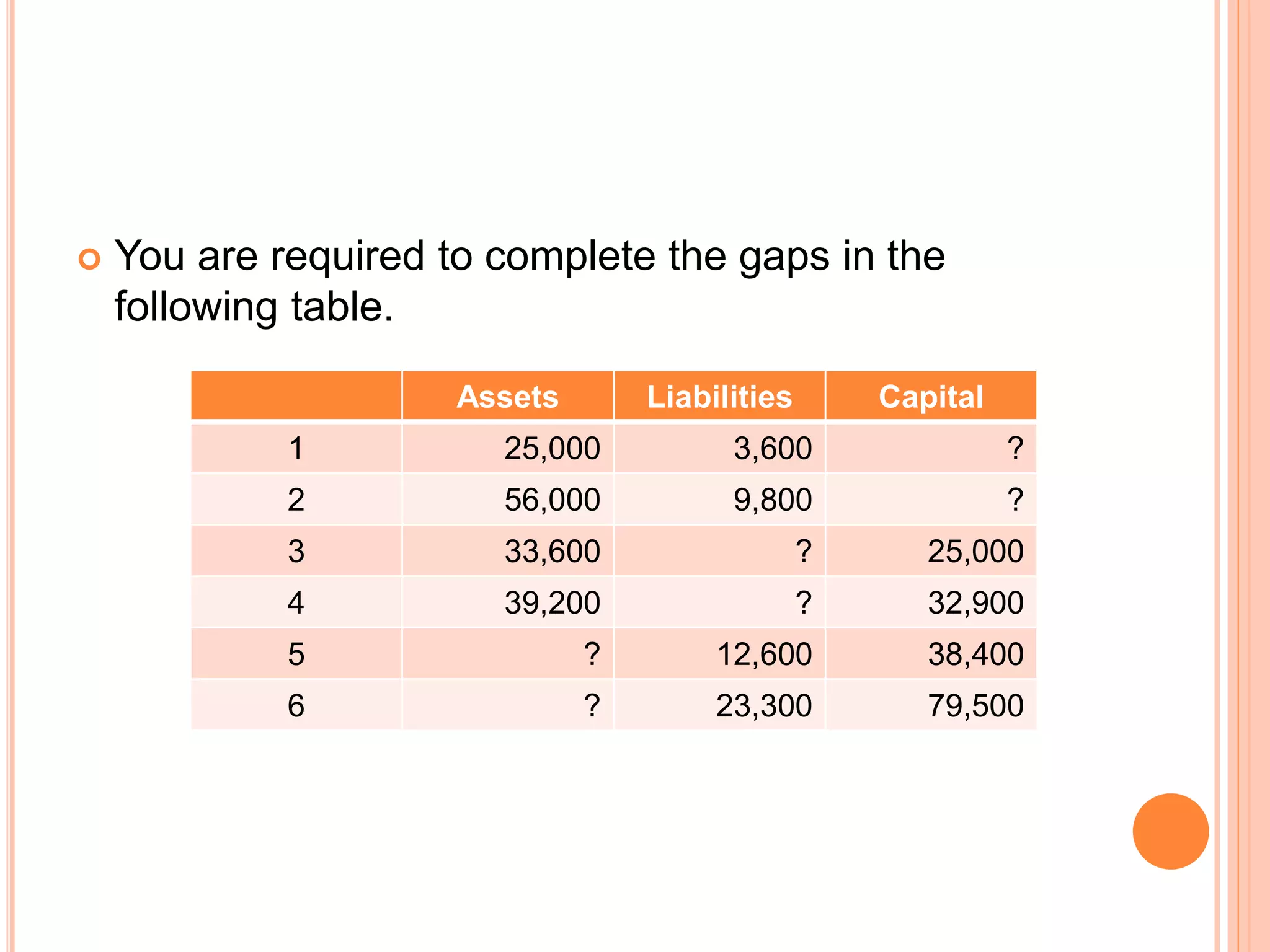

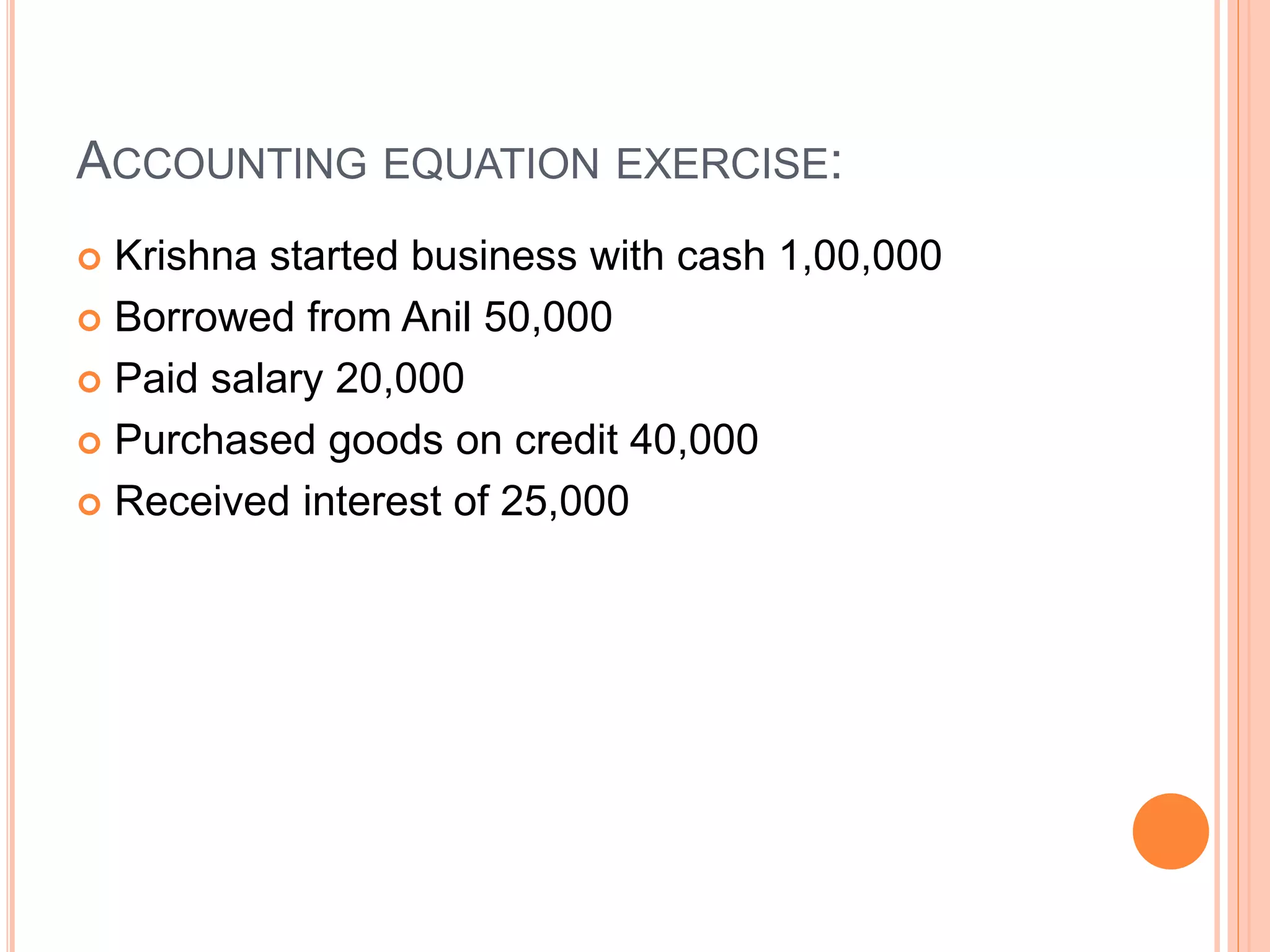

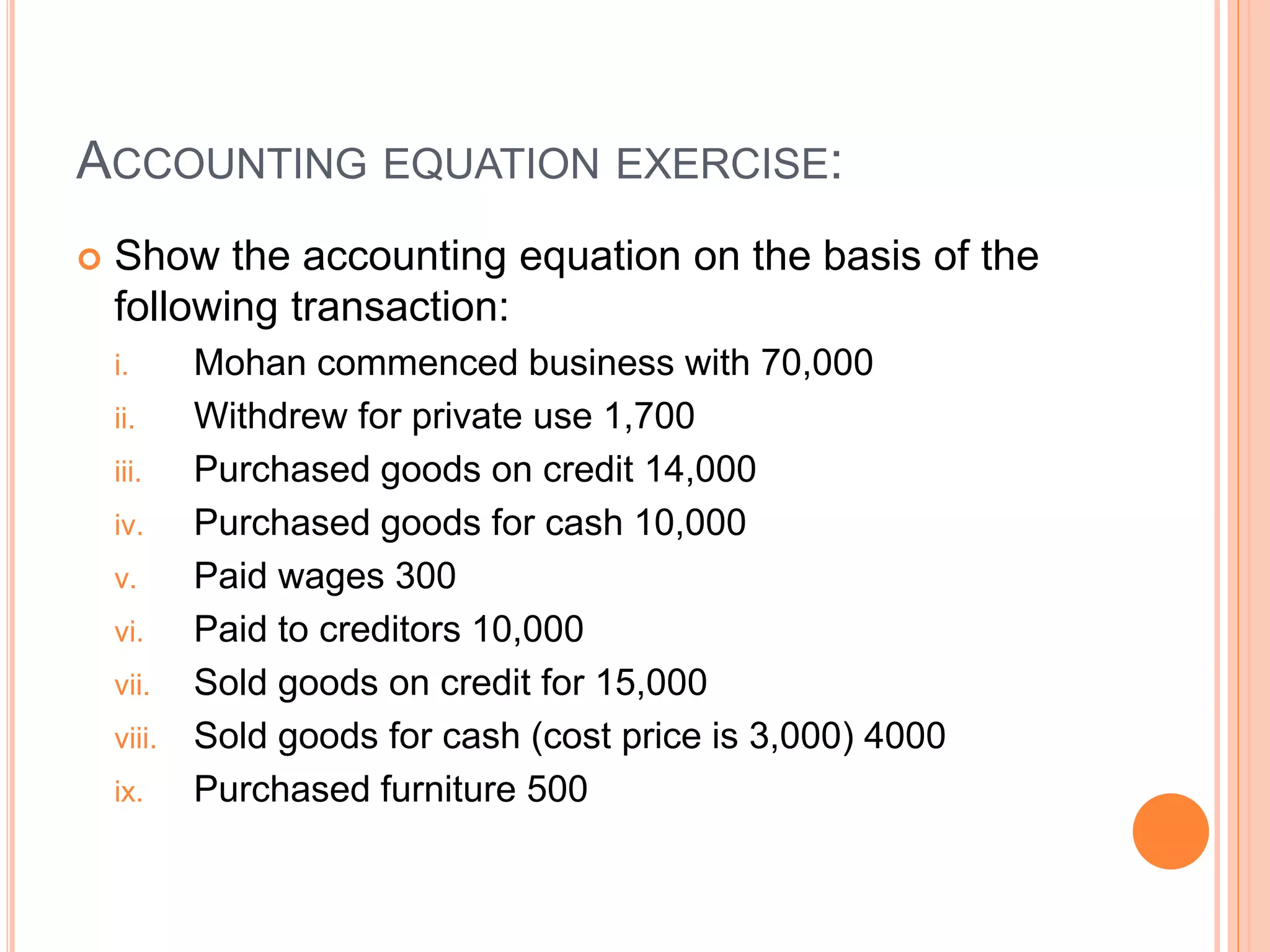

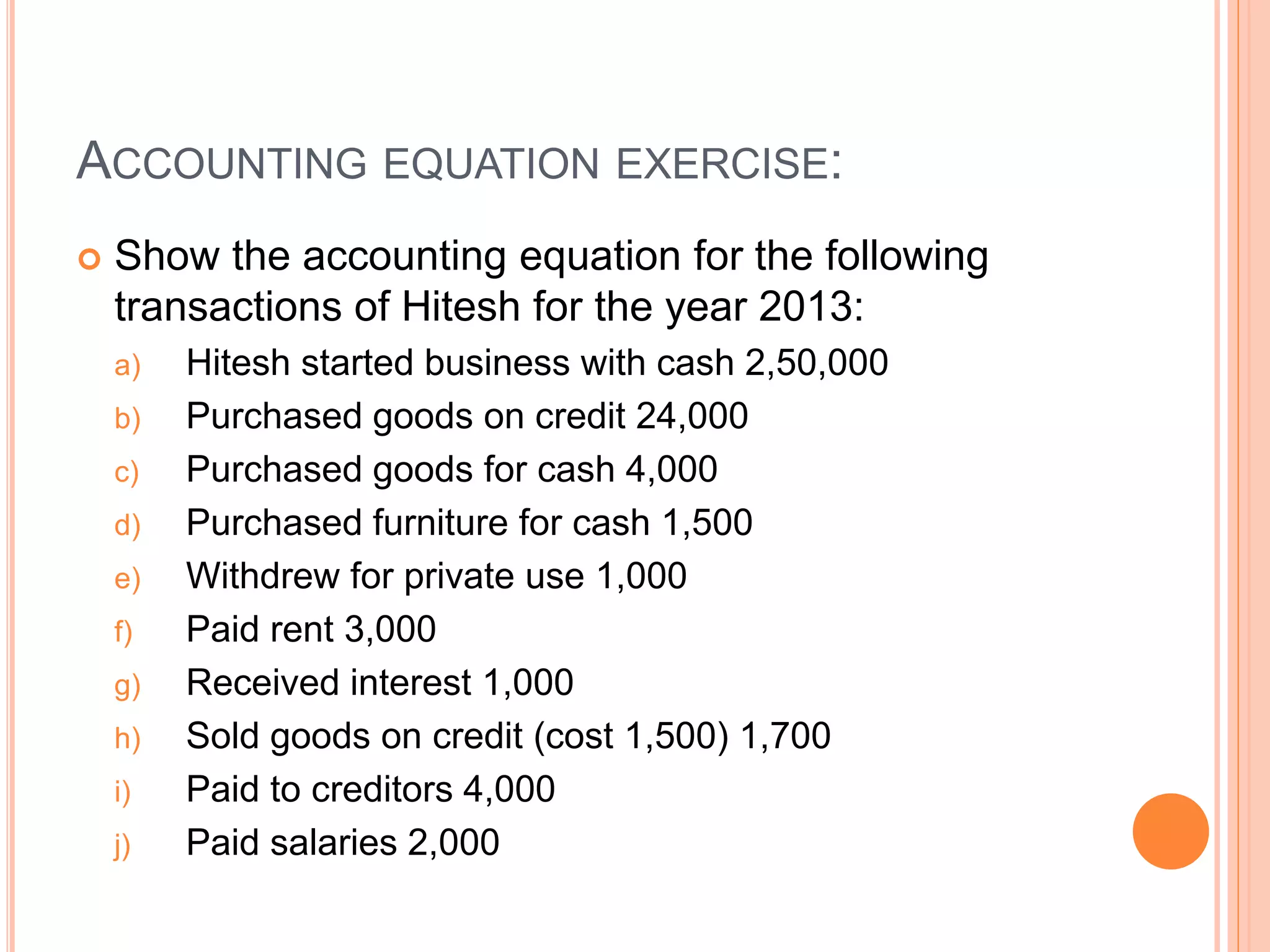

This document provides an overview of basic accounting terminologies, principles, concepts, and conventions. It defines key terms like assets, liabilities, equity, revenue, expenses, cash vs credit transactions. It explains accounting principles like business entity, money measurement, going concern, matching, and conventions like consistency and conservatism. Accounting equations are demonstrated through examples of business transactions that impact assets, liabilities and equity. Basic accounting concepts and their application to business record keeping are concisely introduced.