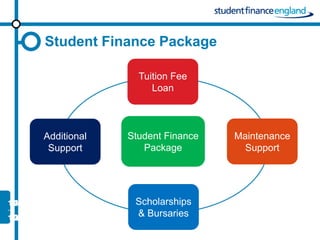

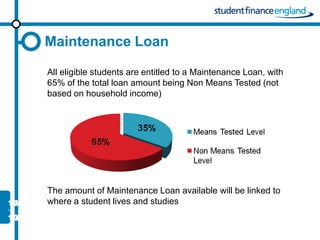

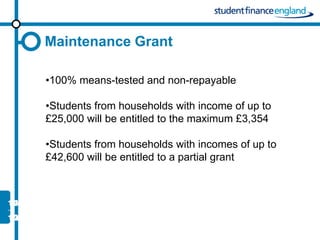

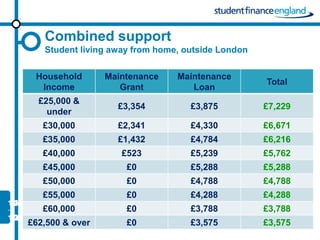

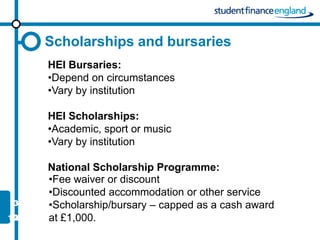

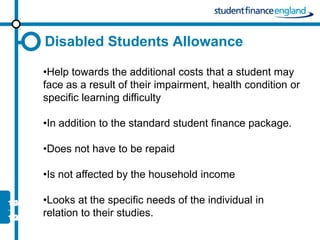

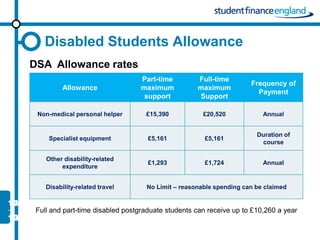

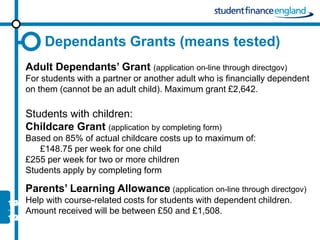

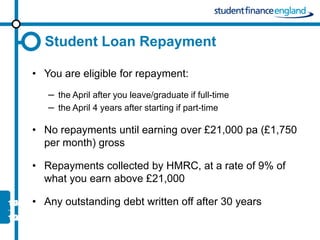

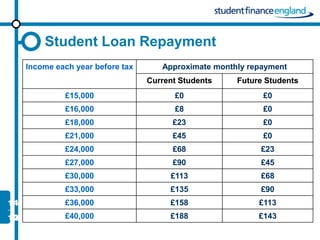

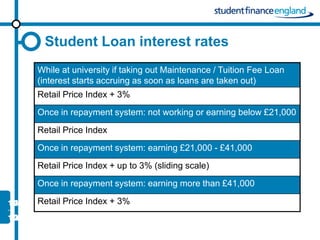

Student Finance England administers financial support for higher education students in England. They provide tuition fee loans to cover university fees, maintenance loans for living costs, and means-tested grants. Additional support is available for disabled students and those with dependents. Loans are repaid once income is over £21,000 per year at a rate of 9% of income above that threshold. Outstanding debt is written off after 30 years.