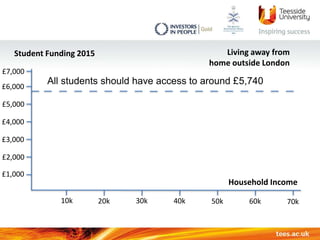

This document provides information about student funding for the 2015 academic year and beyond in the UK. It outlines that university tuition fees are up to £9,000 per year, and all students can take out a tuition fee loan. For living costs, students can receive a non-repayable maintenance grant up to £3,387 if their household income is below £25,000, as well as a maintenance loan. Additional funding may be available for disabled students or those studying certain healthcare subjects through the NHS. Student loan repayments are based on income after leaving education, and any outstanding debt is written off after 30 years.