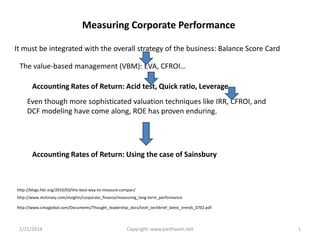

The document discusses various methods for measuring corporate performance, including return on equity, return on assets, economic value added, and accounting rates of return. It provides examples of using these metrics to analyze the performance of Sainsbury, a UK supermarket chain, over several years. Specifically:

1) Return on equity, return on assets, margins, and liquidity ratios like current ratio declined for Sainsbury from 2011 to 2012, indicating weaker performance.

2) Metrics like asset turnover and inventory turnover remained relatively stable, suggesting working capital efficiency did not change significantly.

3) Accounting income only considers operating costs and not capital costs, so economic value added is a better measure as it incorporates the full cost