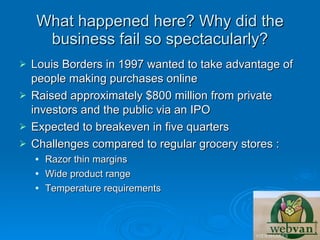

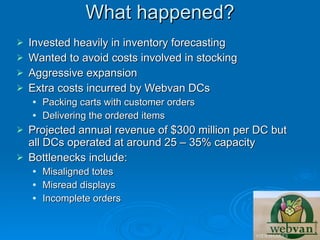

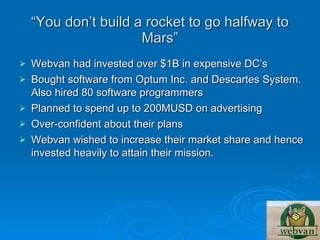

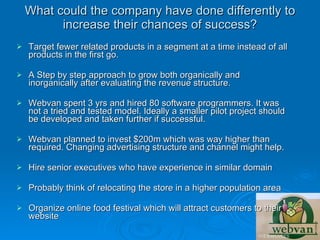

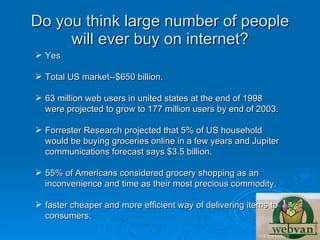

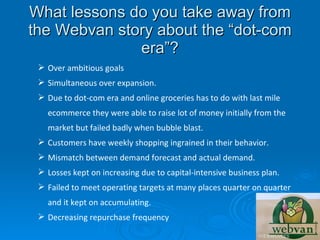

Webvan was an online grocery delivery startup that raised $800 million but failed spectacularly. It expanded too quickly across 26 cities without ensuring efficient operations. High infrastructure costs and low demand led to losses exceeding projections. Webvan's goals of nationwide expansion and 30-minute delivery windows within 5 quarters proved too ambitious given the capital-intensive nature of the grocery business and customer shopping behaviors not being ready to fully transition online.