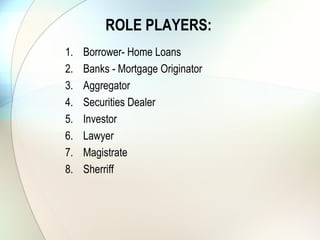

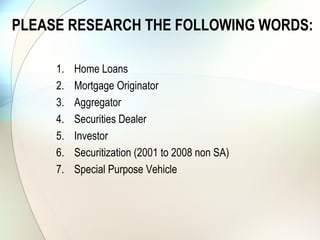

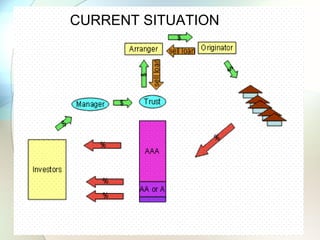

This document discusses securitization in South Africa and provides context on key terms and entities involved in the securitization process. It explains that mortgages and other loans are typically originated by banks or other lenders then aggregated and packaged into securities that are sold to investors. Special purpose vehicles are established to purchase the loans and issue asset-backed securities. The process allows originators to sell loans and free up capital to issue more loans while investors receive interests in the cash flows from the underlying loans.