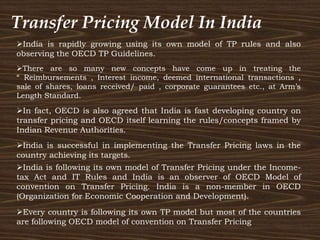

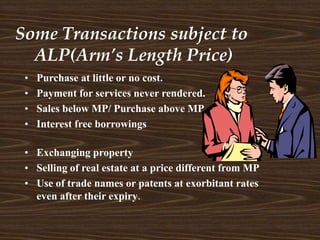

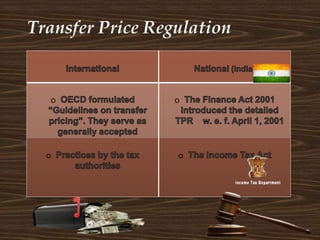

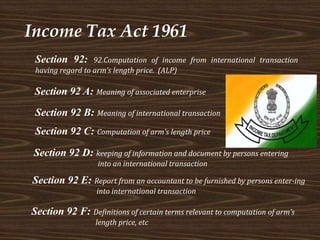

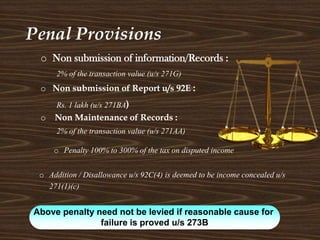

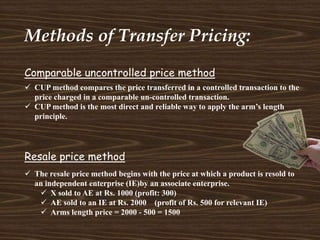

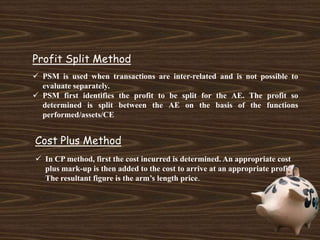

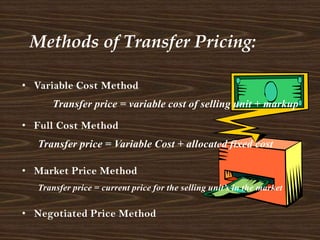

The document discusses transfer pricing within multinational companies. It begins by introducing the team members working on transfer pricing. It then provides definitions of key terms like transfer price and arm's length price. It discusses how transfer pricing is used for different purposes like calculating divisional profits, international taxation, and regulatory issues. The document outlines India's transfer pricing model and laws, and describes various transfer pricing methods like comparable uncontrolled price method, resale price method, cost plus method, and profit split method. It provides an example of transfer pricing and penalties for non-compliance. Finally, it discusses a case study of a client restructuring its transfer pricing between India and Europe.