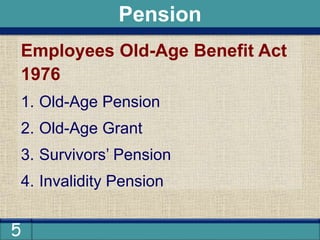

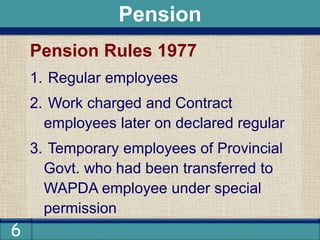

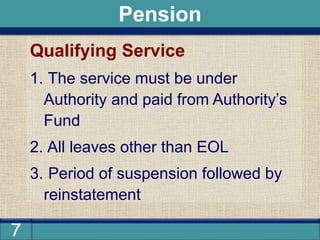

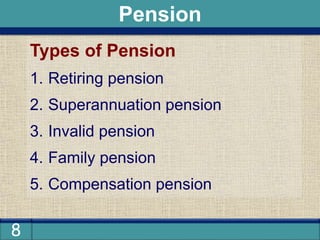

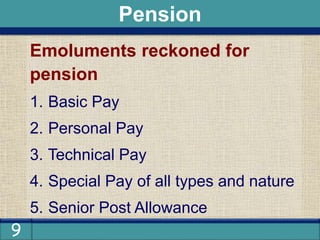

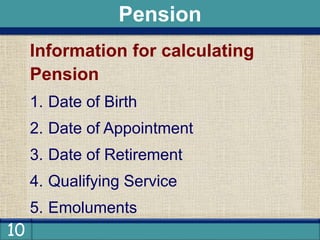

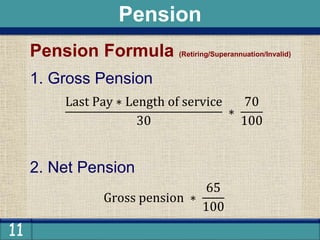

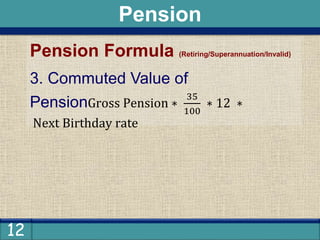

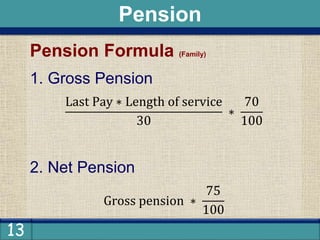

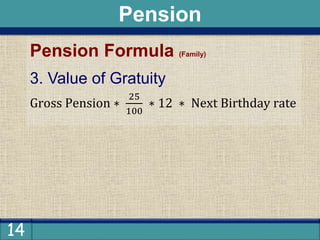

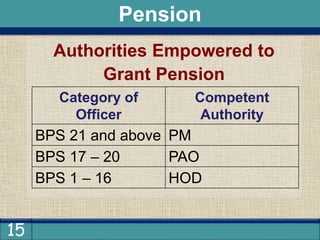

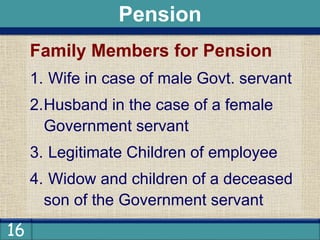

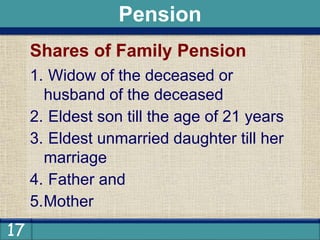

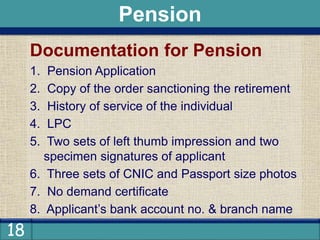

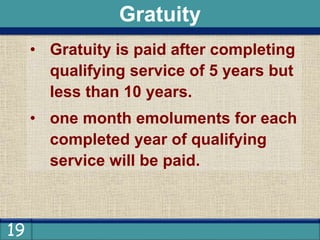

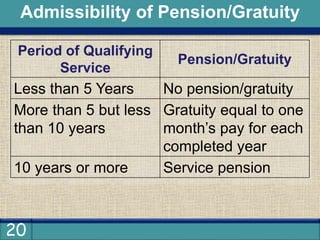

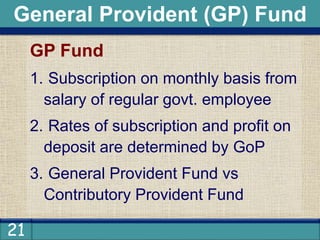

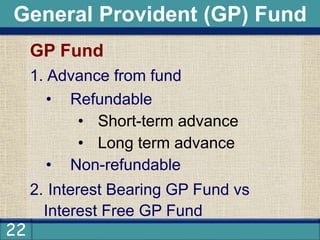

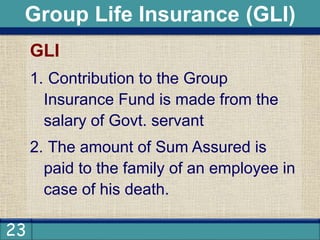

This document outlines pension and terminal benefits for employees in state-owned enterprises in Pakistan. It discusses the pension rules for private and WAPDA employees, qualifying service periods, types of pensions including retiring, superannuation, invalid and family pensions. Formulas are provided for calculating different pension types based on factors like last pay, length of service, emoluments. Authorities for granting pensions, eligible family members, documentation required and conditions for receiving gratuity or pension after various periods of service are also described. The document concludes by covering general provident funds, contributions and advances, as well as group life insurance benefits.