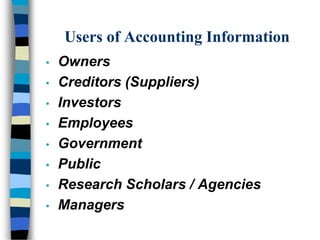

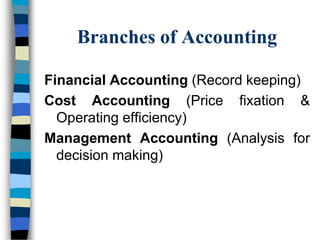

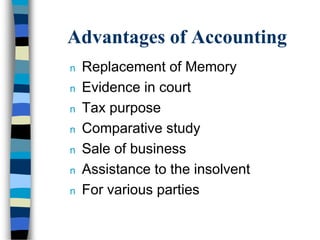

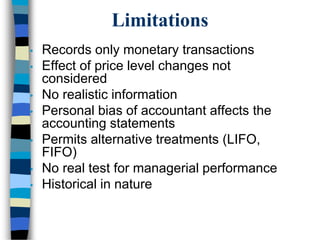

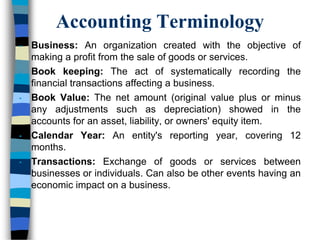

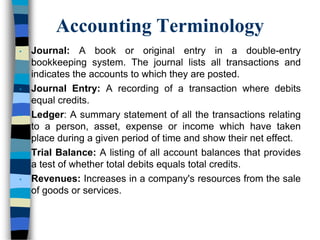

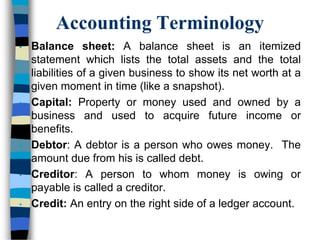

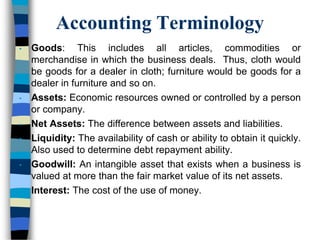

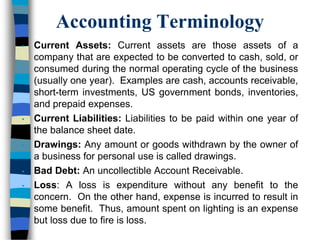

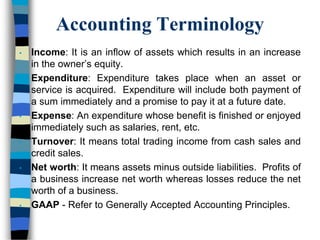

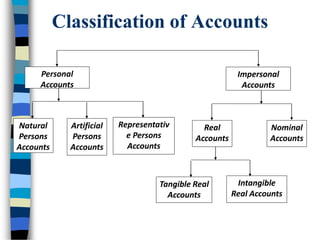

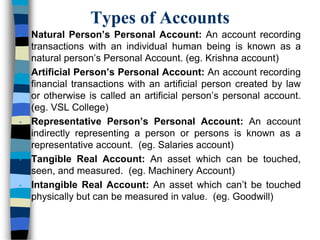

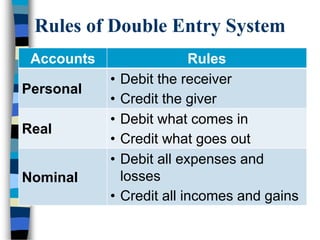

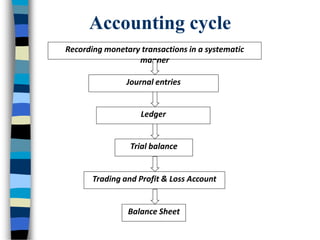

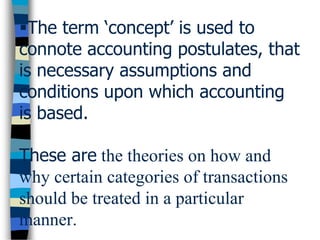

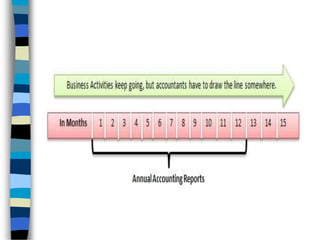

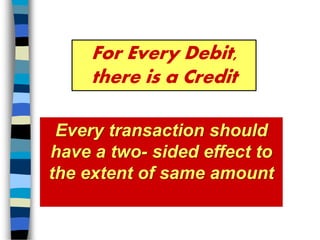

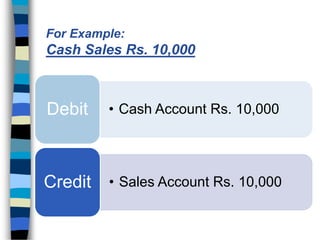

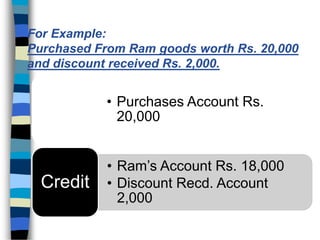

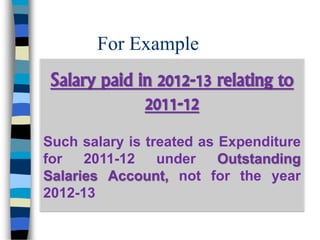

