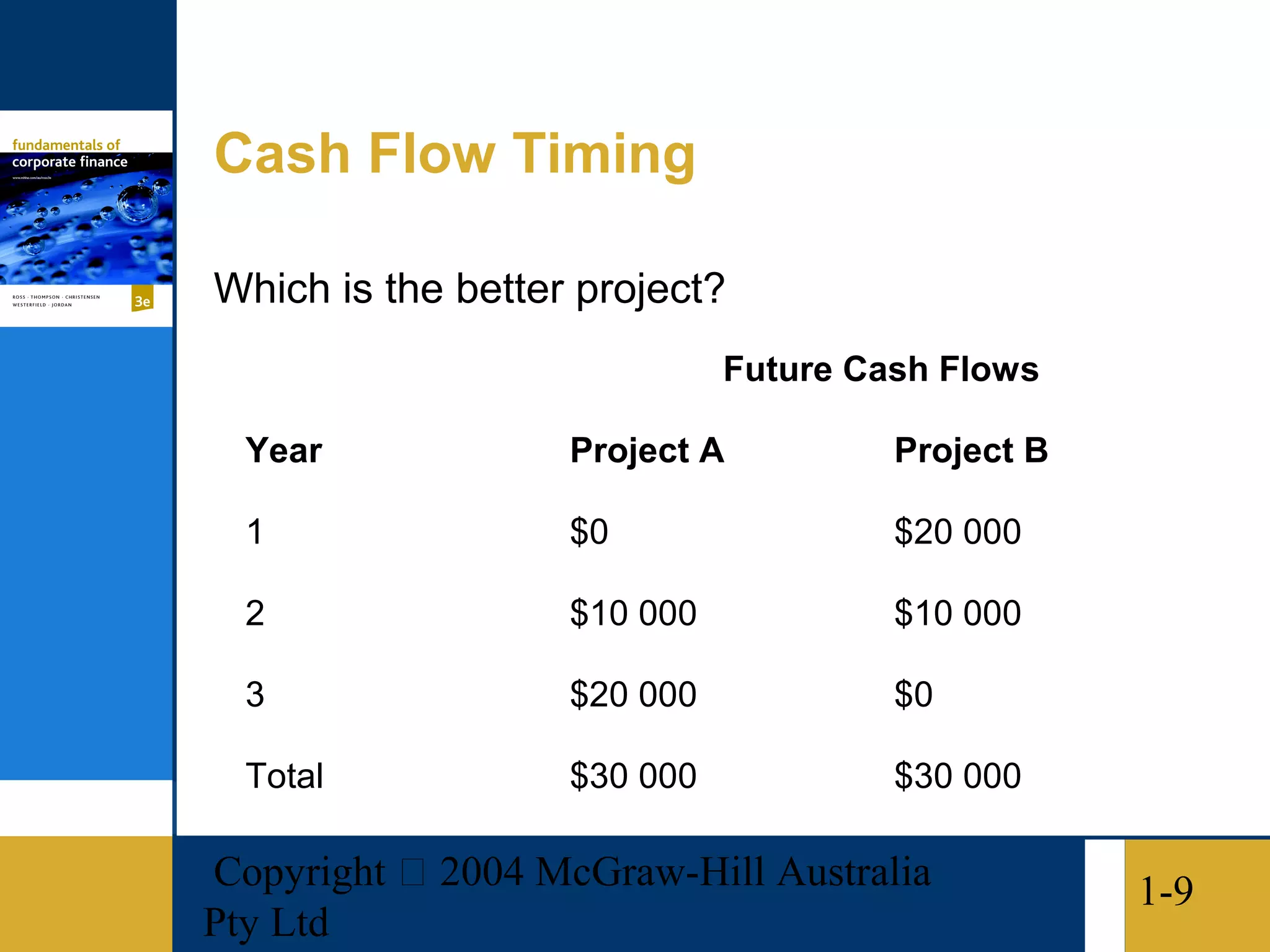

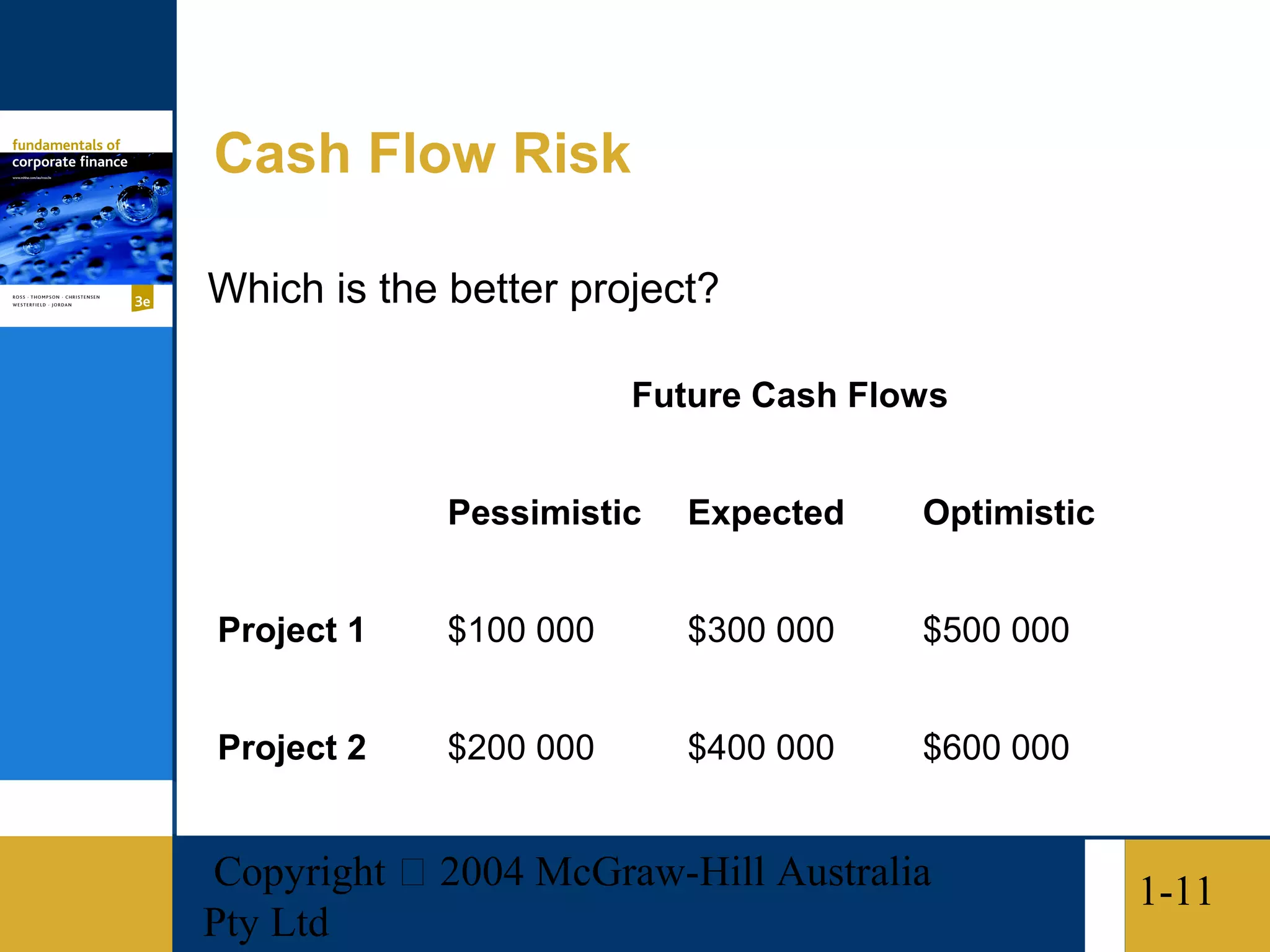

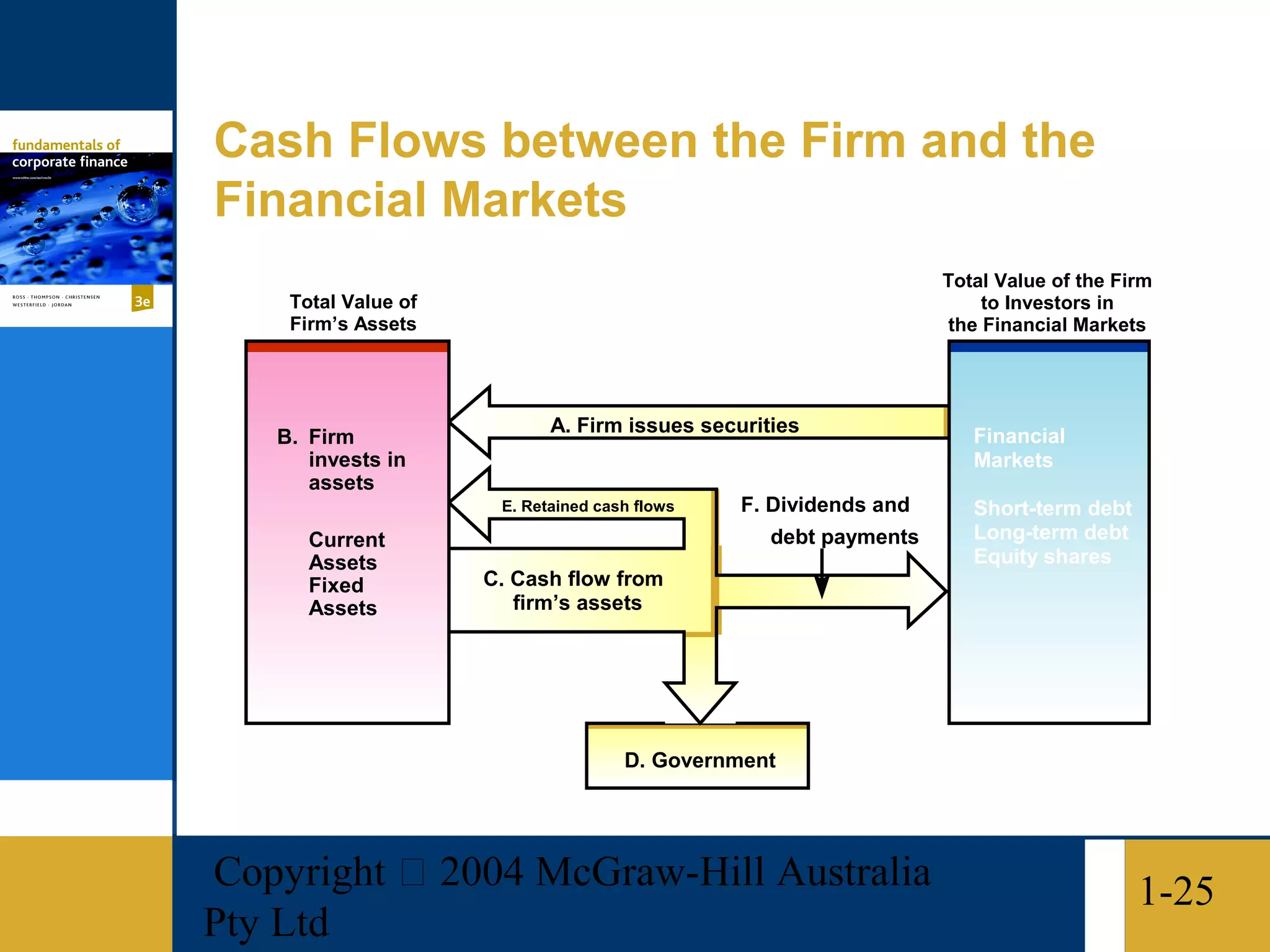

