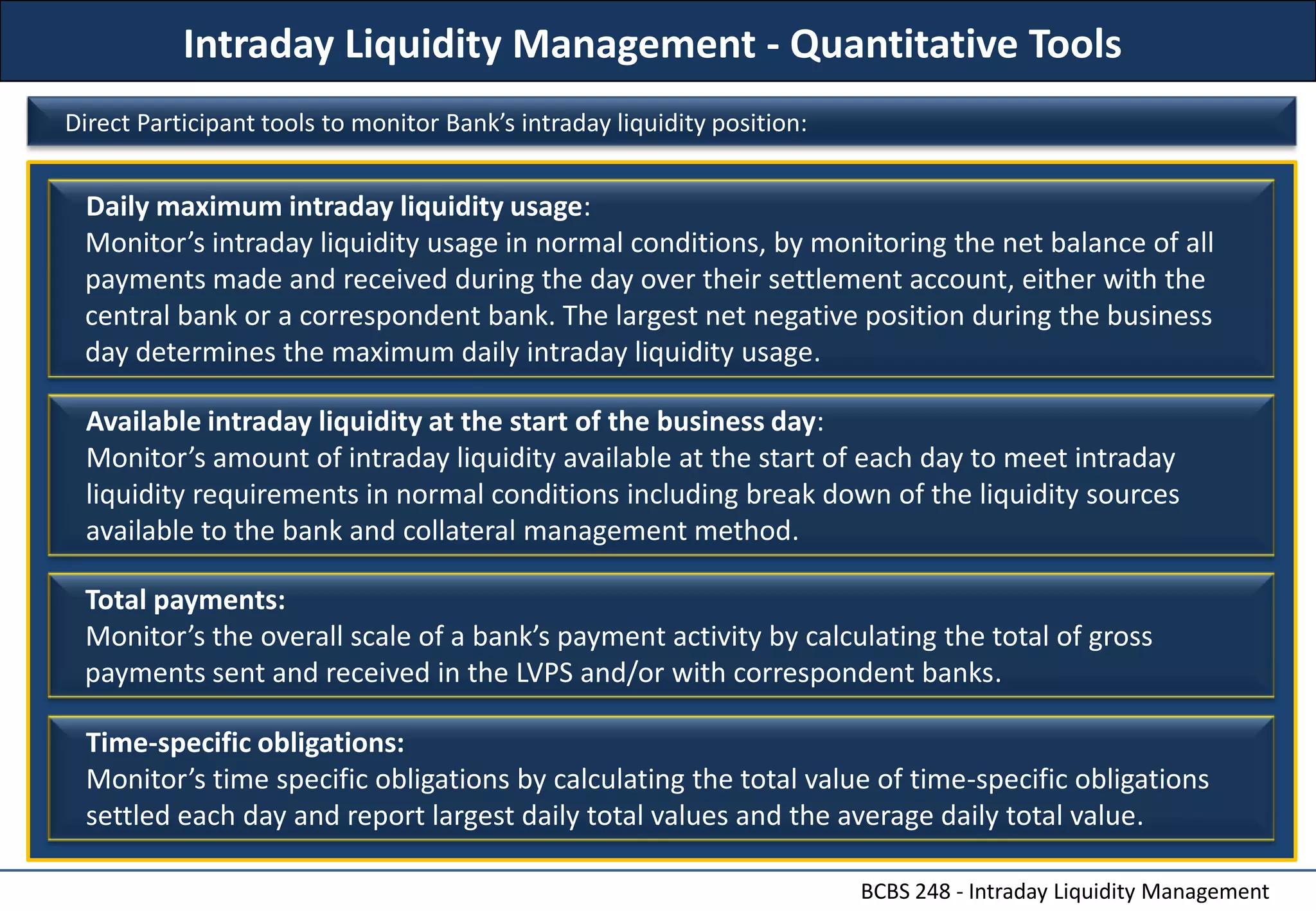

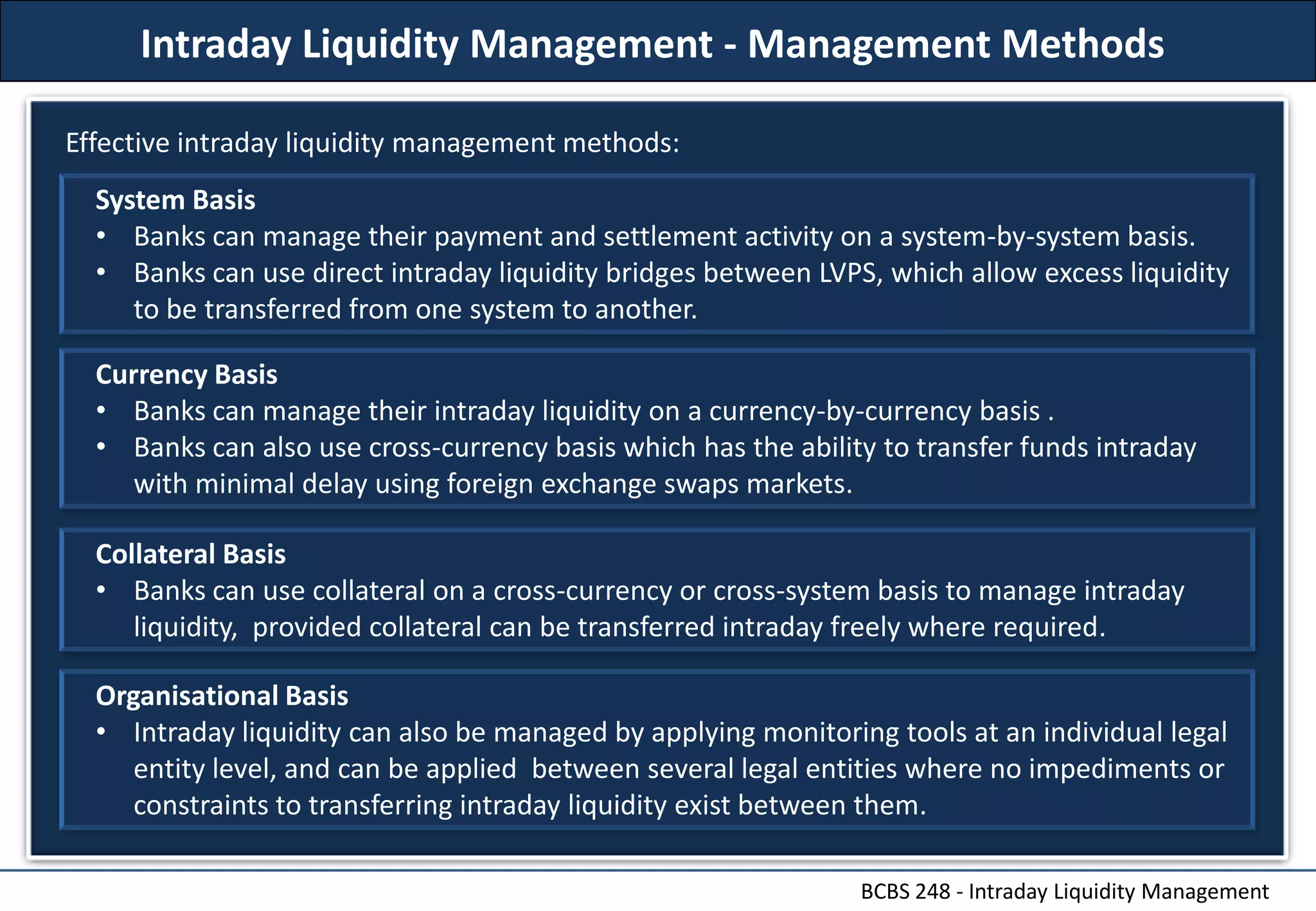

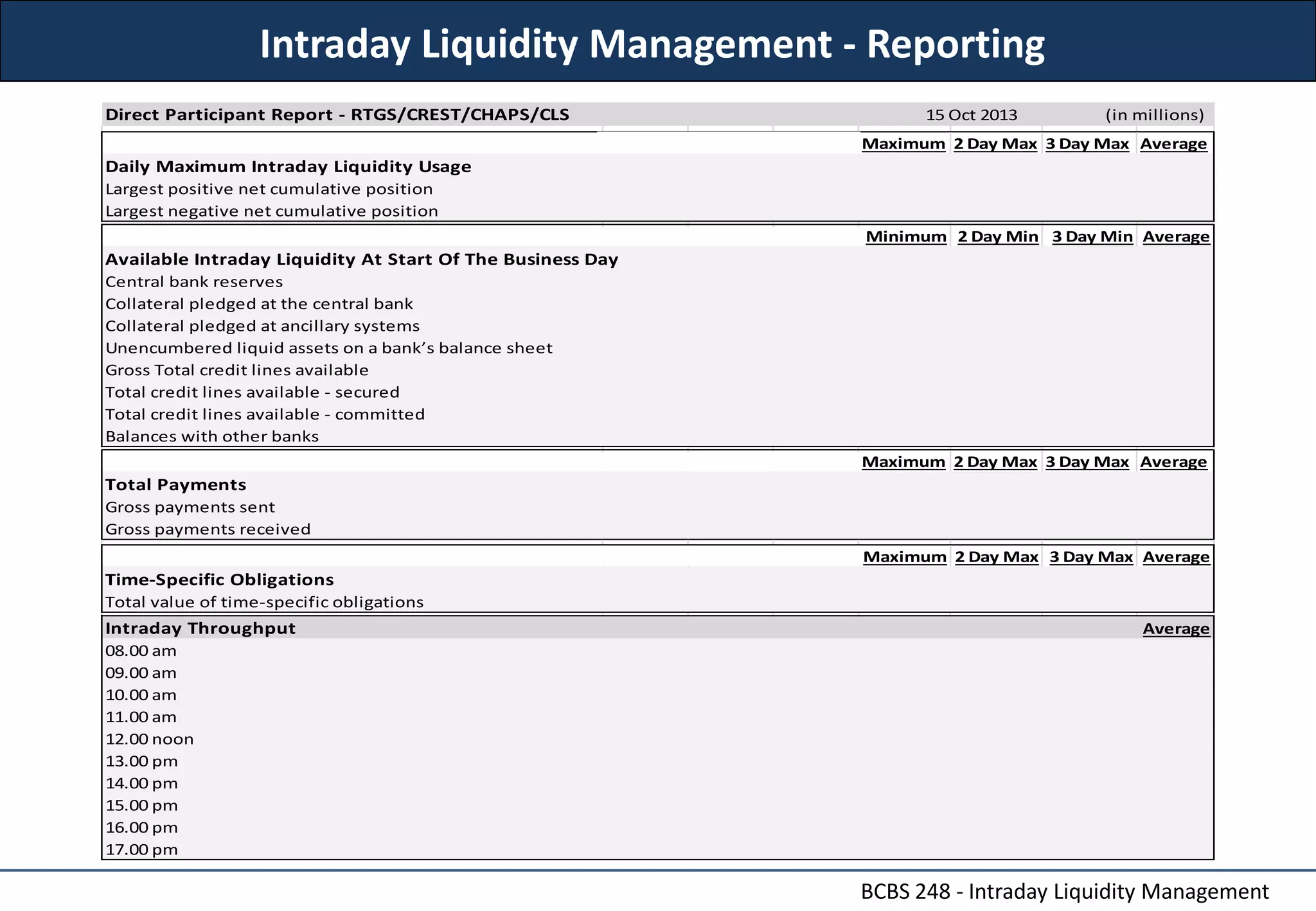

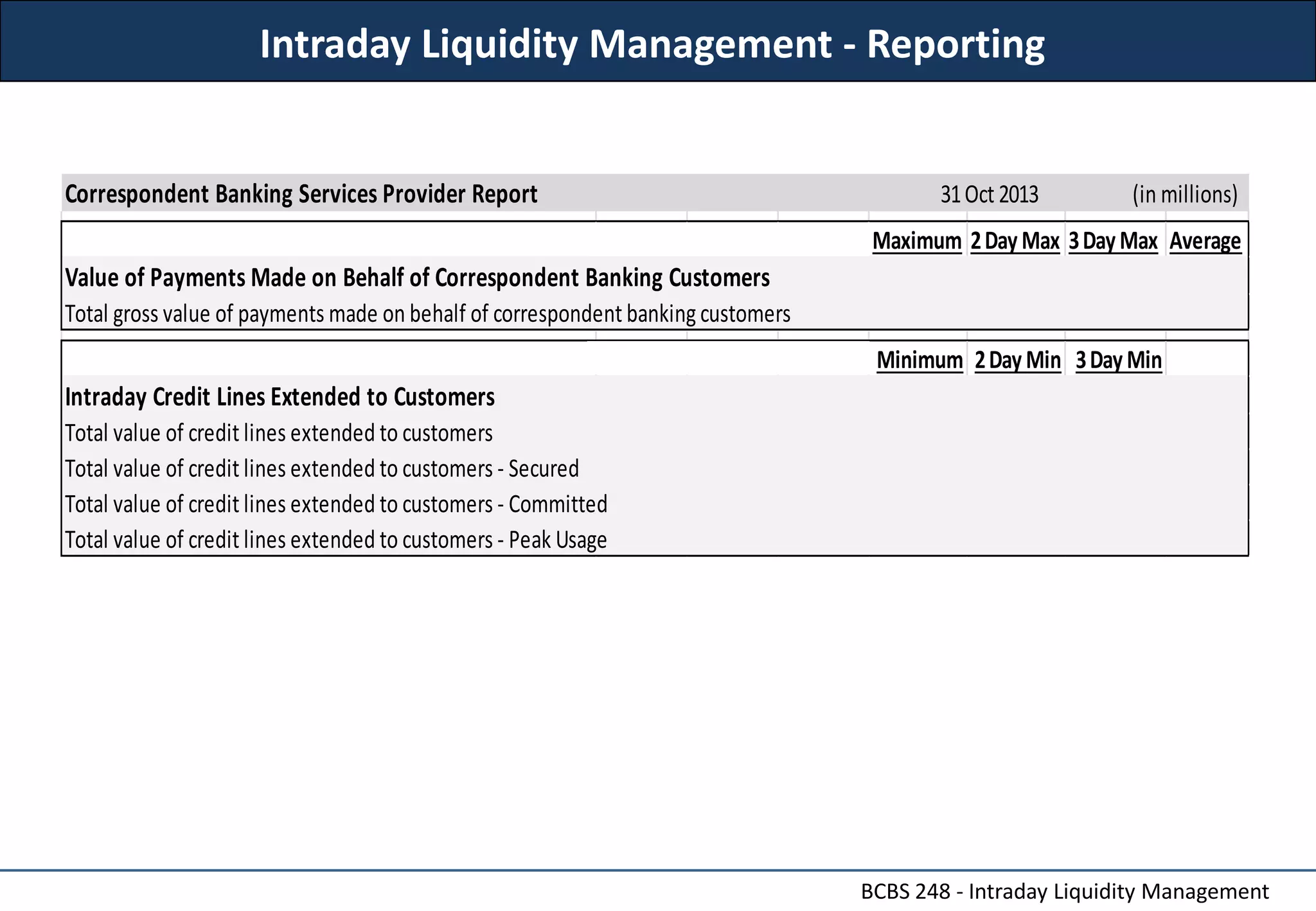

This document summarizes an overview of intraday liquidity management. It discusses measuring and forecasting daily liquidity flows, monitoring positions against available resources, arranging sufficient intraday funding, mobilizing collateral, and dealing with disruptions. It also outlines control indicators for monitoring intraday liquidity requirements and available resources. Charts show an example intraday liquidity profile and quantitative tools are discussed for monitoring intraday positions. Potential stress scenarios and effective management methods are also summarized, along with examples of regulatory reports used for monitoring and reporting intraday liquidity.