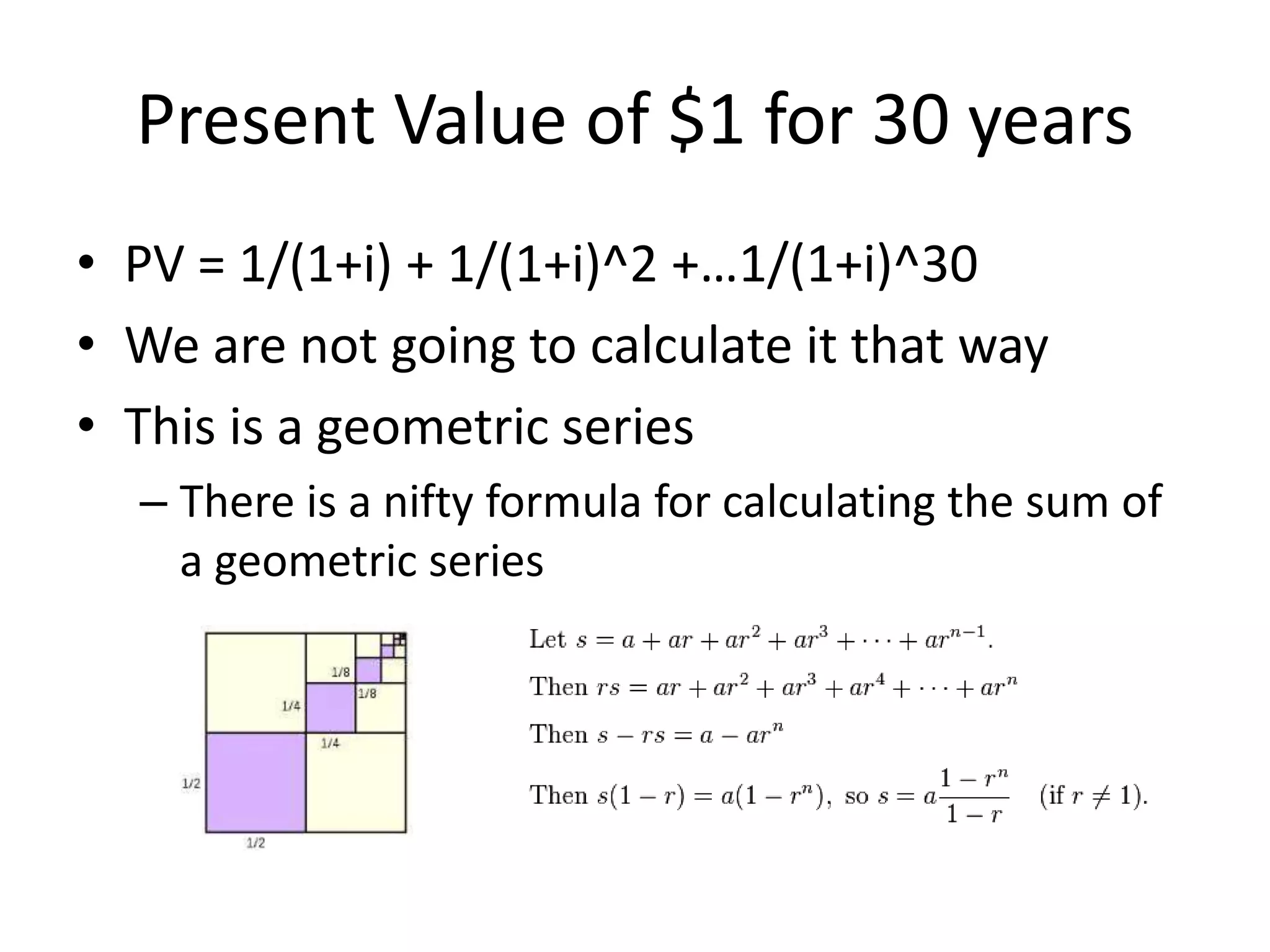

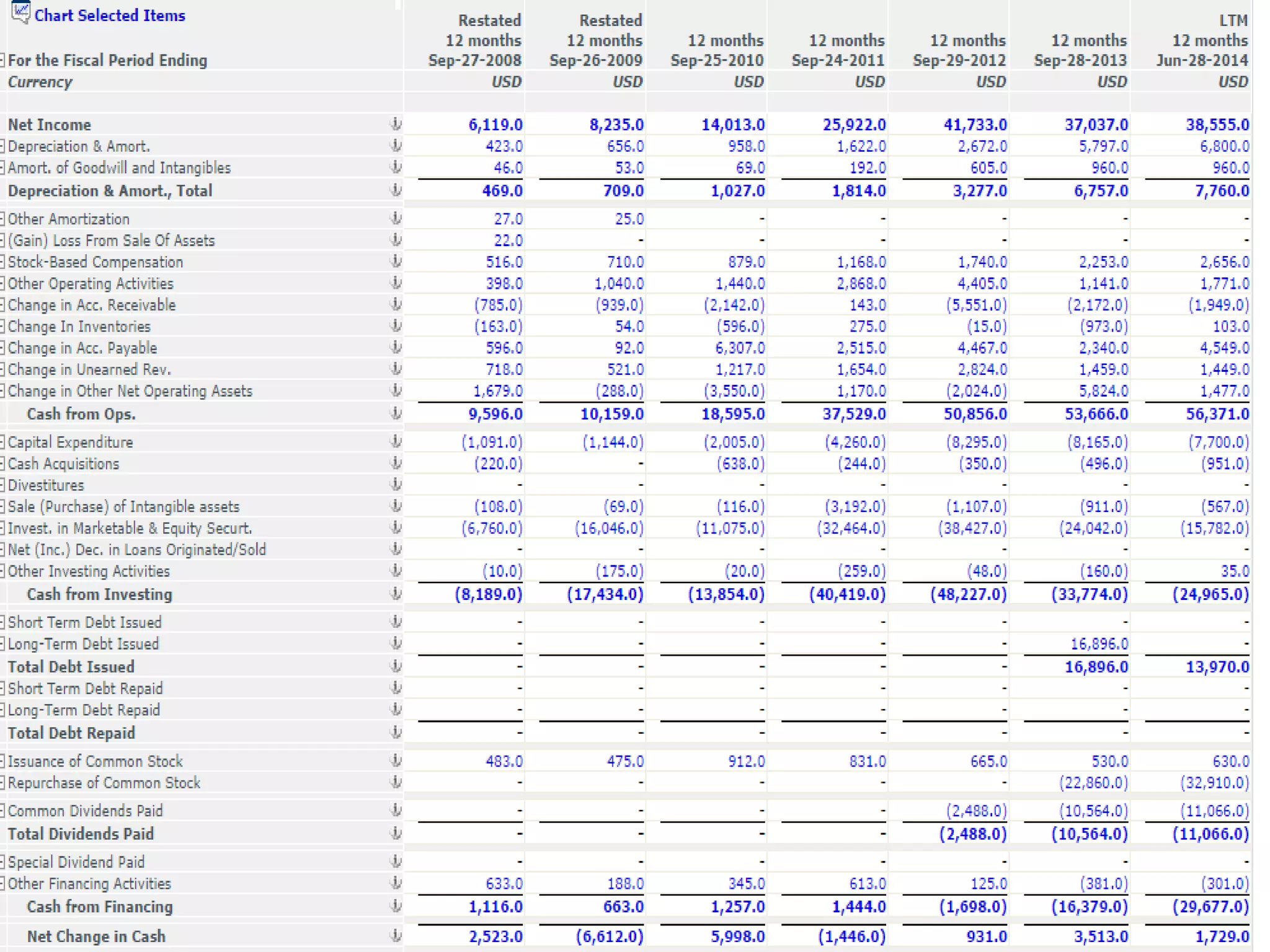

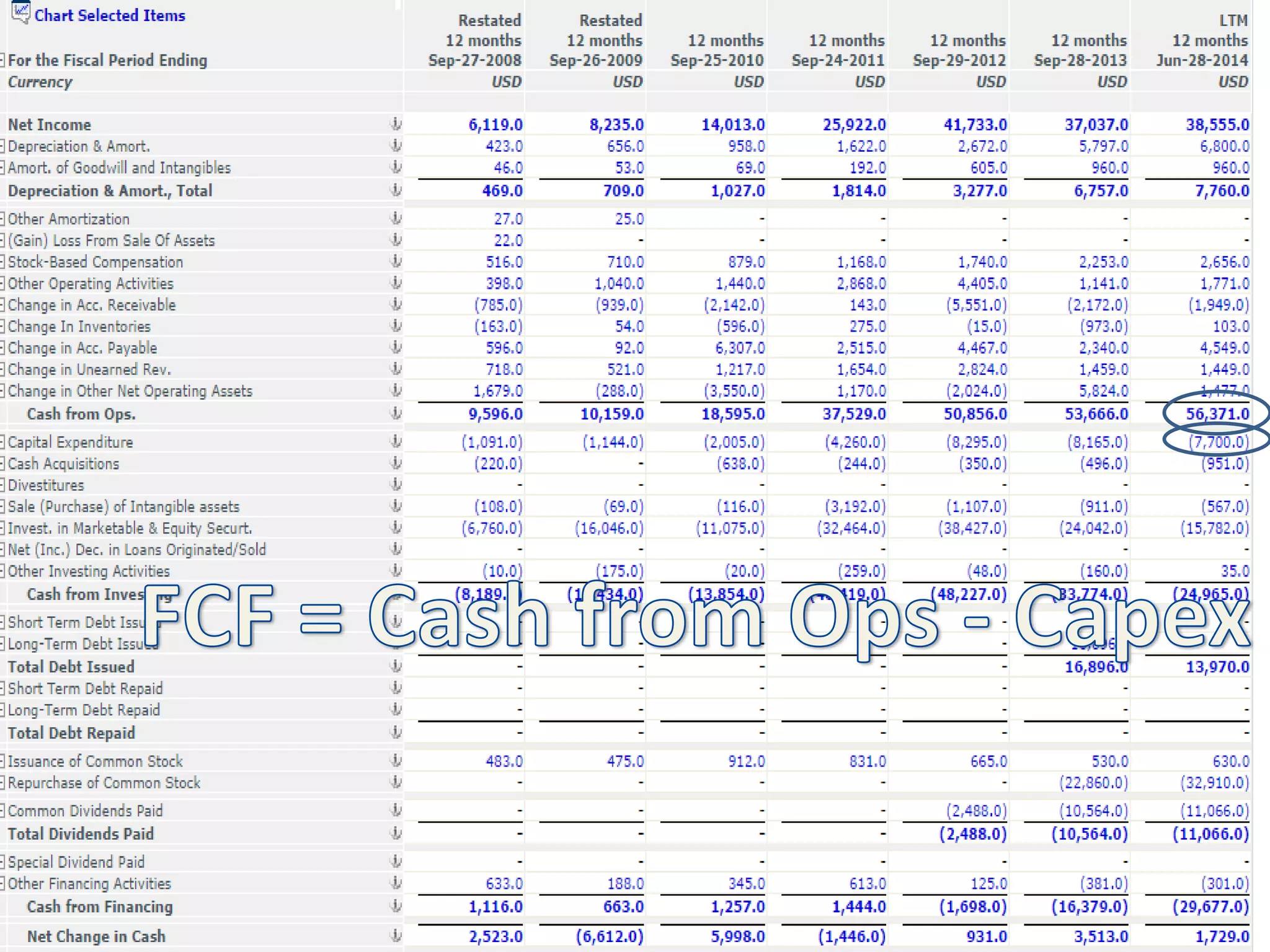

