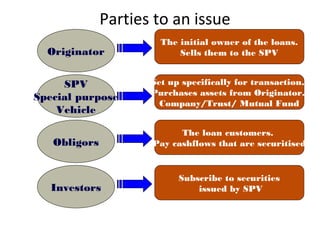

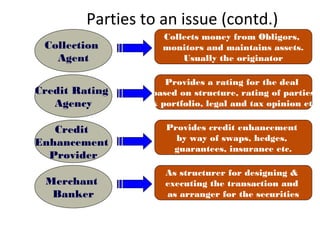

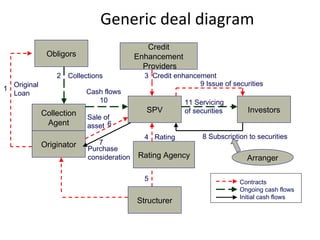

Securitization involves issuing marketable securities backed by expected cash flows from assets like loans. In a typical securitization process, an originator sells assets like loans to a special purpose vehicle (SPV). The SPV issues securities to investors backed by the cash flows from the underlying assets. Key parties include originators, obligors, SPV, collection agents, credit enhancers, rating agencies and arrangers. Securitization provides more efficient financing, improves balance sheet structure and allows better risk management for originators. Mortgage loans, auto loans, credit card receivables and other predictable cash flow assets can be securitized. A robust financial, legal and regulatory infrastructure is required to support successful securitization.