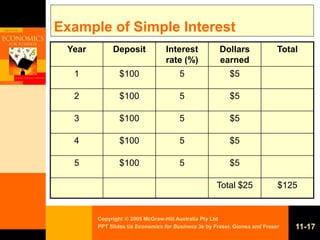

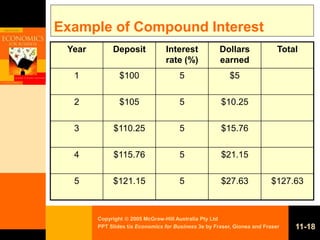

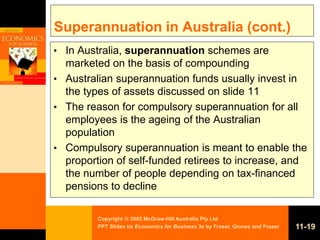

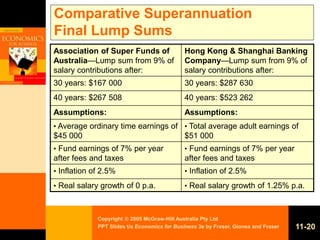

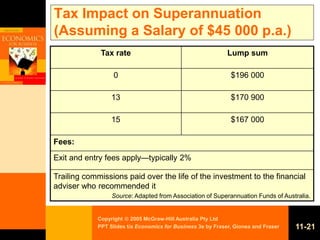

This document is a chapter from an economics textbook that discusses wealth creation. It defines wealth and outlines different types of assets that comprise wealth. The chapter then discusses historical attitudes toward wealth creation, sources of income, financial investment, risk factors, asset classes, risks related to different assets and international investments, taxation considerations, and superannuation in Australia. It provides examples of simple and compound interest as they relate to superannuation and compares lump sum payouts from super funds over 30 and 40 year periods.