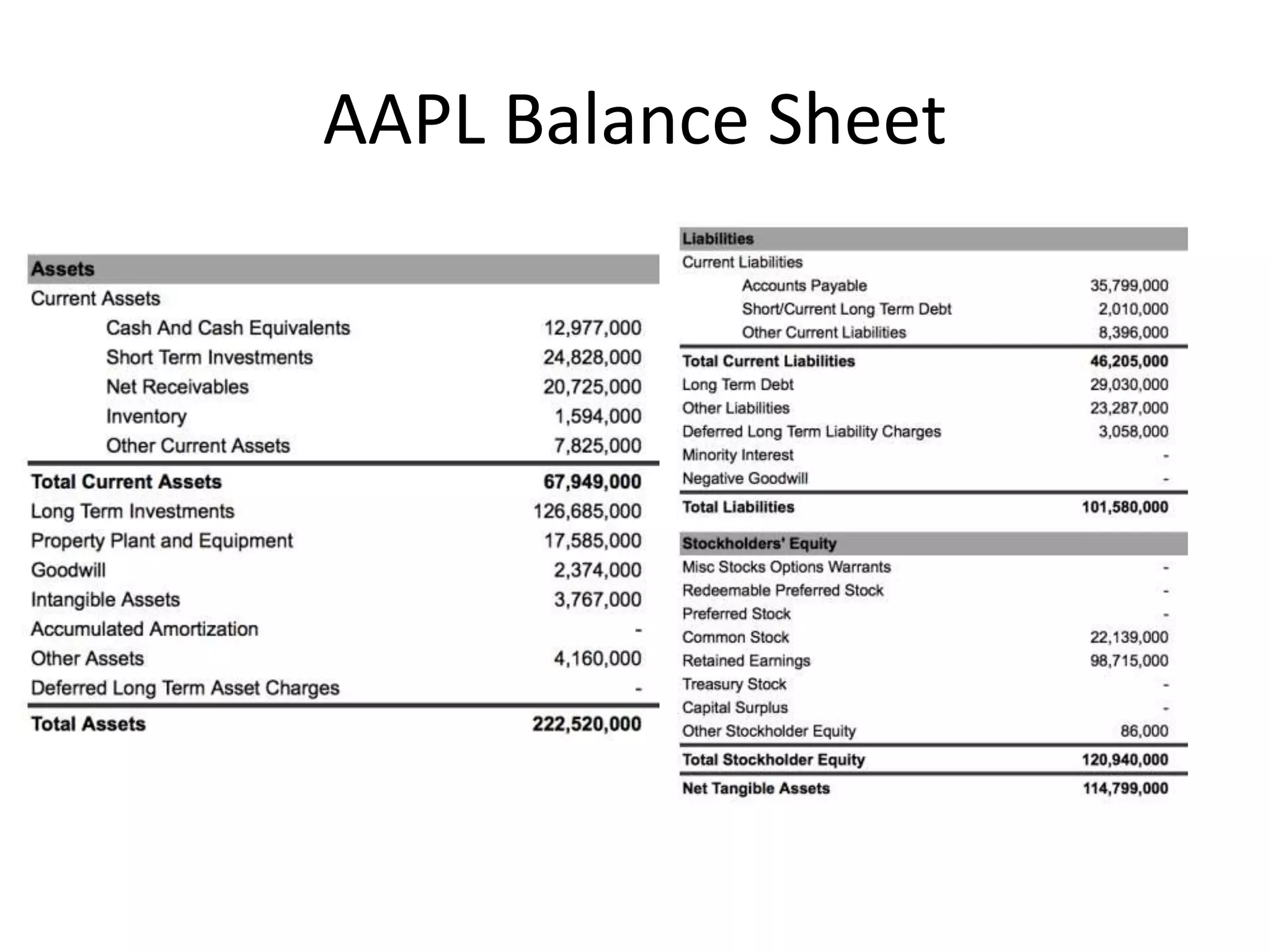

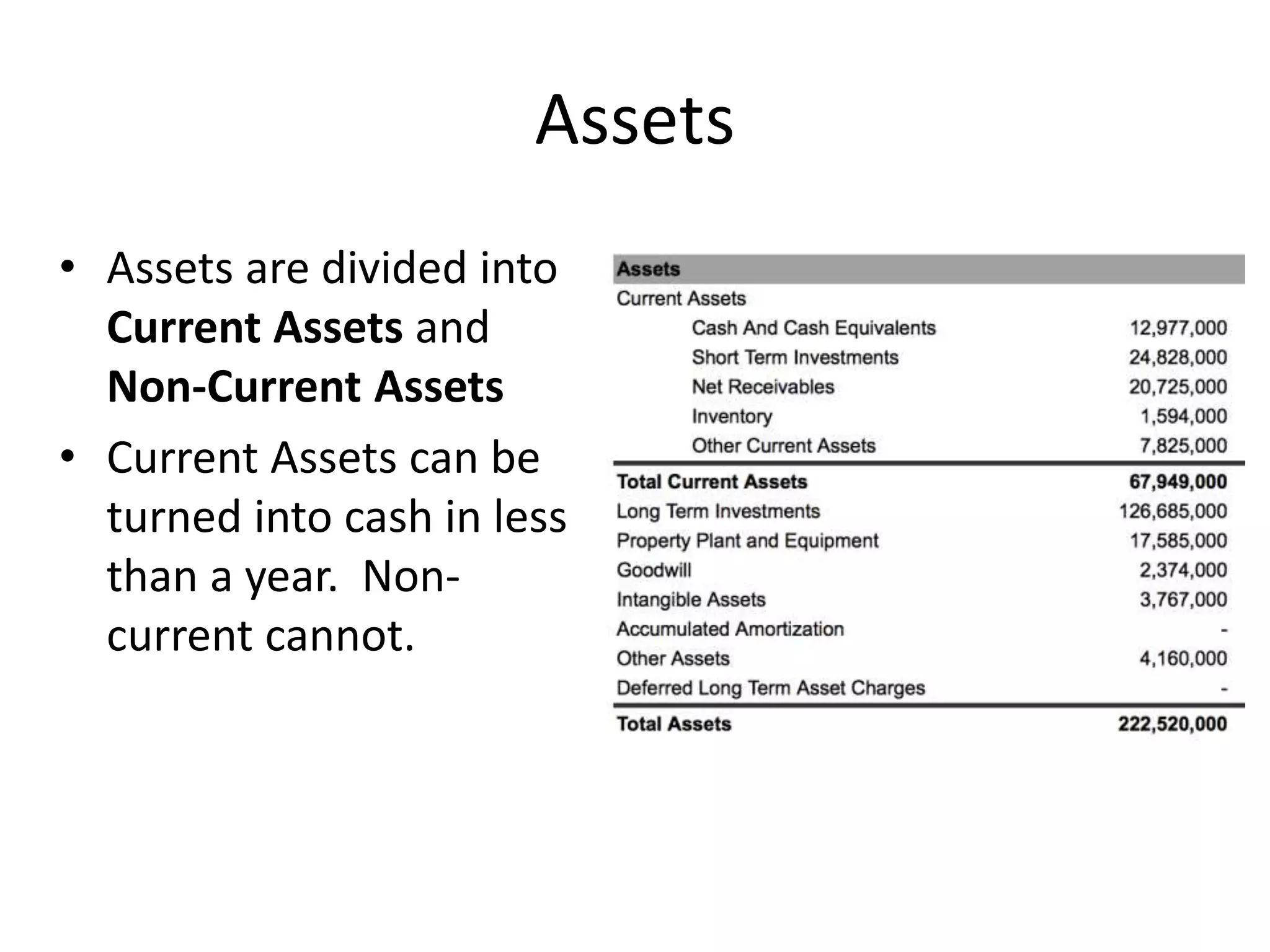

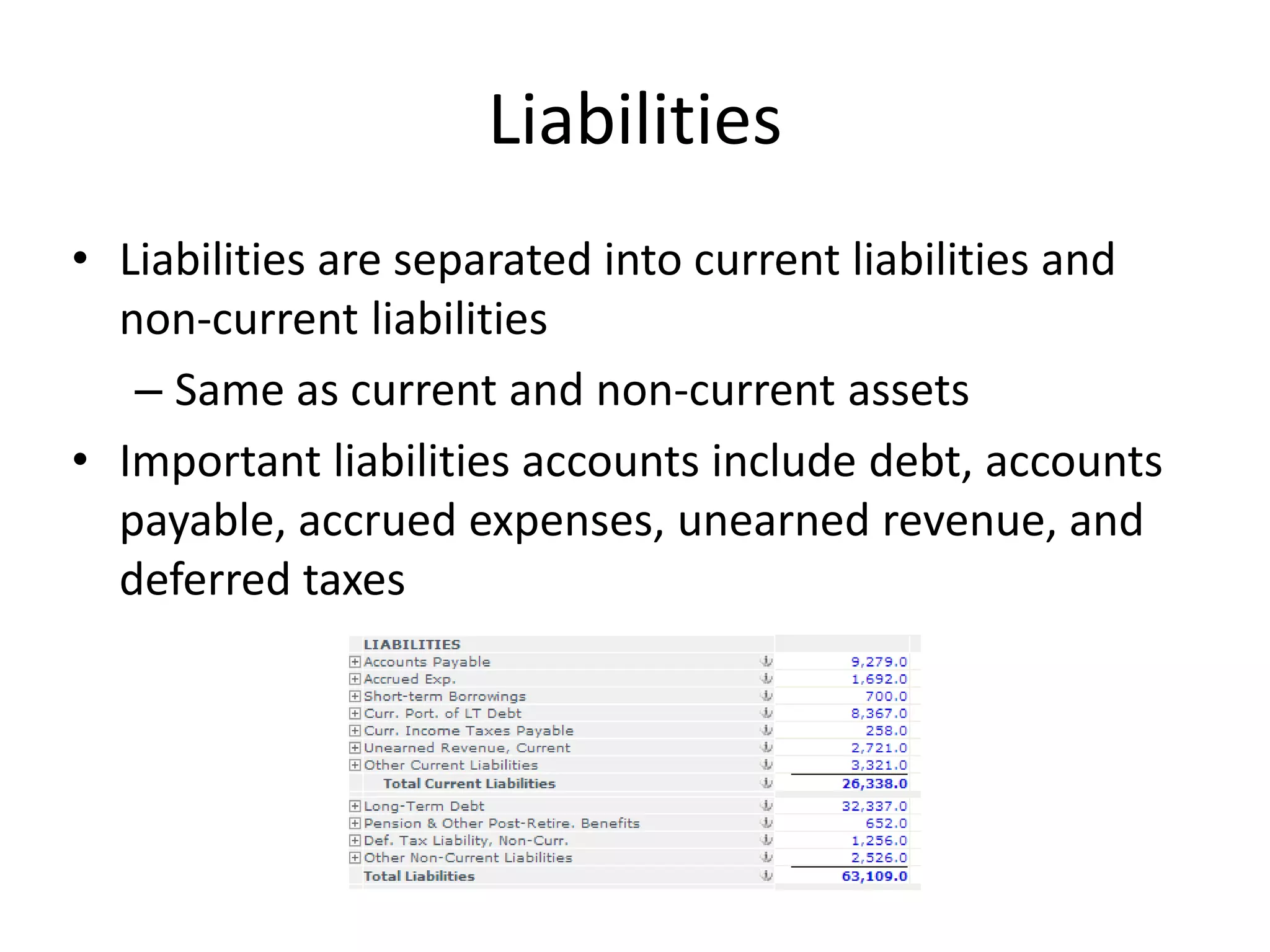

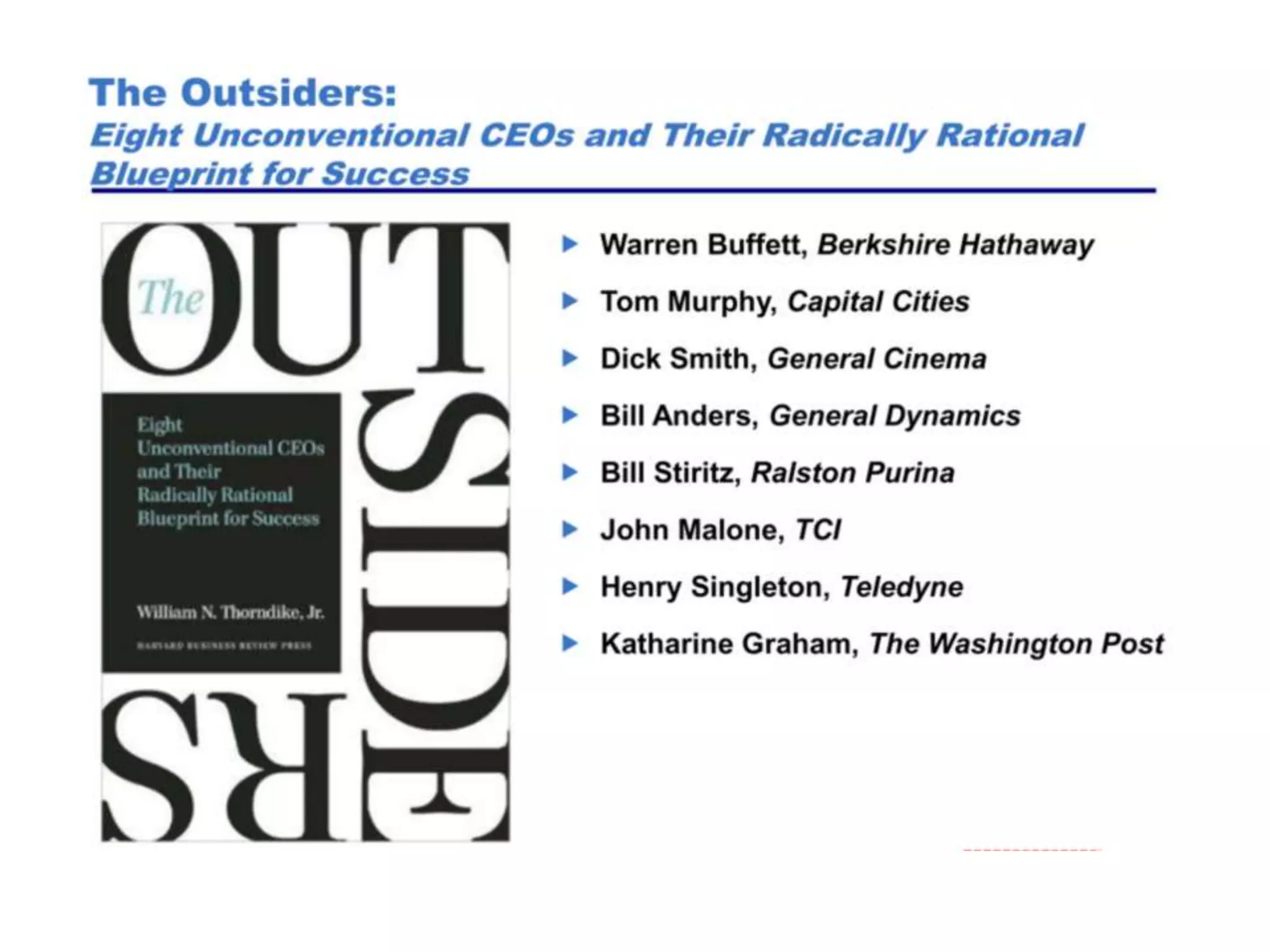

