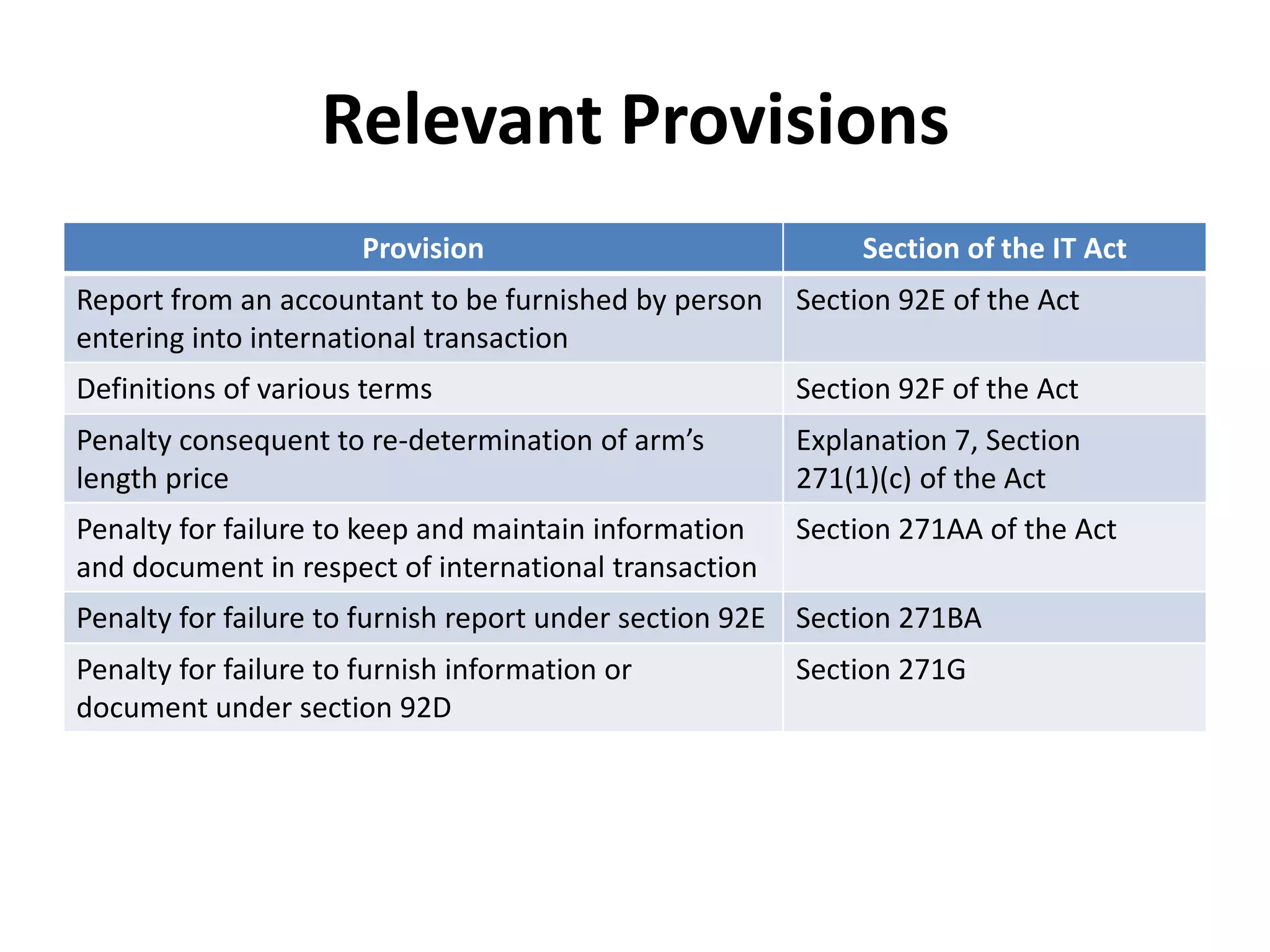

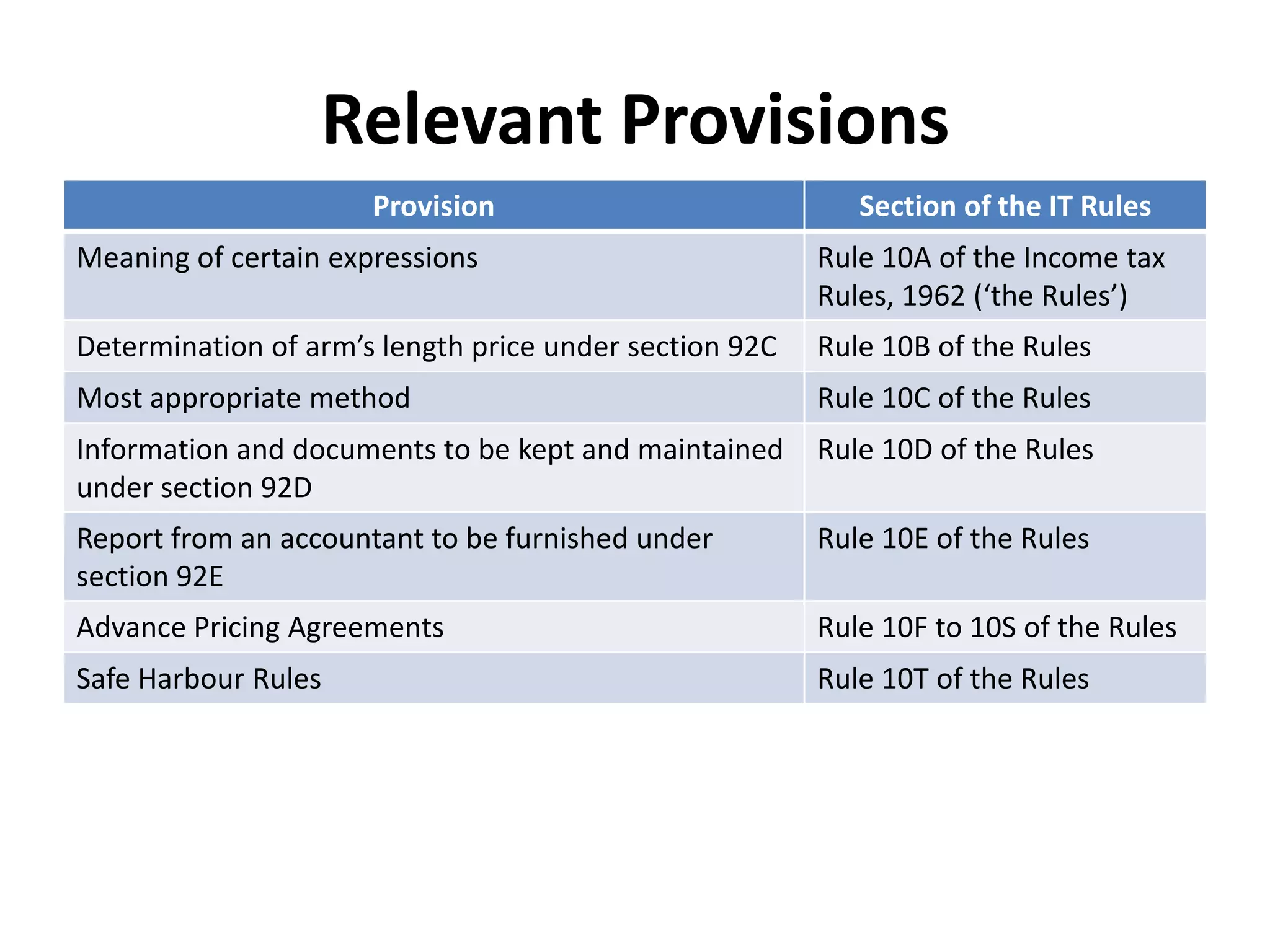

Transfer pricing provisions in India revolve around international transactions between associated enterprises. The key concepts are international transaction, associated enterprise, and arm's length price. Tax authorities require documentation to establish that transfer prices are at arm's length. Non-compliance can result in income adjustments and penalties. Safe harbour rules provide certain transactions predefined arm's length pricing.

![Deemed International Transaction [Sec 92B]

