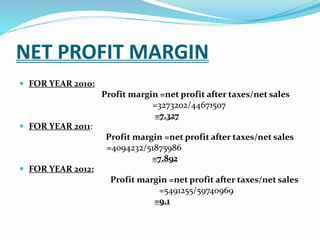

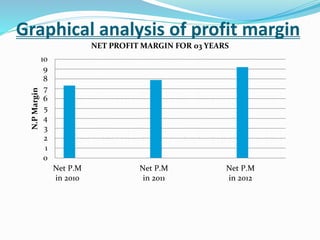

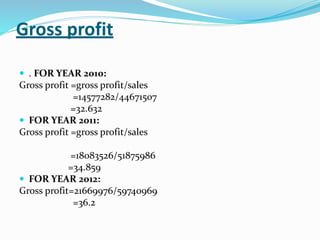

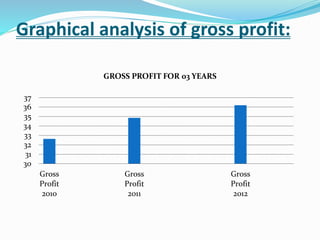

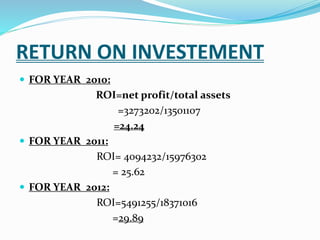

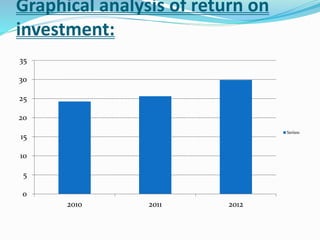

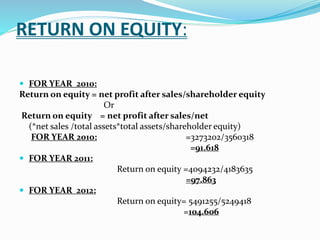

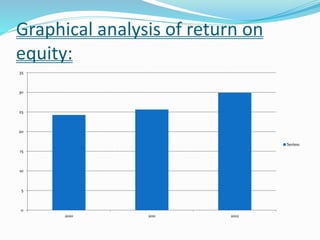

Unilever is a global consumer goods company with top brands accounting for almost 75% of its sales. The document analyzes Unilever Pakistan's profitability from 2010-2012 using four key financial ratios: net profit margin, gross profit, return on assets, and return on equity. The ratios all increased over this period, indicating Unilever Pakistan's profitability improved with time as sales increased and taxation remained low. In conclusion, Unilever Pakistan demonstrated good overall profitability performance that increased each year.