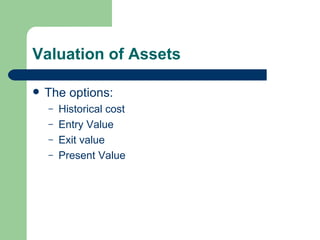

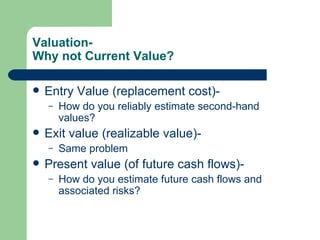

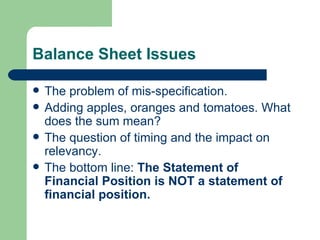

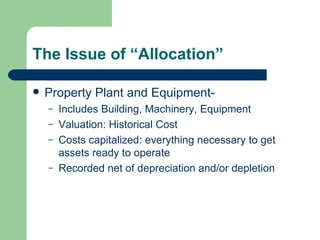

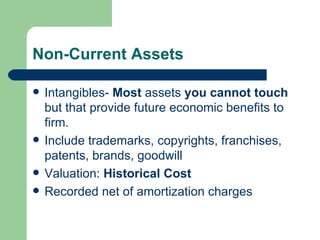

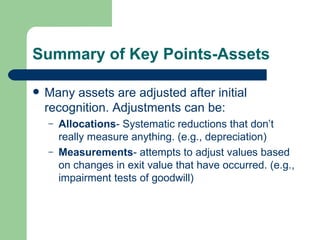

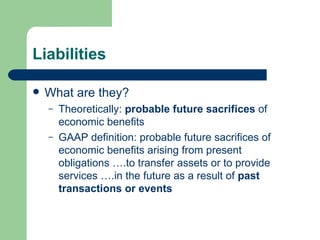

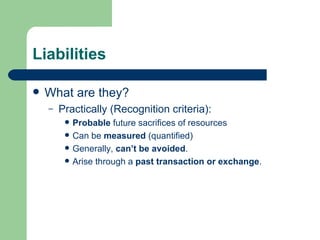

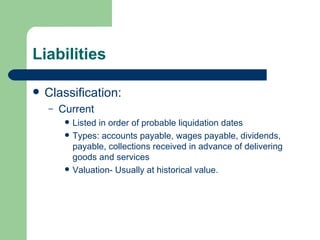

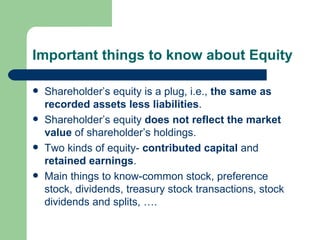

The document discusses key concepts related to the balance sheet, including the purpose, format, time frame, and core issues of recognition, valuation, and classification of assets, liabilities, and shareholders' equity. It notes that assets are recognized based on potential future economic benefits from past transactions and if they can be reasonably measured. Valuation methods include historical cost and present value. Liabilities are probable future sacrifices from obligations from past events that can be measured. Equity is a plug calculated as assets minus liabilities.