Embed presentation

Downloaded 504 times

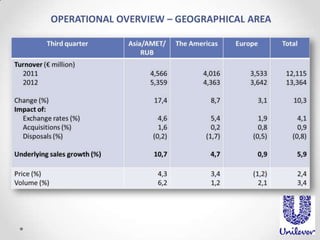

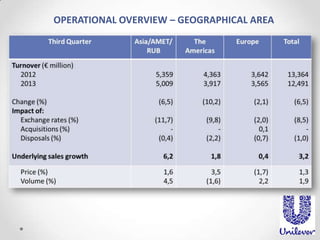

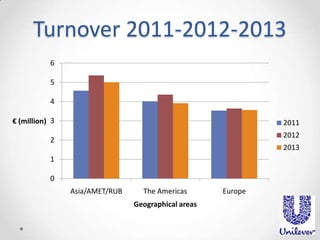

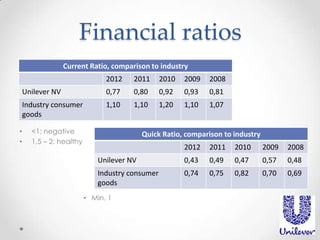

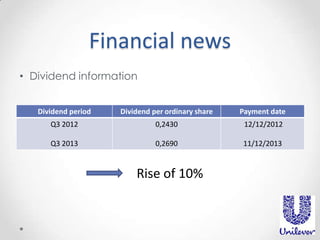

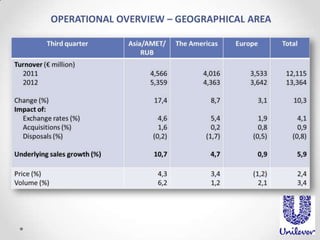

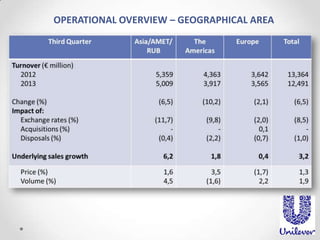

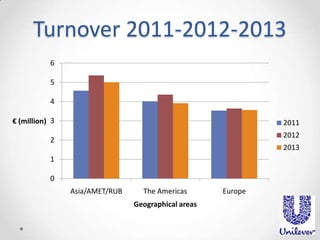

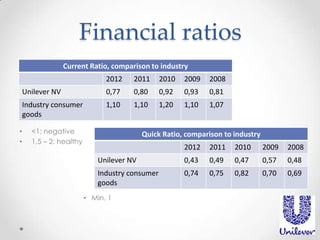

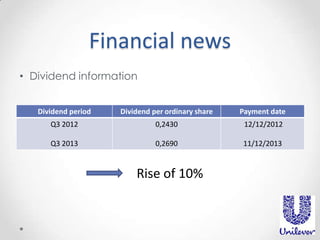

This document provides a financial analysis of Unilever comparing their 3rd quarter results from 2012 to 2013. It includes information on Unilever's geographical sales breakdown, stock price performance, key financial ratios comparing them to industry averages, and details on their dividend payments which rose 10% from Q3 2012 to Q3 2013. The document concludes that Unilever has strong knowhow, continues growing, and provides dividends to shareholders while still having lots of potential. Sources used are listed at the end.