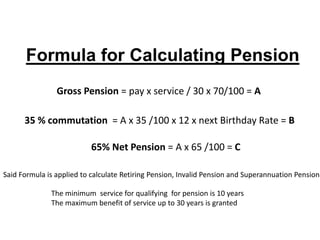

This document outlines the pension rules for Wapda employees in Pakistan. It defines key terms like pension, family, service qualifying for pension, and types of pension including retiring, invalid, superannuation, family, and compensation pension. The minimum service required for pension is 10 years. Formulas are provided to calculate retiring, invalid, superannuation, and family pension based on an employee's pay, service period, and other emoluments. Family members eligible for family pension are also defined.