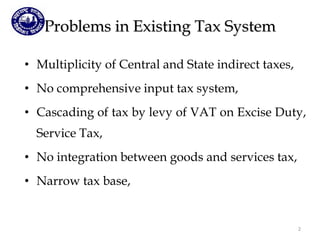

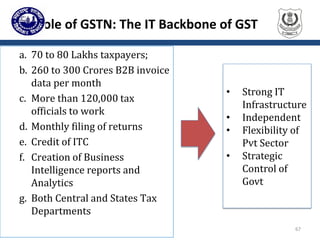

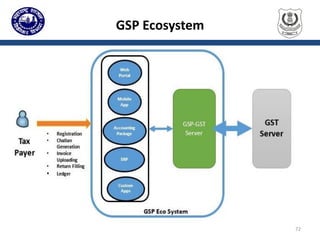

The document provides information about GST awareness campaigns and updates regarding the GST system in India. Some key points:

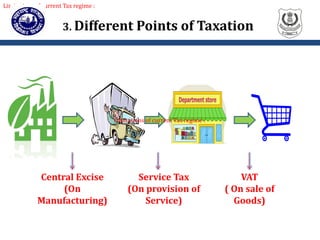

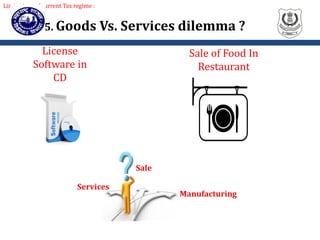

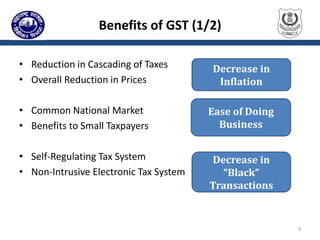

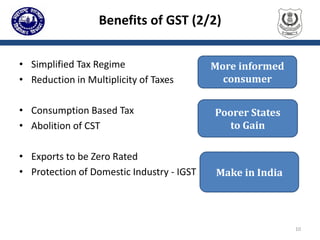

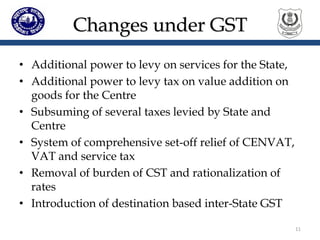

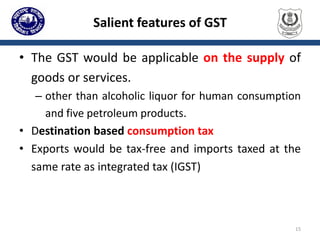

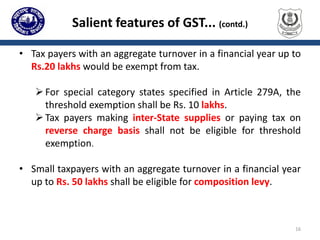

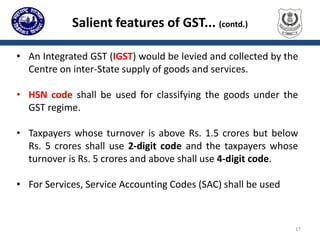

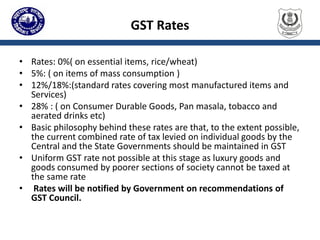

1) GST aims to replace existing indirect tax system with a single, unified tax to reduce cascading of taxes and make India a common market.

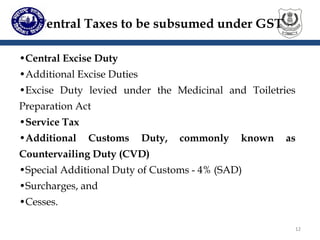

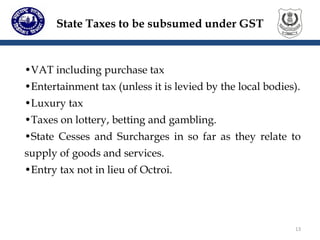

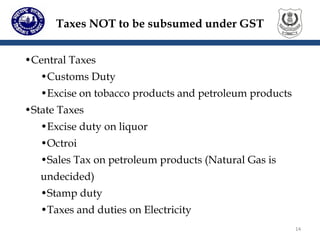

2) GST will subsume many central and state taxes into a single tax applicable on supply of goods and services.

