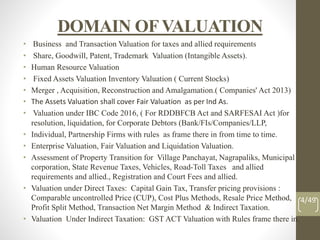

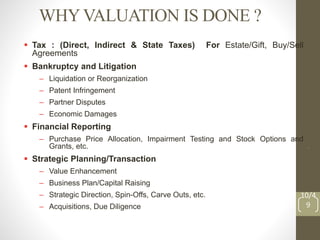

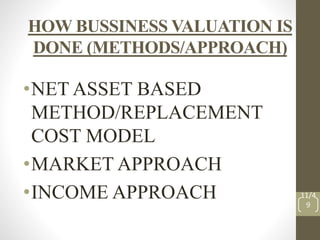

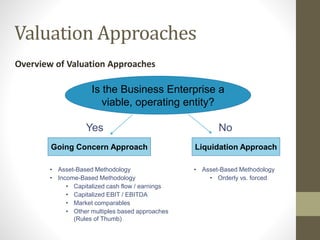

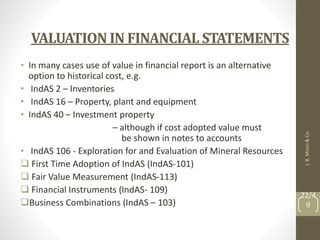

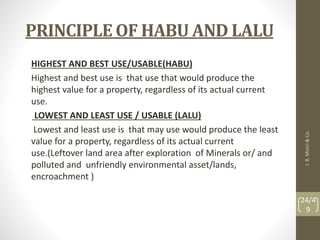

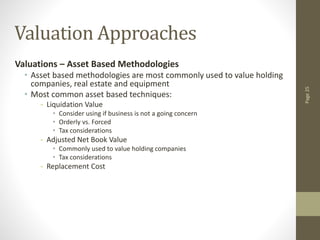

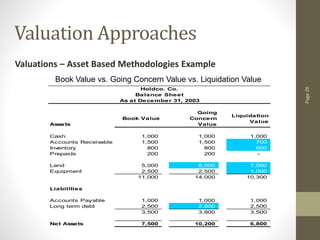

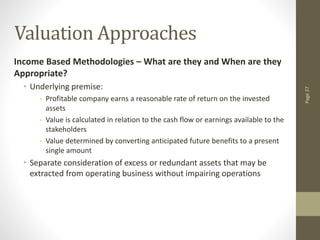

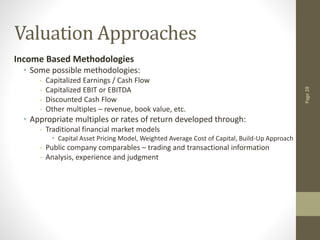

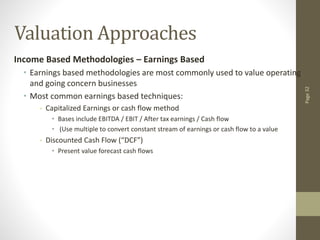

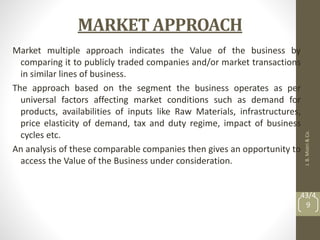

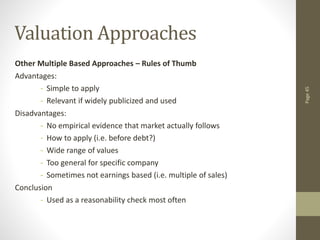

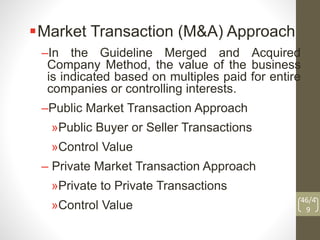

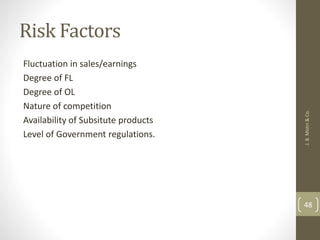

Valuation is a complex process that considers many financial and non-financial factors. It requires calibrating knowledge from various disciplines like art, science, economics, and law. Valuation is used for many purposes including taxation, transactions, financial reporting, and strategic planning. There are several approaches to valuation such as asset-based, income-based, and market-based methods. The appropriate valuation approach and method depends on the nature of the business or assets being valued.