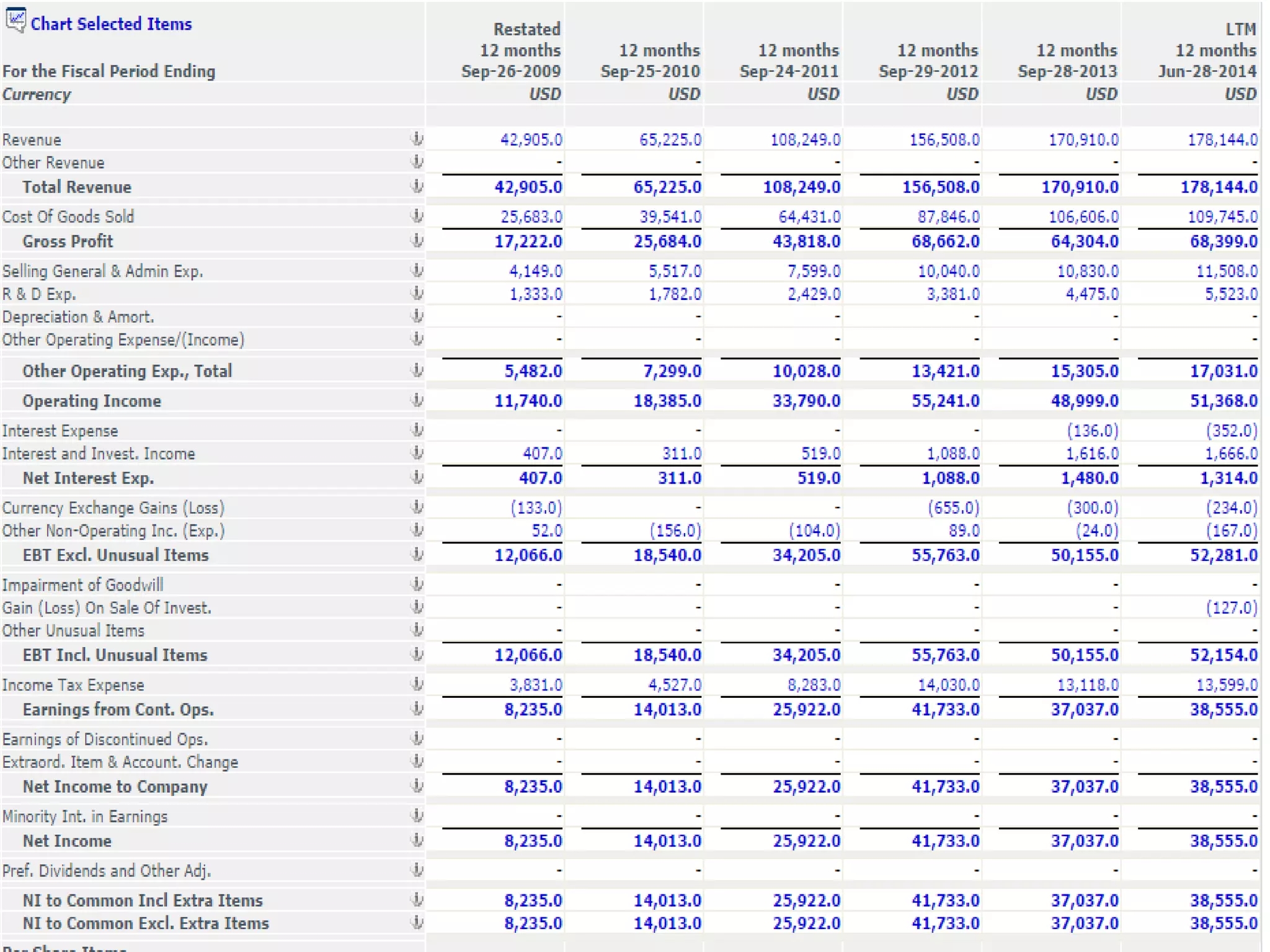

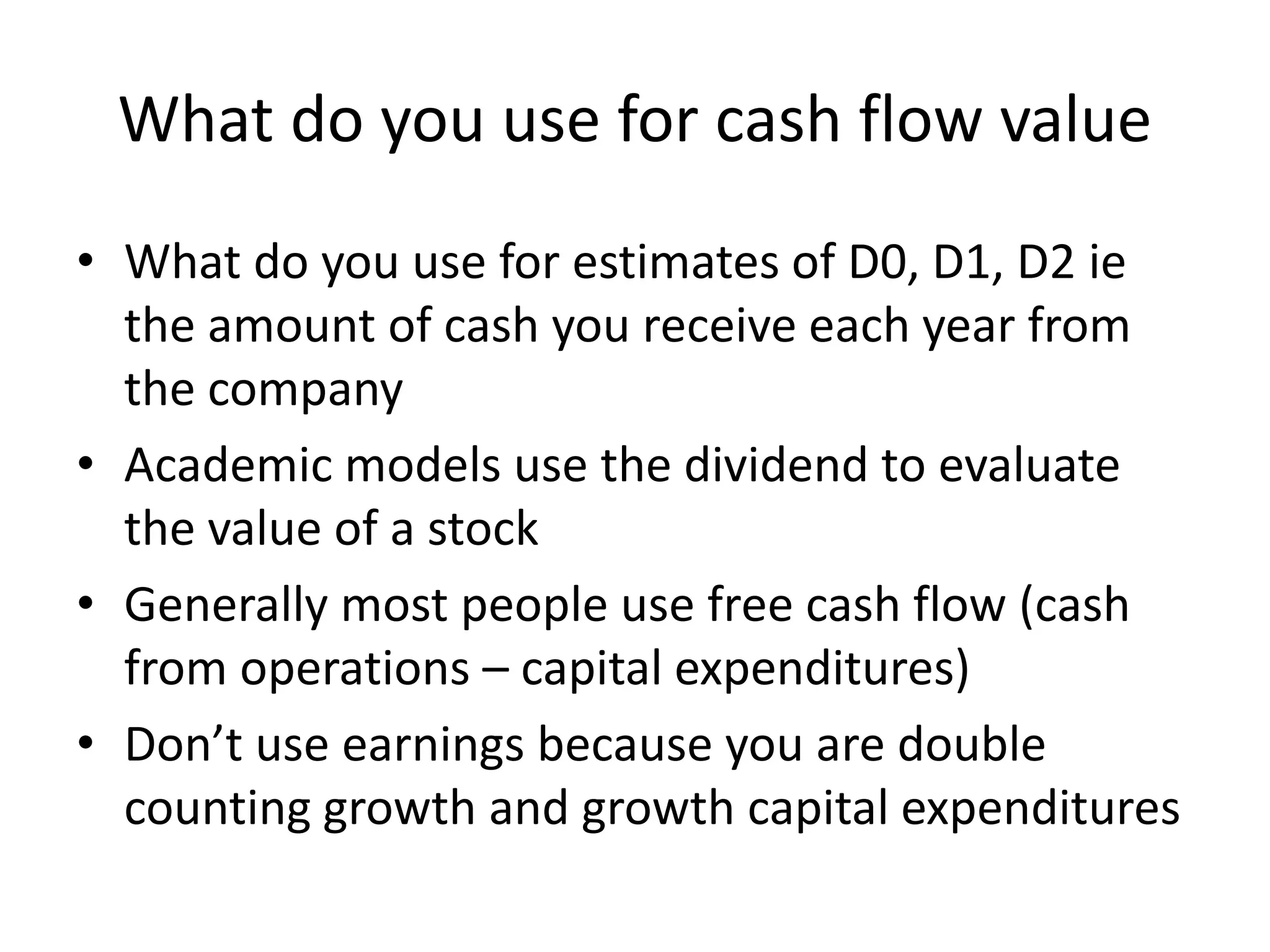

