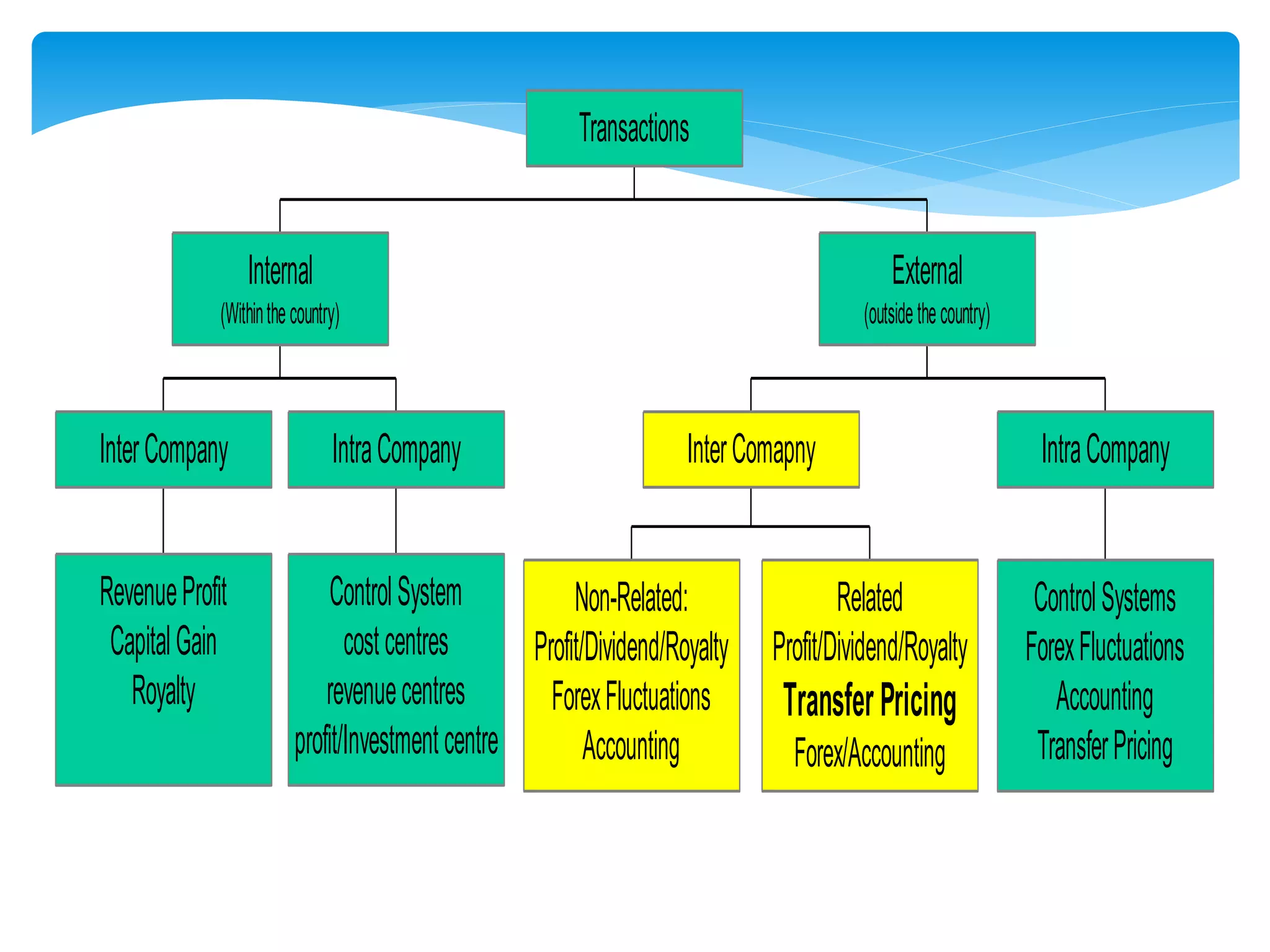

The document discusses transfer pricing, which refers to the price at which services or goods are exchanged between related parties, highlighting its importance in international transactions and tax minimization strategies. It outlines various methods for determining transfer prices, including the comparable uncontrolled price method, resale price method, and cost plus method, each with specific steps for calculation. The document emphasizes the need for compliance with regulations and accounting standards, as well as the impact of internal and external factors on transfer pricing decisions.