Embed presentation

Downloaded 195 times

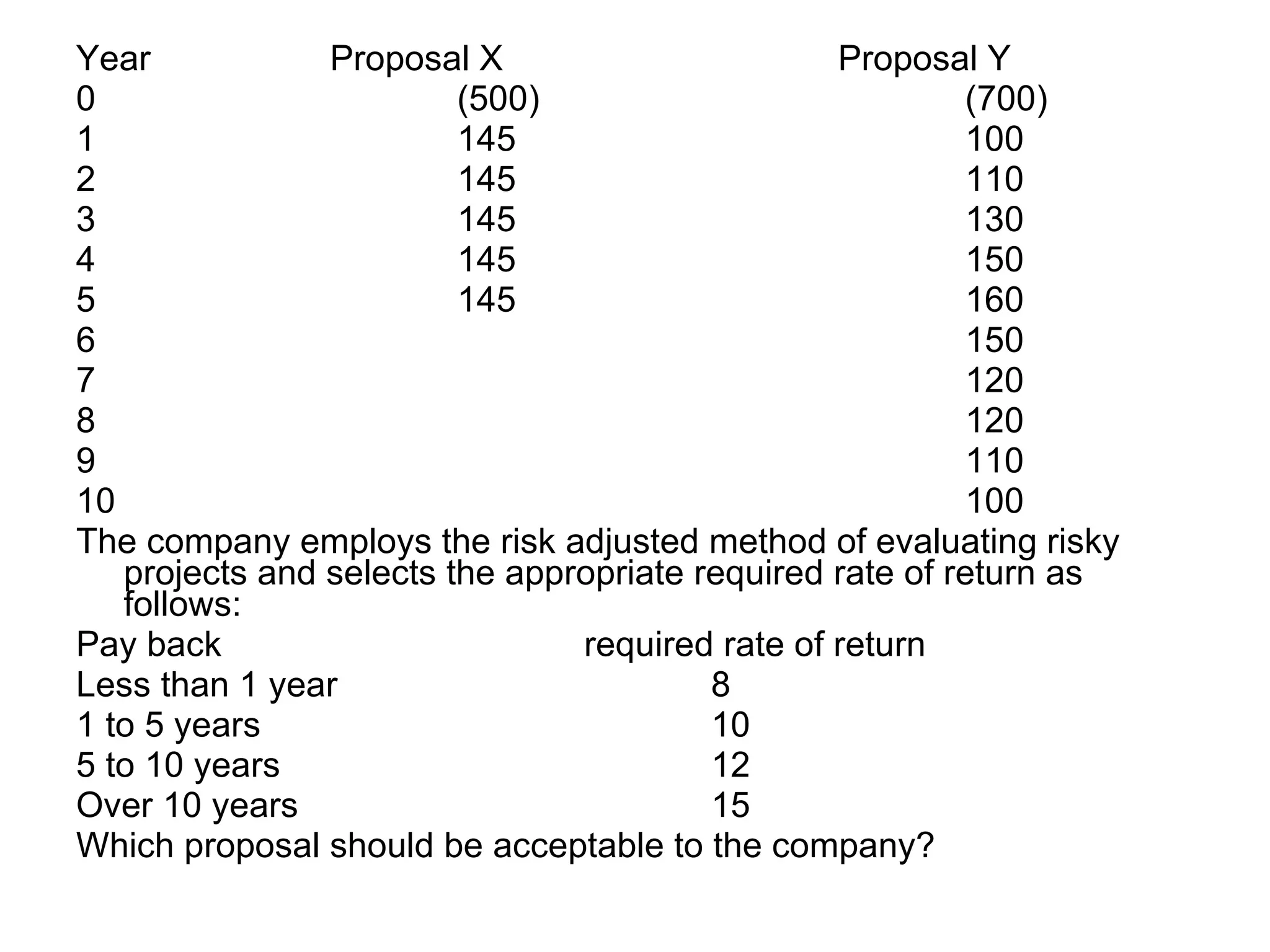

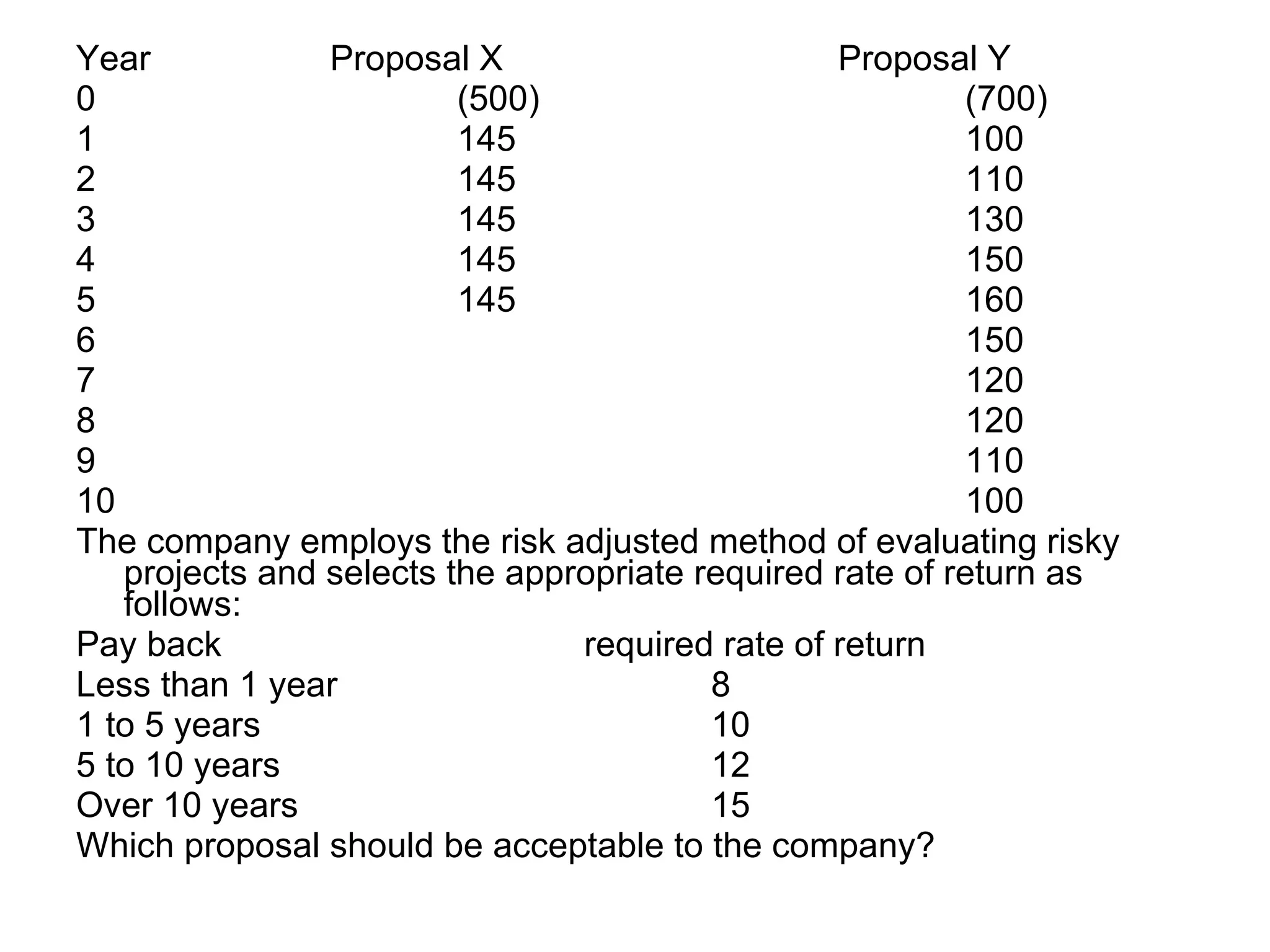

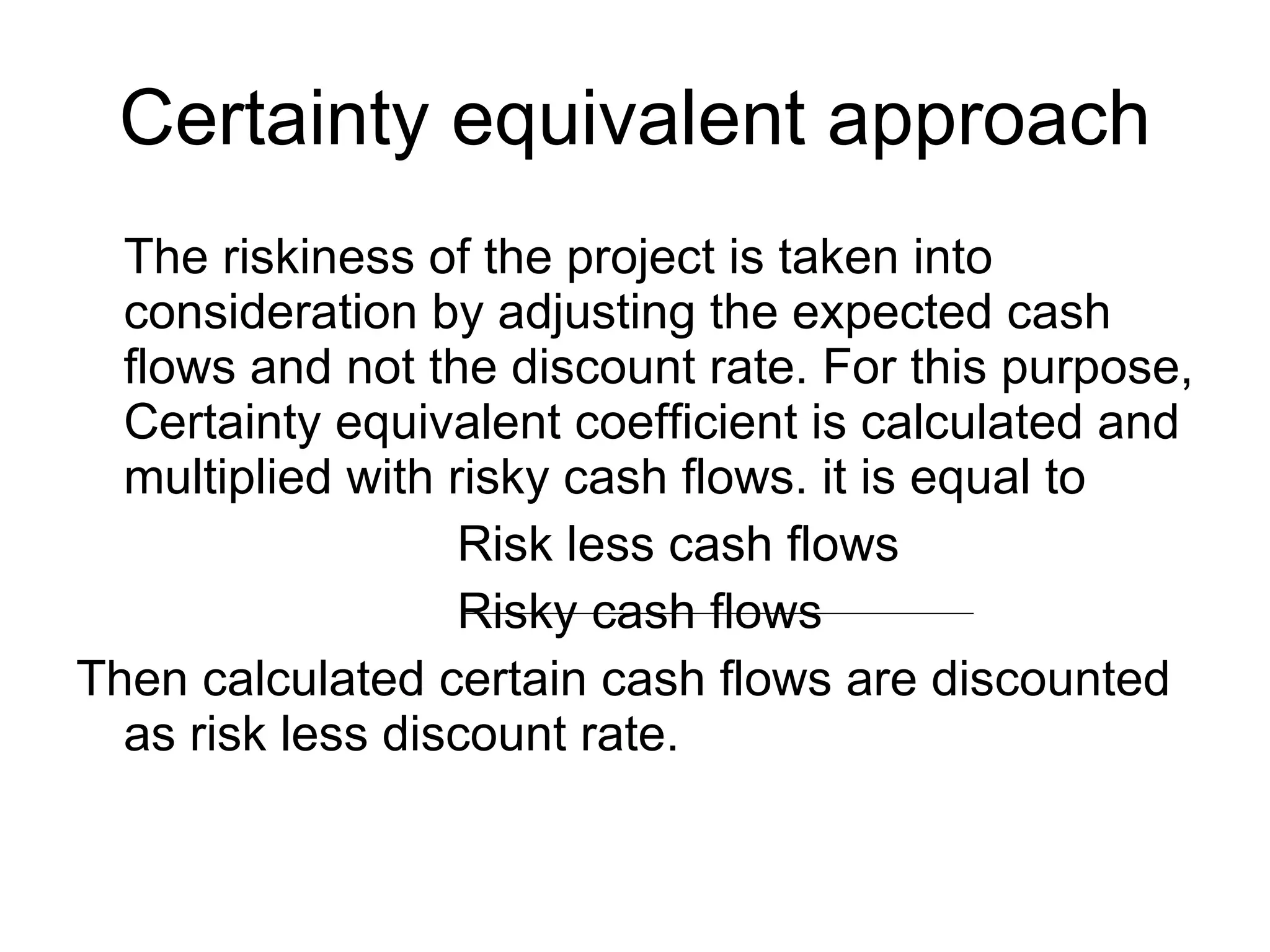

The document discusses two approaches to evaluating risky projects in capital budgeting: the risk adjusted discount rate approach and the certainty equivalent approach. It provides examples of how to apply each approach, including a table of cash flows for two proposals being evaluated with the risk adjusted discount rate approach and a table of expected cash flows and certainty equivalent quotients for a project being evaluated with the certainty equivalent approach. It asks which proposal should be acceptable to the company using the risk adjusted approach and whether the project should be accepted using the certainty equivalent approach.