The document provides an overview of investments, including:

1. It defines investment as exchanging money wealth for tangible wealth with the goal of receiving more money in the future through interest, dividends, or capital gains.

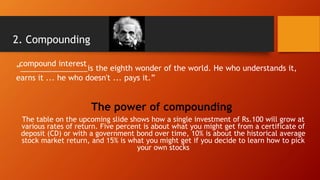

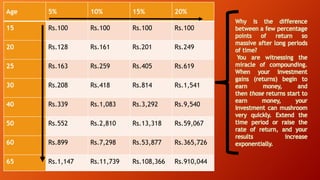

2. Investments are needed to offset inflation and allow money to generate more money through interest or asset appreciation.

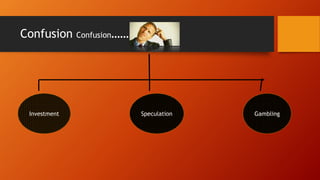

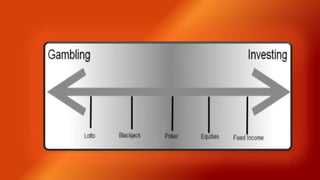

3. It distinguishes between investment, speculation, and gambling and defines each. Investment involves risk but is properly analyzed, while speculation and gambling involve uncontrolled risk.

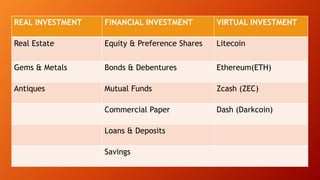

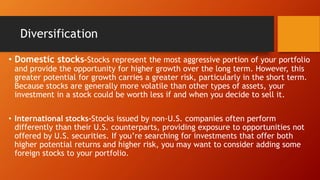

4. It discusses various types of investments including real assets, financial assets, and virtual assets as well as direct and indirect investing.