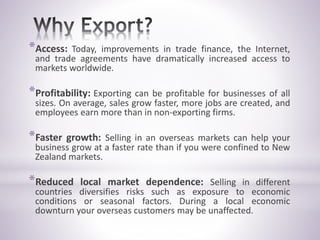

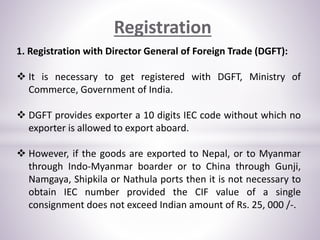

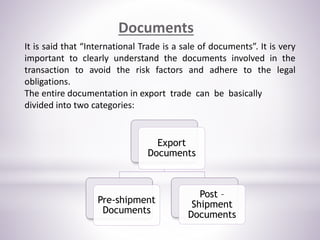

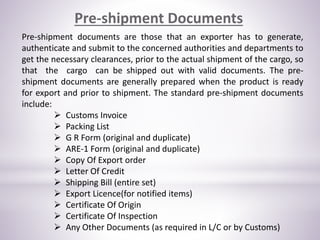

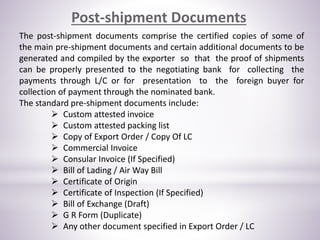

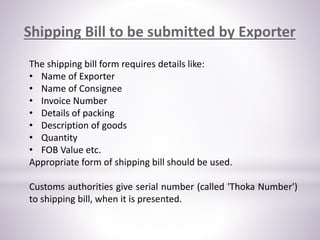

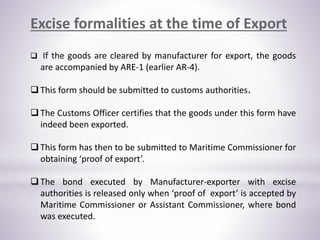

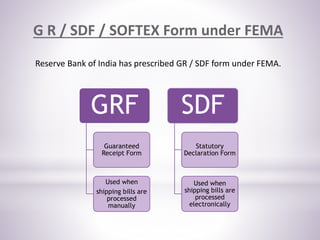

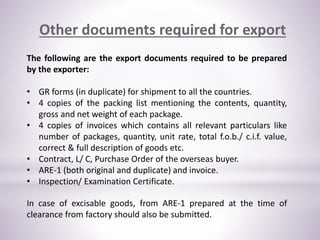

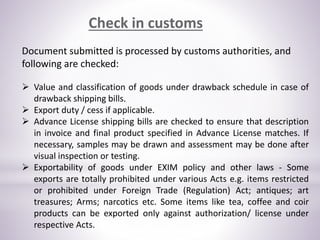

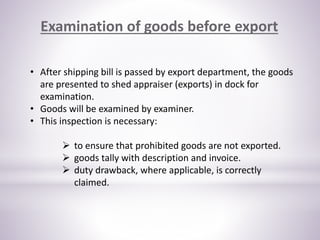

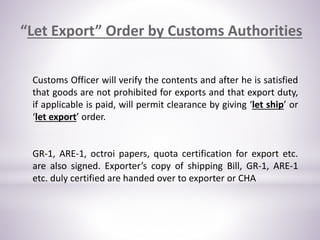

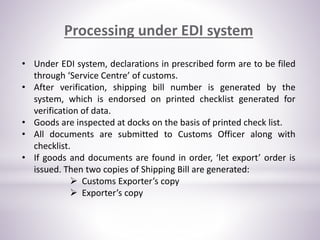

The document outlines the processes and documentation required for exporting goods, including registration, obtaining export licenses, and necessary pre- and post-shipment documents. It highlights the benefits of exporting, such as market access, profitability, and innovation, while detailing the various steps involved, including customs checks and approvals. Additionally, it explains specific forms and requirements governed by regulations, emphasizing the importance of accurate documentation in international trade.