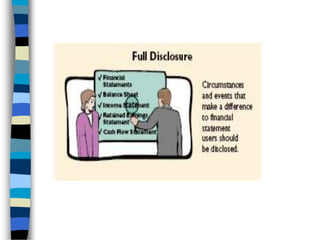

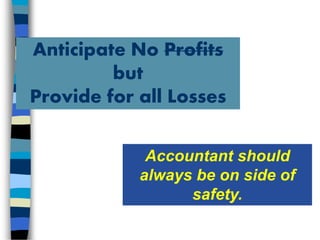

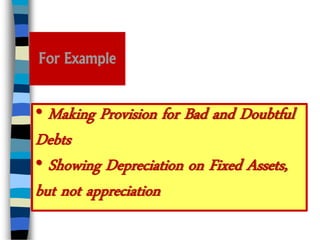

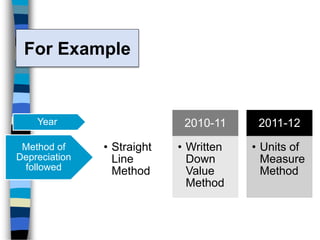

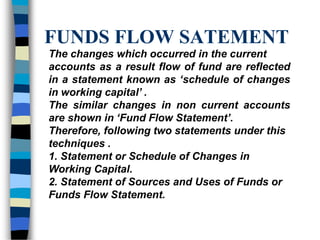

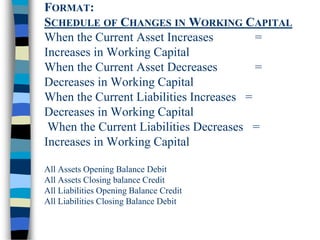

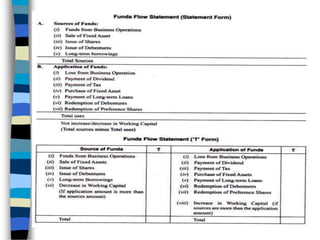

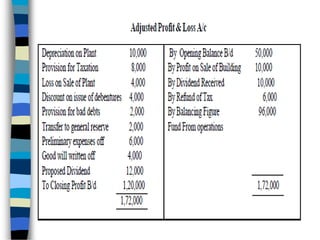

The document provides an overview of key accounting concepts for budding managers. It defines accounting and discusses its functions and branches. It also covers accounting terminology, the accounting cycle, classification of accounts, types of accounts, and accounting concepts such as business entity, money measurement, and matching. Finally, it discusses accounting conventions like consistency, materiality and conservatism, as well as funds flow statements.