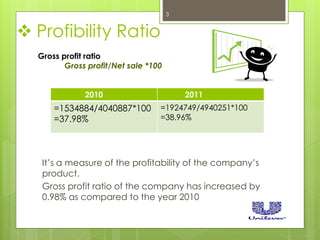

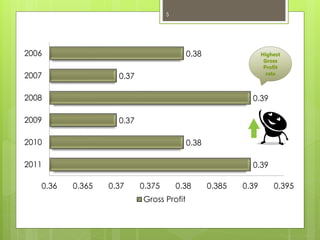

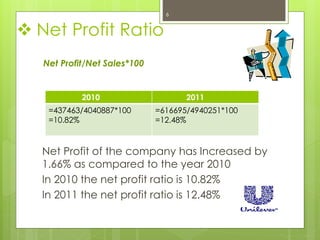

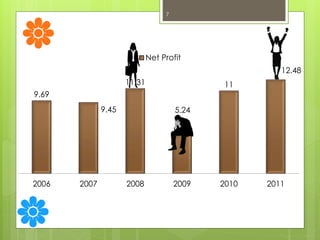

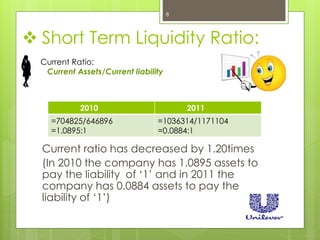

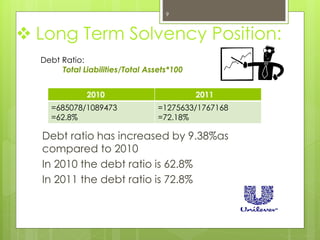

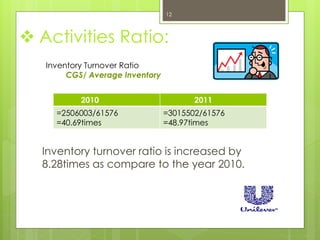

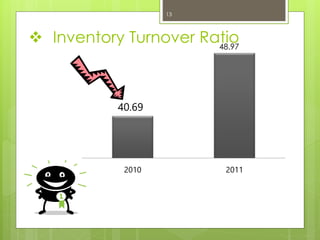

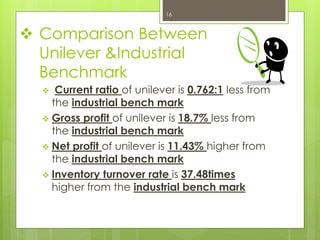

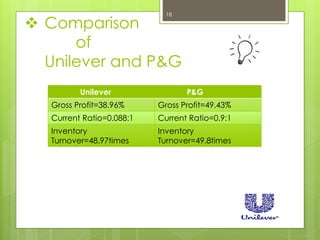

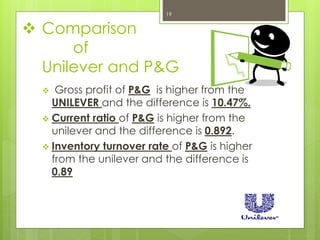

This document analyzes the financial performance of Unilever from 2010-2011. It finds that Unilever's gross profit ratio increased 0.98% from 2010-2011. Its net profit ratio also increased, from 10.82% in 2010 to 12.48% in 2011. However, its current ratio decreased from 1.0895 in 2010 to 0.0884 in 2011. When compared to industrial benchmarks, Unilever's current ratio, gross profit, and inventory turnover were lower, while its net profit was higher. Compared to P&G specifically, P&G had higher gross profits, current ratio, and inventory turnover than Unilever.