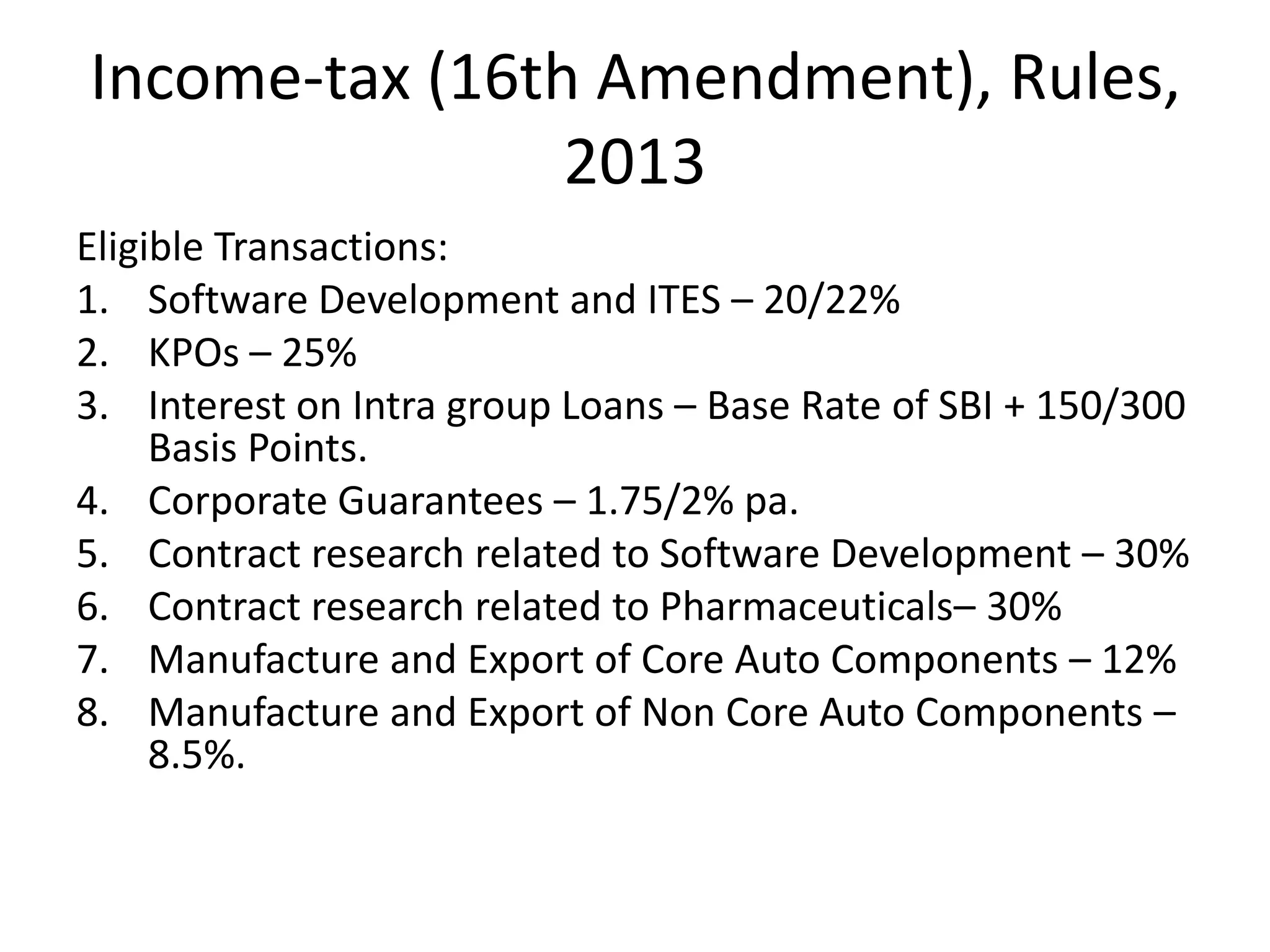

• Further section 92B provides that, where a

transaction entered into by an enterprise with a

person other than an associated enterprises and

there exist a prior agreement in relation to the

relevant transaction between such other person

and associated enterprise, or the terms of the

relevant transaction are determined in substance

between such other person and the associated

enterprises then such transaction shall also be

treated as an international transaction.](https://image.slidesharecdn.com/transferpricing2013sept20thbyvikramsinghsankhala-130920080549-phpapp01/75/Transfer-pricing-2013-sept-20th-by-vikram-singh-sankhala-21-2048.jpg)

![Micro Inks Ltd. v. ACIT

• The Ahmedabad Bench of the Income Tax

Appellate Tribunal ruled that in applying the

CUP method, an adjustment can be made

under Rule 10B(1) “to account for differences

…. which could materially affect the price in

the open market”.. Micro Inks Ltd. v. ACIT

[2013], Ahemedabad ITAT, Bench.](https://image.slidesharecdn.com/transferpricing2013sept20thbyvikramsinghsankhala-130920080549-phpapp01/75/Transfer-pricing-2013-sept-20th-by-vikram-singh-sankhala-65-2048.jpg)