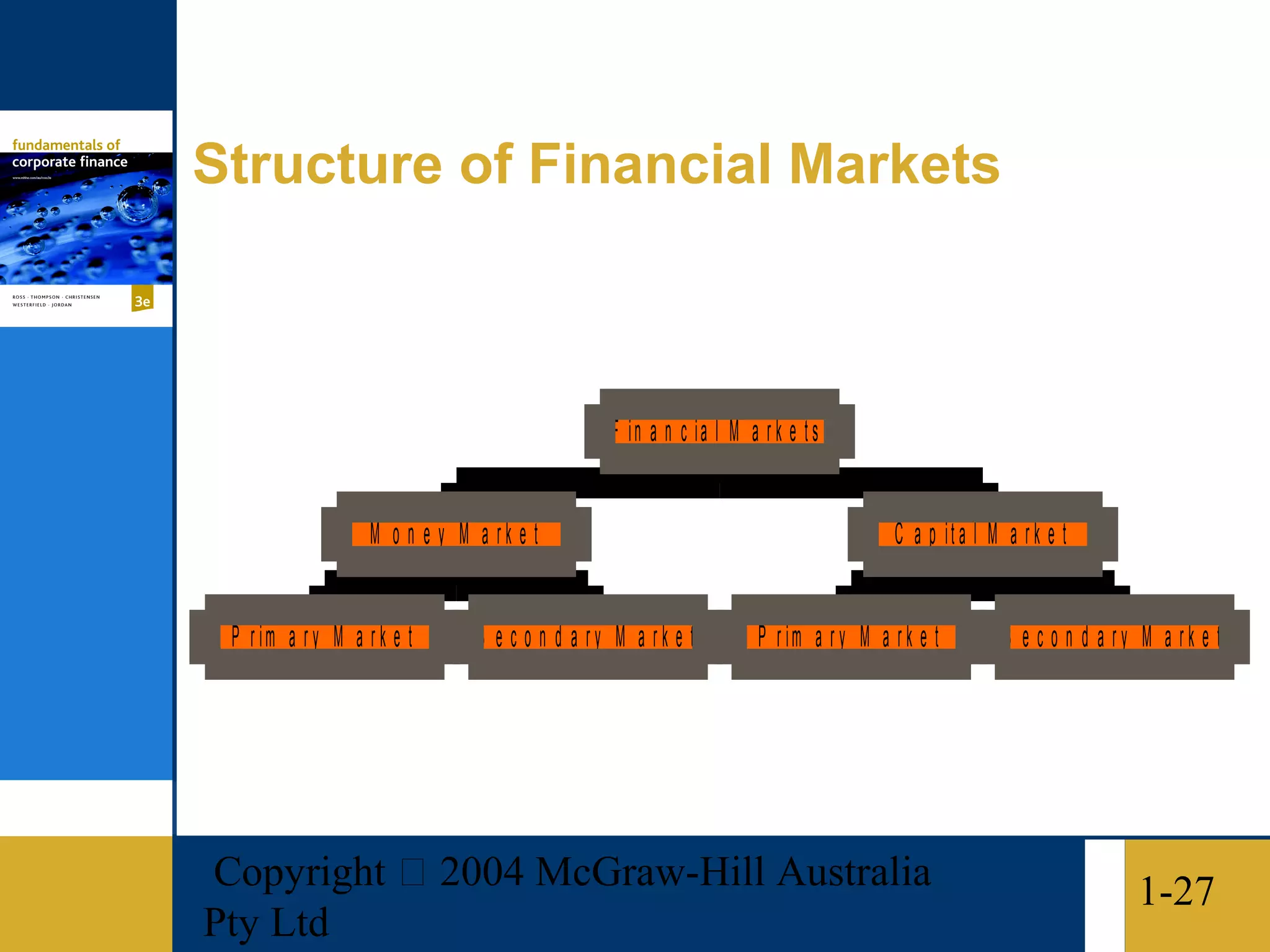

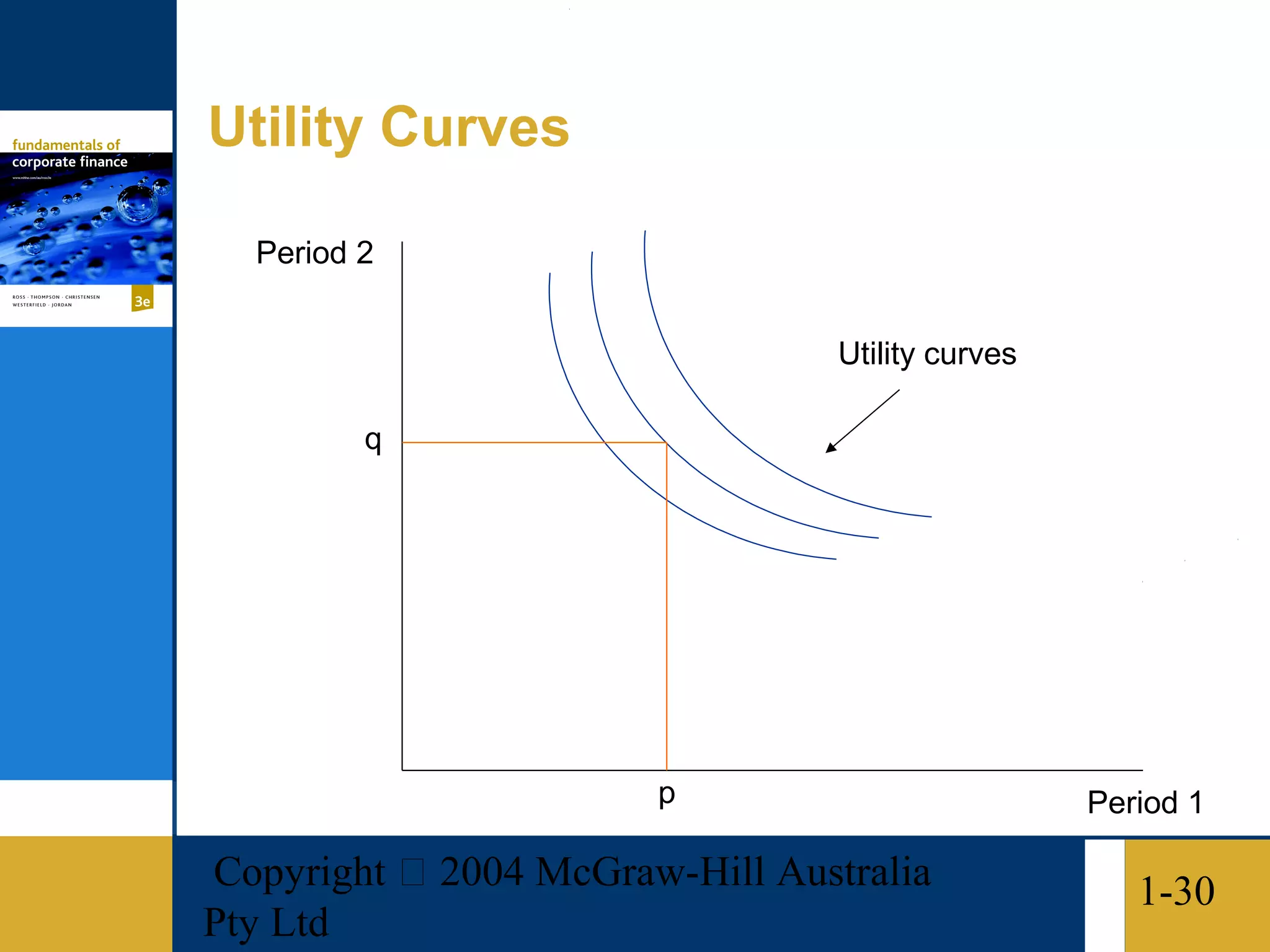

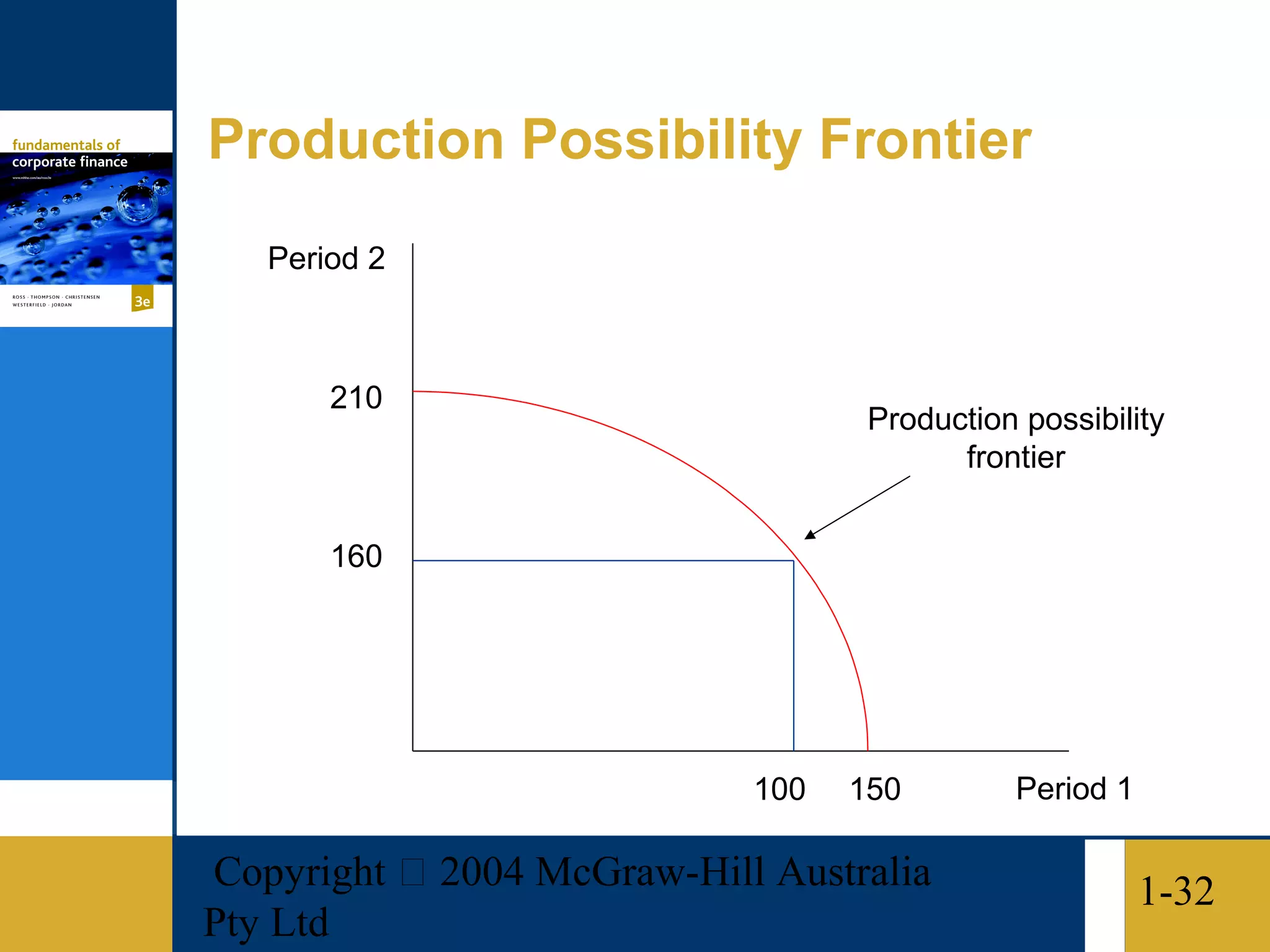

