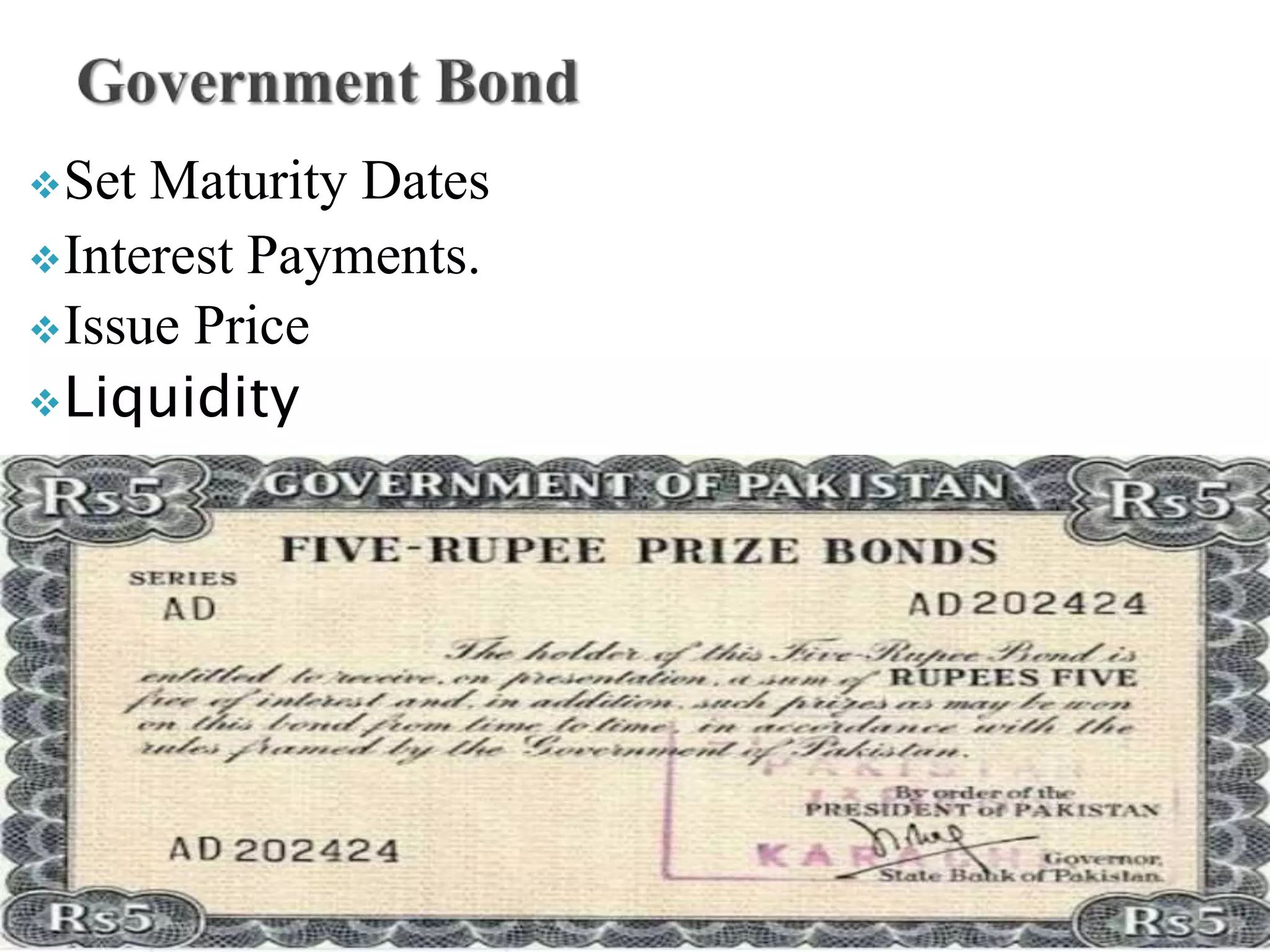

This document discusses various types of credit instruments such as checks, bank drafts, bills of exchange, promissory notes, government bonds, and treasury bills. It outlines their key characteristics and compares advantages like encouraging savings and capital formation to disadvantages like potential overspending. The role of credit in the economy is also examined, noting how it can facilitate large-scale production, shift capital to productive uses, and increase savings rates.