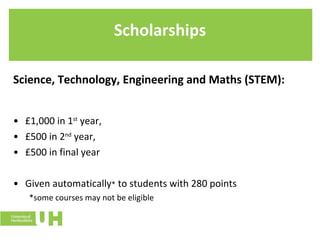

The document summarizes information about student finance for the 2010/11 academic year in the UK. It outlines changes to the student finance system including a new online application process. It provides details on tuition fees, financial support like loans and grants, repayment terms, and scholarships. Additional resources for students to manage their money are also mentioned.