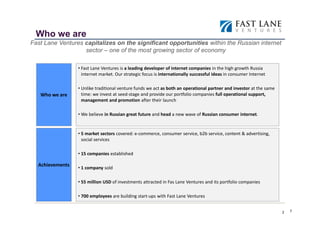

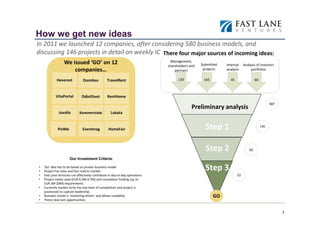

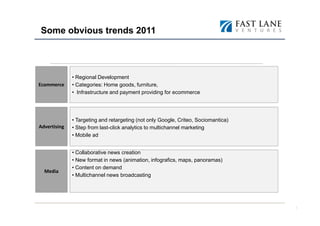

Fast Lane Ventures is a leading venture capital firm focused on investing in promising internet companies in Russia. In 2011, they launched 12 new companies after reviewing over 500 business models. They focus on sectors like e-commerce, consumer services, B2B services, content/advertising, and social media. Some trends they expect to see growth in include regional e-commerce development, targeted/retargeted advertising, and new media formats. The Russian e-commerce market is growing rapidly but still small compared to other countries. Promising niches include categories with high volumes/margins and repeated purchasing. Local commerce also has potential as mobile internet usage grows.