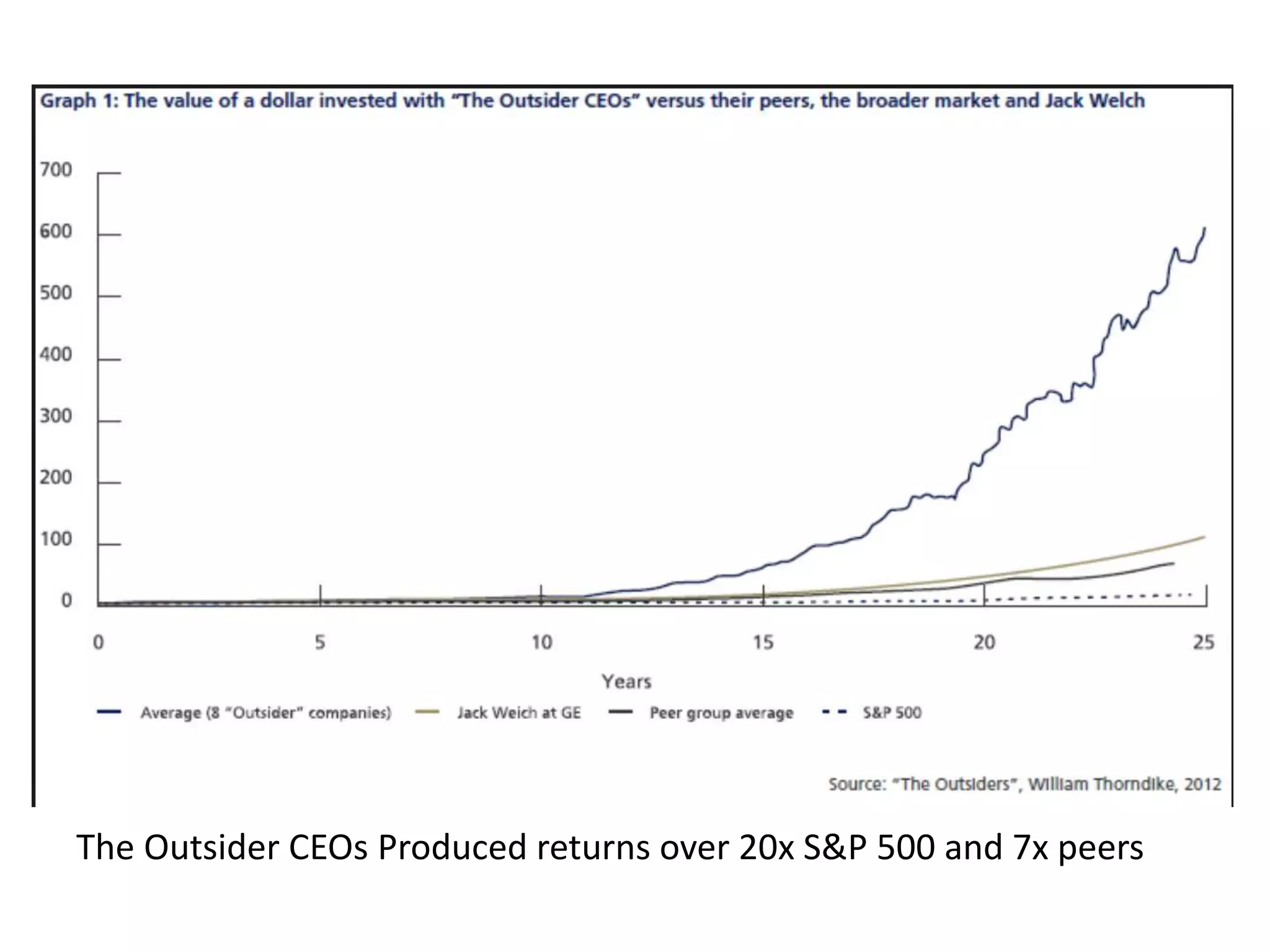

The document discusses balance sheets and their components. It begins by explaining that a balance sheet provides a snapshot of everything a company owns (assets) and owes (liabilities and equity), where assets must equal liabilities plus equity. It then discusses the key components of a balance sheet - current and non-current assets, like cash, inventory, and property/equipment; current and non-current liabilities, like accounts payable and debt; and equity, including retained earnings. It also covers how companies allocate capital between investing in their business, acquisitions, debt repayment, and returning value to shareholders. Effective capital allocation is positioned as the CEO's most important job.