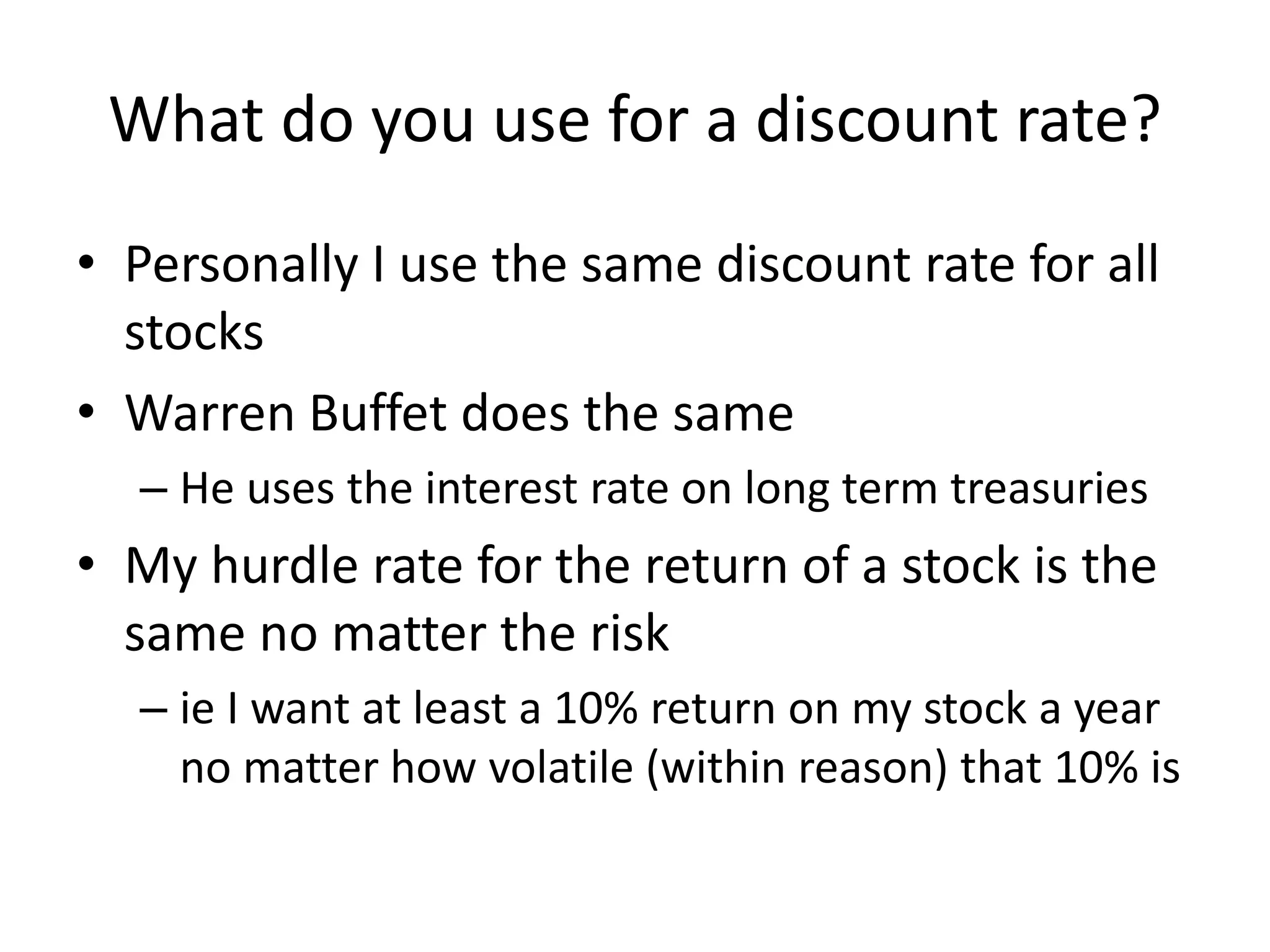

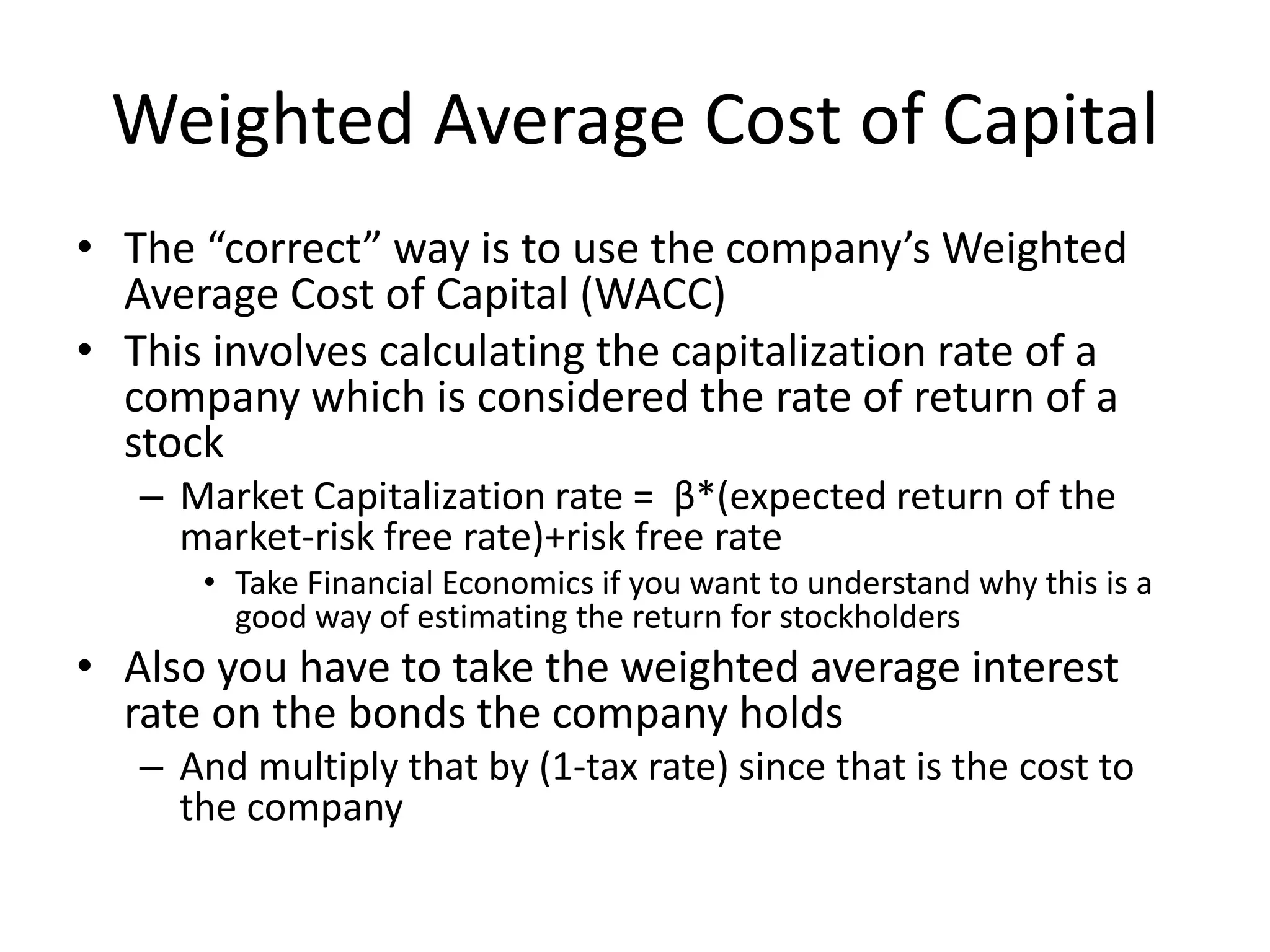

This document provides an overview of various methods for valuing companies, including discounted cash flow (DCF) modeling. It discusses key DCF concepts like present value, free cash flow, growth rates, and weighted average cost of capital (WACC). Other valuation metrics mentioned include P/E ratios, comparable company analysis, and liquidation value based on tangible book value or net current assets. The document aims to explain the theoretical underpinnings of intrinsic stock valuation.