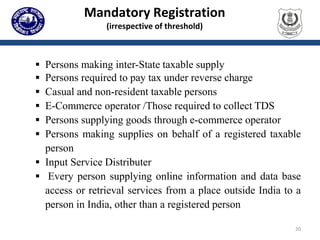

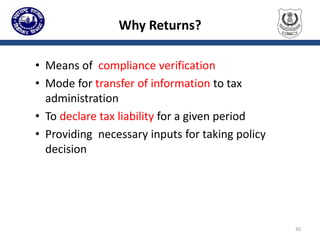

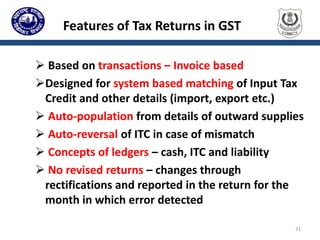

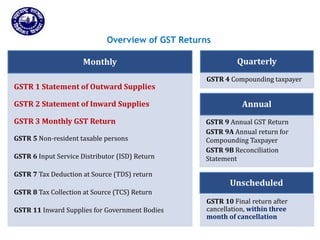

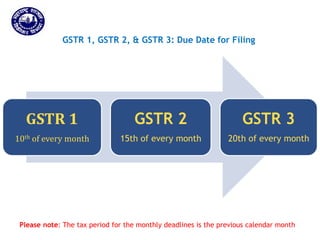

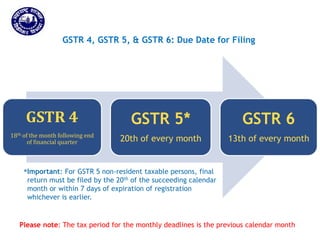

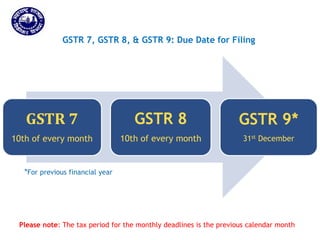

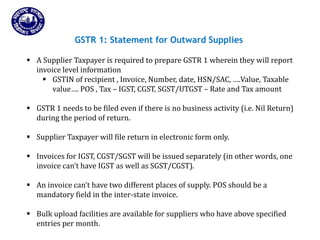

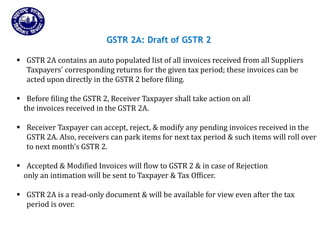

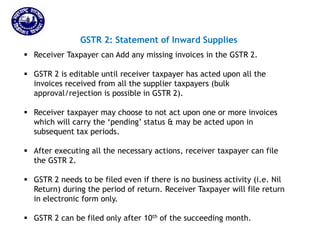

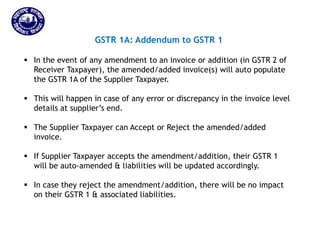

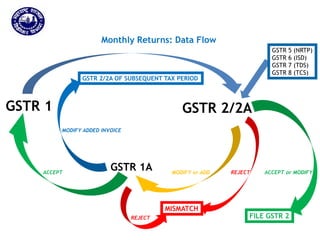

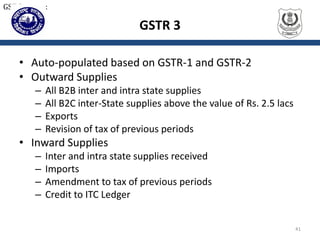

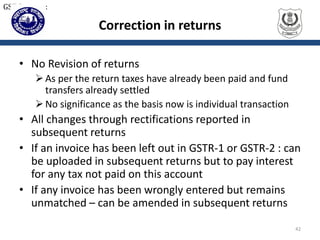

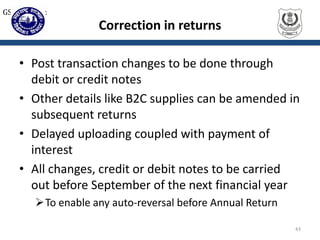

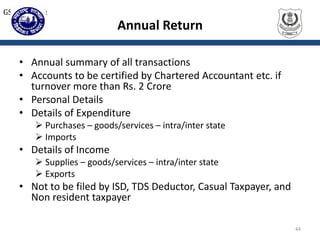

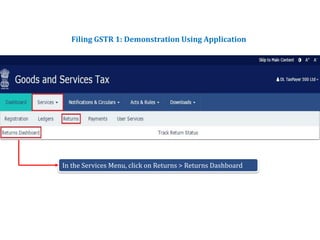

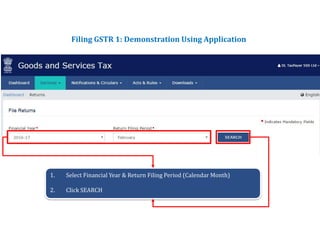

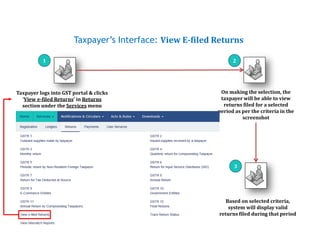

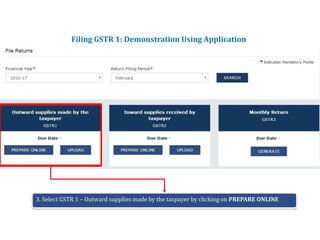

