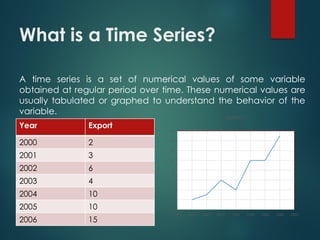

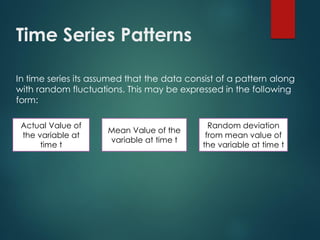

This document discusses time series analysis. It defines a time series as a set of numerical values of some variable obtained at regular intervals over time. The objectives of time series analysis are to understand the behavior of variables over time and evaluate changes. There are four main components of a time series: trend, which is a long-term movement; cycles, which are medium-term fluctuations; seasonality, which are short-term and regular fluctuations; and irregularity, which are unpredictable short-term changes. Time series can be decomposed using either a multiplicative or additive model to isolate the effects of each component.