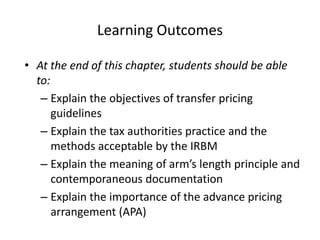

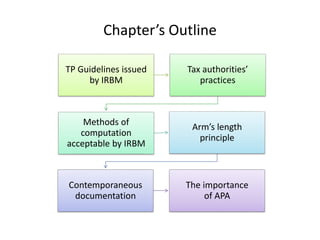

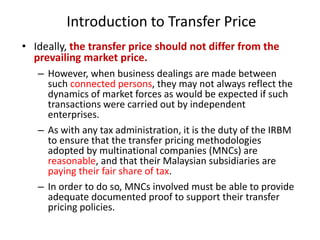

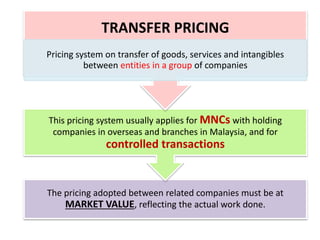

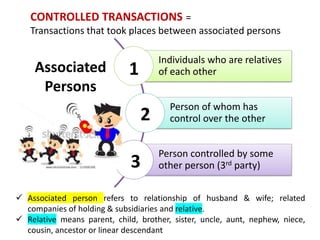

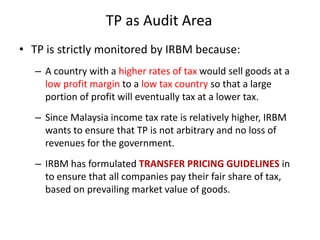

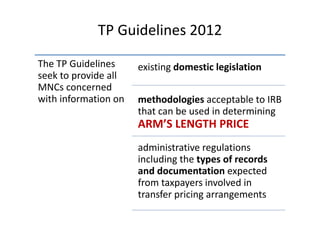

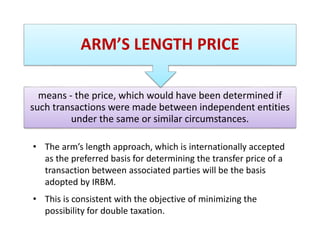

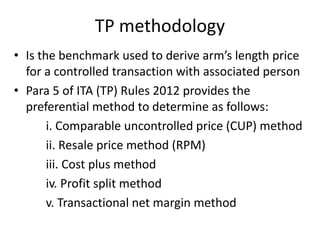

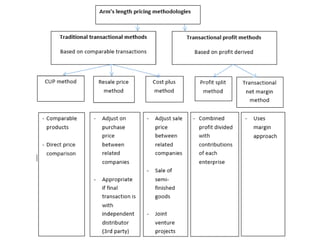

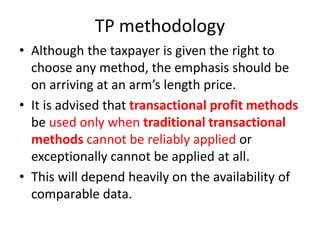

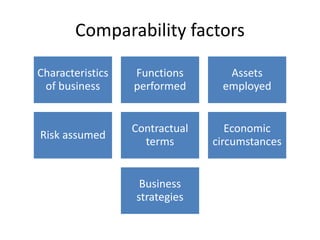

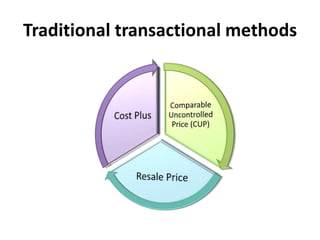

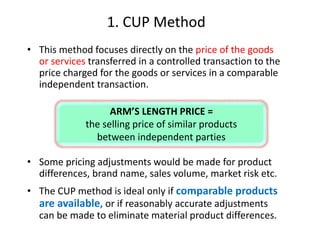

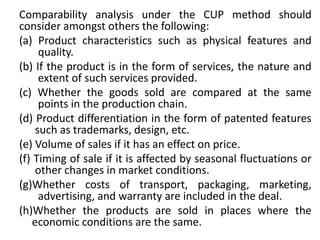

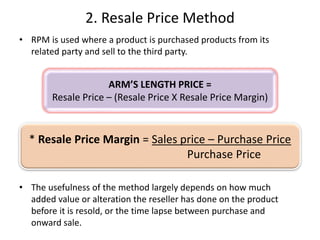

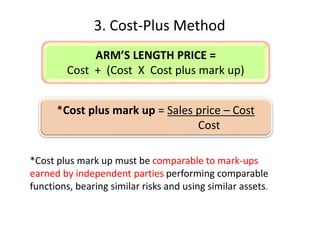

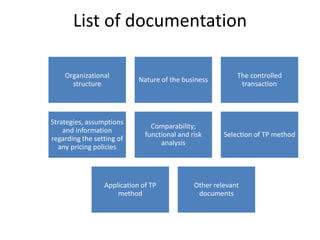

This document discusses transfer pricing guidelines issued by the Malaysian Inland Revenue Board (IRBM). It provides an overview of key concepts related to transfer pricing such as controlled transactions between associated persons, the arm's length principle, and transfer pricing methods acceptable to the IRBM like comparable uncontrolled price method, resale price method, cost plus method, profit split method and transactional net margin method. It emphasizes the importance of contemporaneous documentation and advance pricing arrangements to support transfer prices and reduce audit risks.