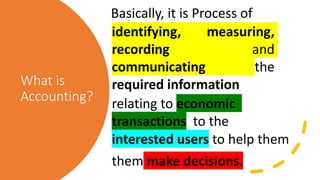

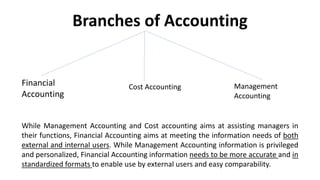

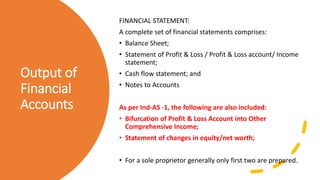

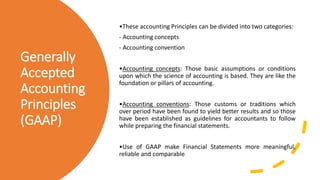

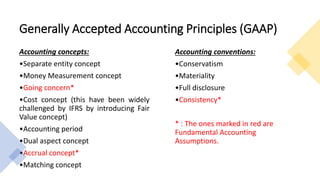

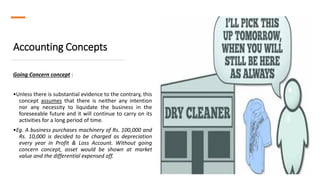

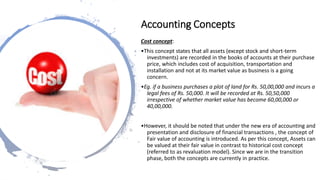

This document provides an overview of accounting concepts, principles, standards and financial statements. It discusses key accounting concepts like money measurement, going concern, cost, dual aspect etc. It also explains accounting conventions like conservatism and full disclosure. Furthermore, it introduces accounting standards and their role in reducing discretion and improving financial reporting. Lastly, it discusses the branches of accounting and users of accounting information.

![Meaning &

Relevance of

Accounting

Standards

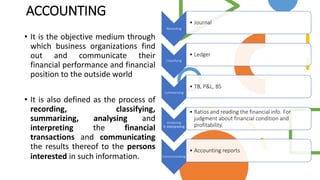

•Accounting Principles (concepts and conventions) that have

evolved over a period of time as general rules for accounting

transactions do not cover specific situations. Also they do not

have backing of law.

•Accounting Standards reduce these general principles to

specific rules covering specific accounting events or

transactions and have the backing of law.

•Eg. AS- 2 states that inventory should be valued at ‘lower of

cost or net realizable value’

•AS-13 states that short-term investments should be shown at

‘lower of cost or market value’[conservatism principle applied]

•Accounting Standards thus reduce management discretion in

choosing accounting policies.

•They also lay down disclosure requirements in order to

provide more meaningful information to various users of FS.](https://image.slidesharecdn.com/accountingbasics-220907165802-358b50d1/85/Accounting-Basics-pdf-33-320.jpg)