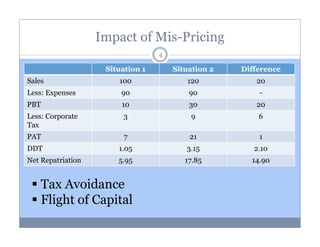

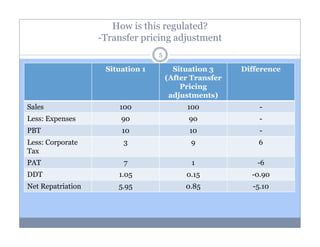

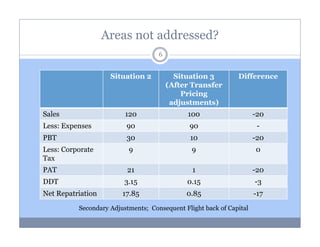

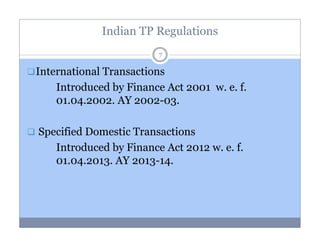

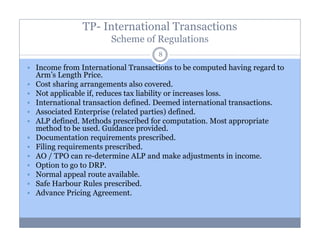

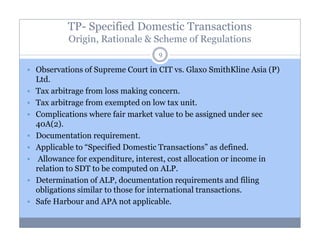

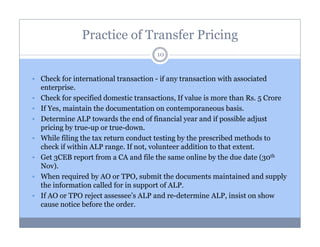

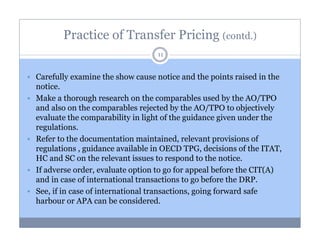

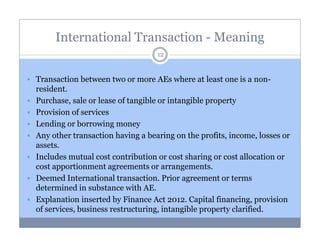

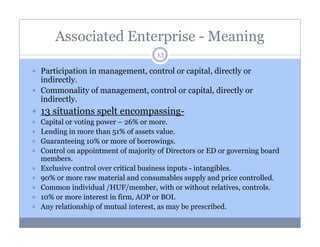

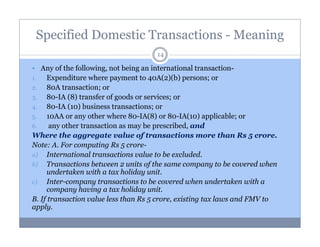

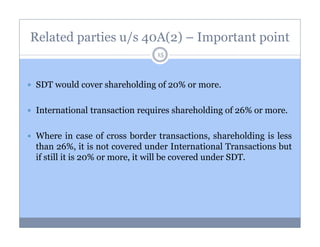

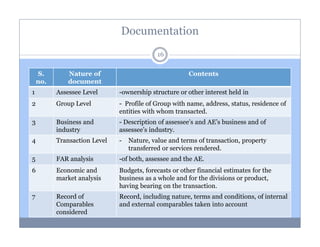

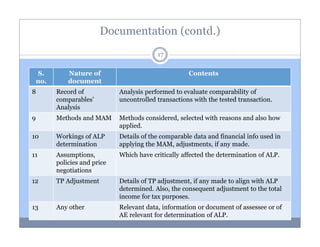

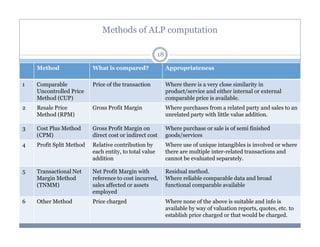

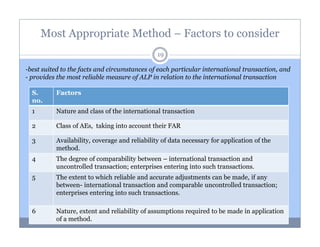

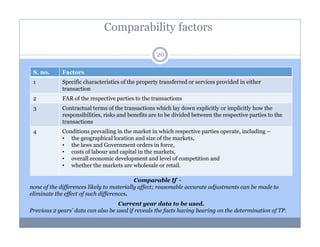

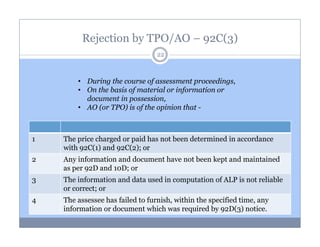

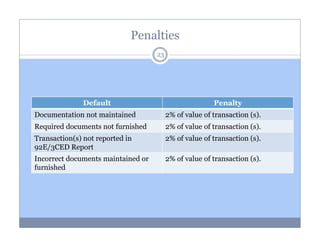

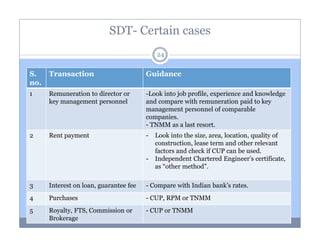

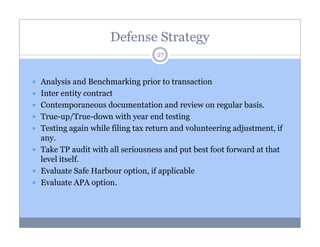

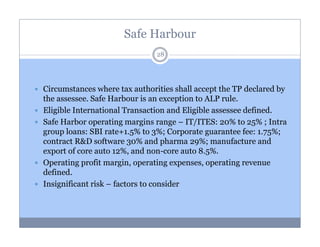

The document outlines the concept and practice of transfer pricing, highlighting its definition, regulatory impact, and adjustments necessary for compliance. It explains how mis-pricing between related parties can lead to significant tax avoidance and capital flight, and details the regulatory framework introduced by the Finance Act for international and specified domestic transactions. Additionally, it emphasizes documentation requirements, methods for determining arm's length prices, and strategies for taxpayers to align with regulations.