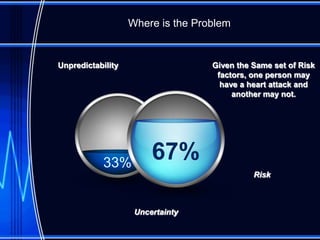

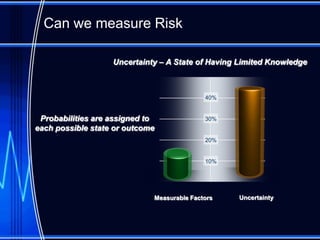

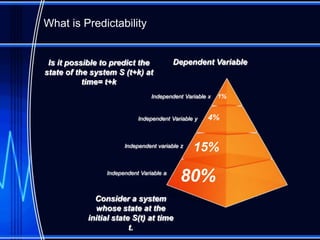

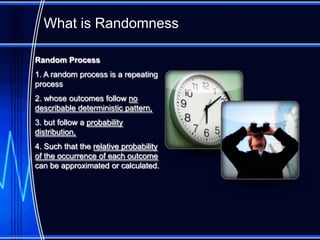

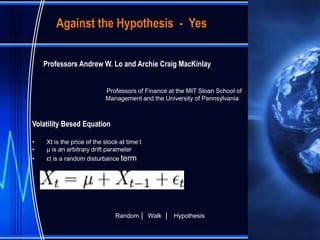

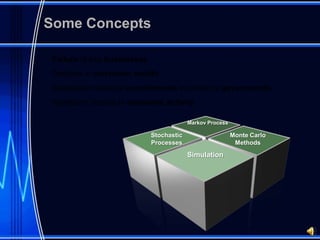

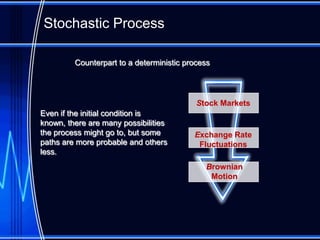

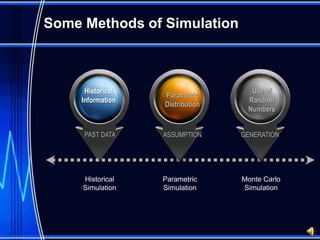

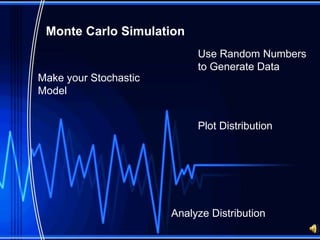

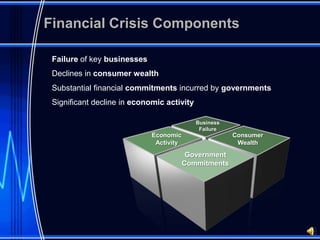

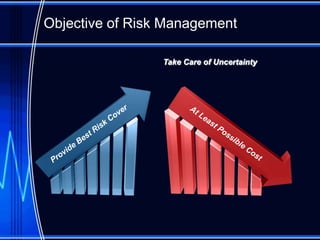

This document provides an introduction to risk and discusses key concepts related to predicting and modeling risk. It defines risk as a set of measured uncertainties where some outcomes could result in significant loss. It discusses factors that can increase the risk of a heart attack and challenges in predicting who specifically will have one. The document also introduces concepts like stochastic processes, Markov processes, Monte Carlo simulation, and the random walk hypothesis which are used to model and predict risk. It notes the components that contributed to past financial crises and how simulation methods can be used to analyze risk. The overall objective of risk management is to take care of uncertainty and allow for better planning and more secure outcomes.