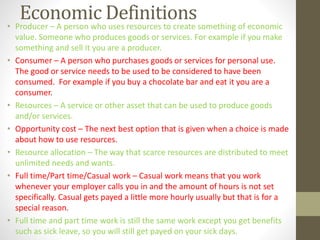

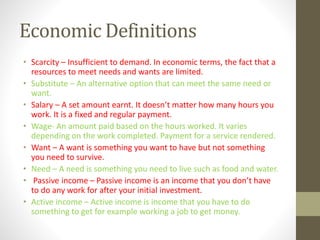

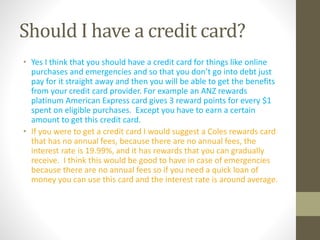

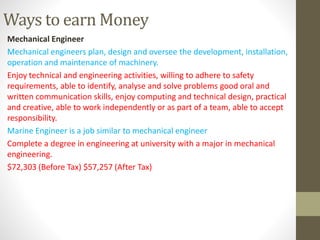

The document provides definitions of economic terms like producers, consumers, resources, and passive vs active income. It then discusses ways to earn money through careers like mechanical engineering, accounting, and medicine. Passive income opportunities through real estate investing and stock market investing are presented. The benefits and drawbacks of credit cards and taking on debt are debated. Finally, the document acknowledges that scarcity means not everyone can have everything they want.