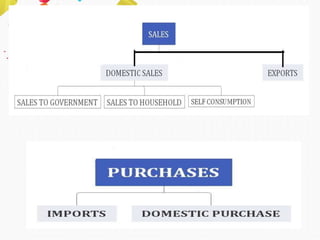

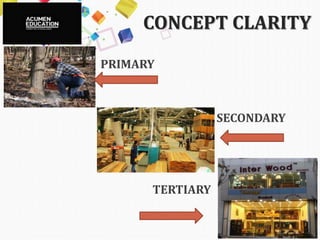

The document discusses the value added method of calculating gross domestic product (GDP). It defines value added method as measuring national income in terms of the value added by each producing enterprise. It provides the formula for calculating value added, gross value added, net value added, and national income. It also discusses concepts like primary, secondary and tertiary sectors. The document cautions against double counting in national income calculation and provides steps and examples to clarify the application of value added method.

![PRESENTATION BY:-

CS. SOHIL GAJJAR

CS, MA [ECONOMICS], B.COM

CO-FOUNDER &

CHIEF MENTOR OF

ACUMEN EDUCATION](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-2-320.jpg)

![FORMULA

1. GROSS VALUE ADDED@MP/VALUE ADDED = VALUE OF OUTPUT – INTERMEDIATE COST

2. VALUE OF OUTPUT = SALES + CHANGE IN STOCK [Closing –Opening]

OR SALES + ADDITION TO STOCK/INCREASE IN STOCK

OR SALES - FALL IN STOCK/DECREASE IN STOCK

OR SALES + INVENTORY INVESTMENT

3. SALES = PRICE x QUANTITY/UNITS/OUTPUT

4. NVAMP = GVAMP - DEPRECIATION

5. GVAFC = GVAMP - NIT [IDT – SUBSIDIES]

6. NVAFC = GVAMP - DEP – NIT

NVAFC IS OUR DOMESTIC INCOME

NVAFC = NDPFC

ADD NFIA TO NVAFC TO GET NATIONAL INCOME [NNPFC]](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-5-320.jpg)

![EXAMPLE

SECTOR PRODUCT VALUE OF

OUTPUT

INTERMEDIATE

COST

VALUE

ADDED

PRIMARY COTTON 1000 - 1000

SECONDARY THREAD

& COTTON

CLOTH

3000 1000 2000

TERTIARY SHIRT 6000

[GDP MP]

3000 3000

GVA MP - - 6000

[GVA MP]

GDP MP [6,000] = GVA MP [1,000 + 2,000 + 3,000 = 6000]

GVAPMP = VALUE ADDED BY PRIMARY + SECONDARY + TERTIARY SECTOR

GDP MP IS THE FINAL VALUE OF SHIRT RS. 6,000

HENCE, GVAP MP = GDP MP](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-8-320.jpg)

![STEPS OF VALUE ADDED METHOD

Step I Identify and classify the production units of an

economy into primary, secondary and tertiary.

Step II Estimate GVAMP. It is the sum of Gross Value Added

by all the sectors of an economy.

GVA = GDP MP

Step III Calculate Domestic Income NDP FC

By subtracting the amount of depreciation and net indirect taxes

from GVAMP we get domestic income.

NVA FC = GVP MP – Depreciation – NIT

Step IV Estimate NFIA to arrive at National Income

NVA FC + NFIA = NNP FC [National Income]](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-10-320.jpg)

![PRECAUTION OF VALUE

ADDED METHOD

• Intermediate goods are not included in the national income

• Sale and purchase of second hand goods is not included as they were included in

the year in which they were produced.

• However, any commission, brokerage on sale or purchase of such goods will be

included in the national income as it is a productive service.

• Production of services for self consumption [domestic services] are not included.

Example; services like of housewife, gardening etc., as these services are produced

and consumed at home and never enter the market place and are termed as non-

market transactions.

• Imputed value of production for self consumption is taken into account. Because,

these goods are like those produced for the market. They are not sold simply

because of their need by the producers themselves.

• Imputed rent on the owner occupied house is also taken into account. Because, all

house have rental value, no matter these are self-occupied or rented out.

• Change in stock of goods will be included as it is a part of capital formation.](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-11-320.jpg)

![GVA MP by Primary Sector

+

GVAP MP by Secondary Sector = GVA MP

+

GVAP MP by Tertiary Sector

- Depreciation

- Net Indirect Taxes

= NVAFC/NDPFC [DOMESTIC INCOME]

+

NFIA

=

NNPFC [NATIONAL INCOME]](https://image.slidesharecdn.com/valueaddedmethod-200330135217/85/VALUE-ADDED-METHOD-12-320.jpg)