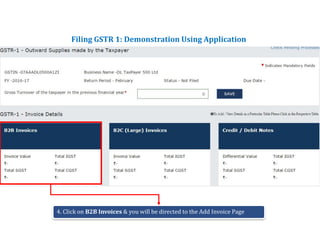

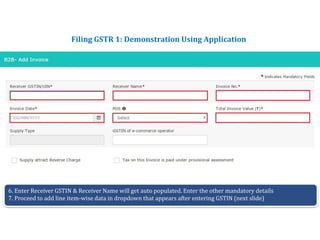

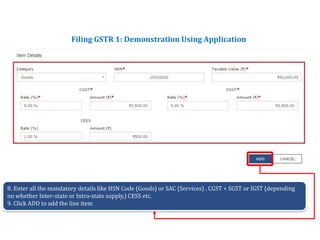

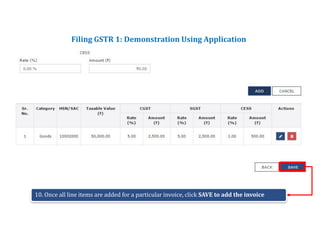

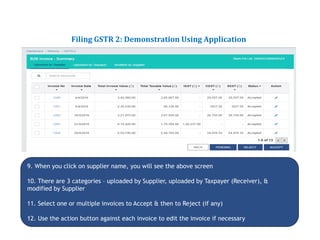

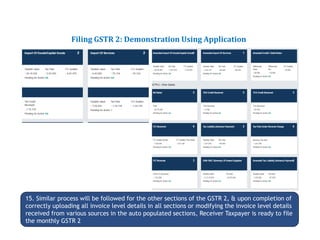

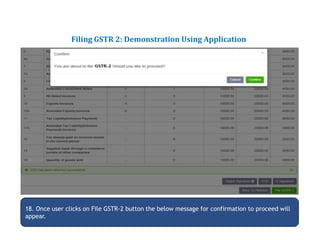

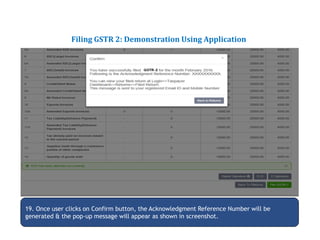

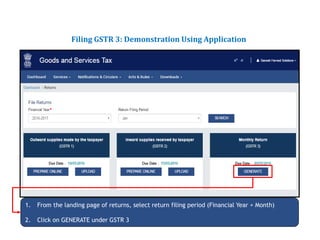

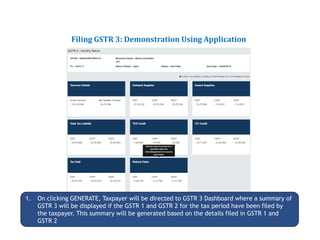

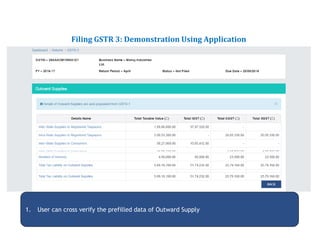

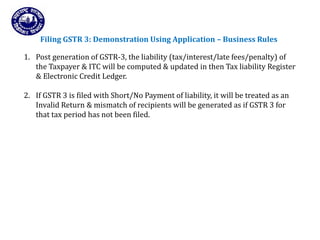

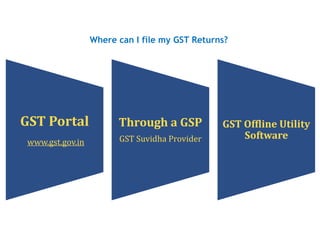

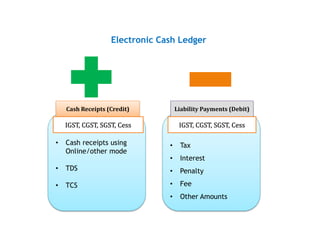

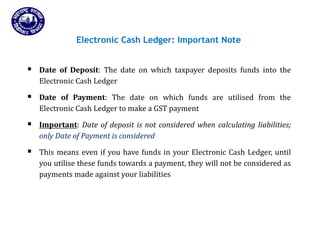

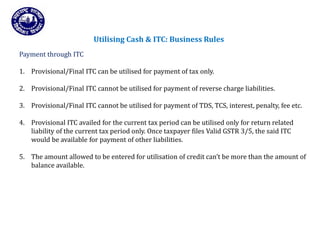

3) Taxpayers will need to file regular returns providing details of outward supplies, input tax credits, and tax liabilities to allow for matching and compliance verification by tax authorities.