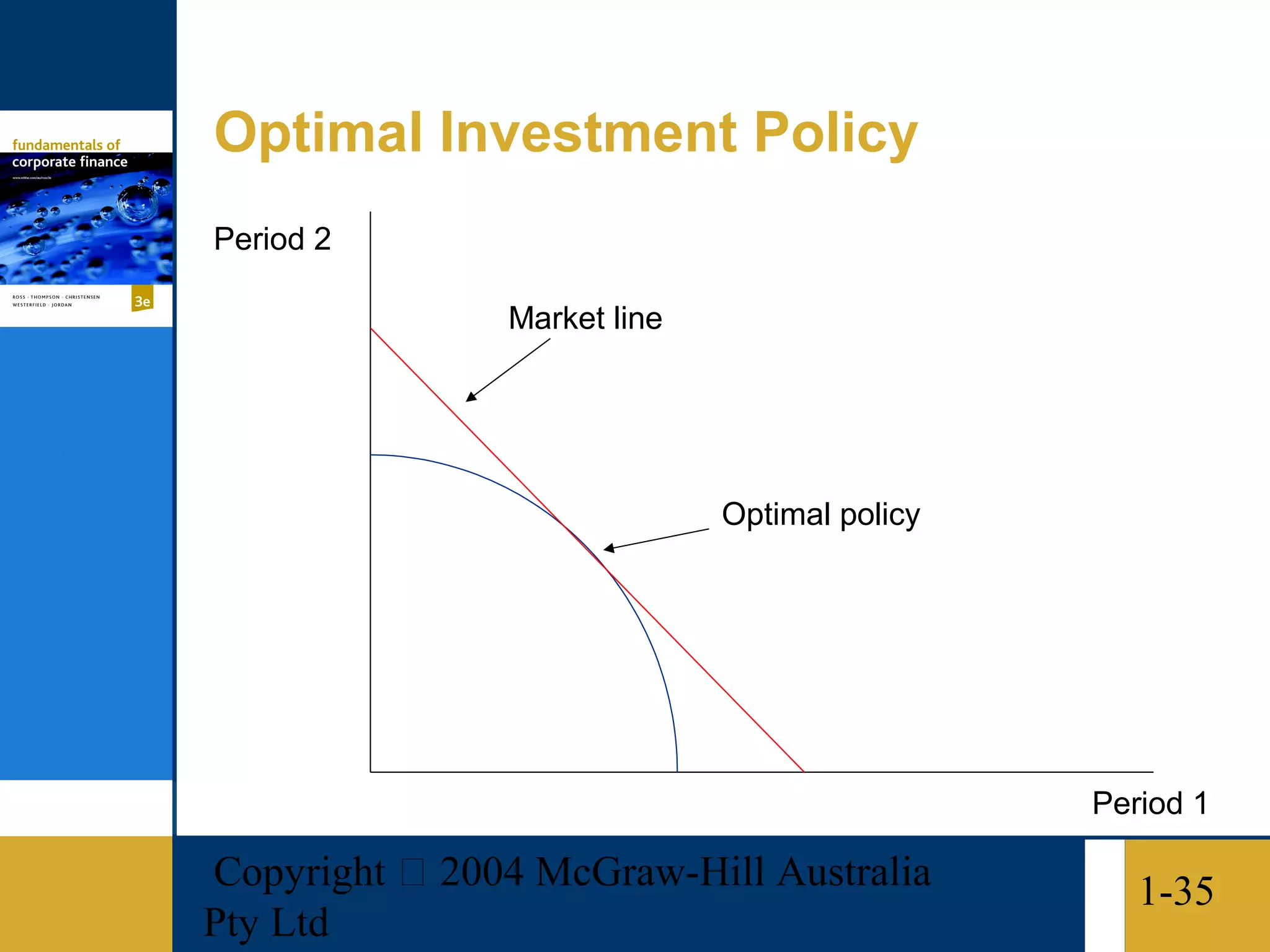

The document provides an overview of Chapter 1 from a corporate finance textbook. It introduces key concepts such as the three main financial decisions facing managers regarding investments, financing, and dividends. It also discusses the corporate form of business organization and explains that the goal of financial management is to maximize shareholder wealth. The chapter objectives are outlined and several models and concepts are defined, including the investment decision process, capital structure, and agency relationships between managers and shareholders.