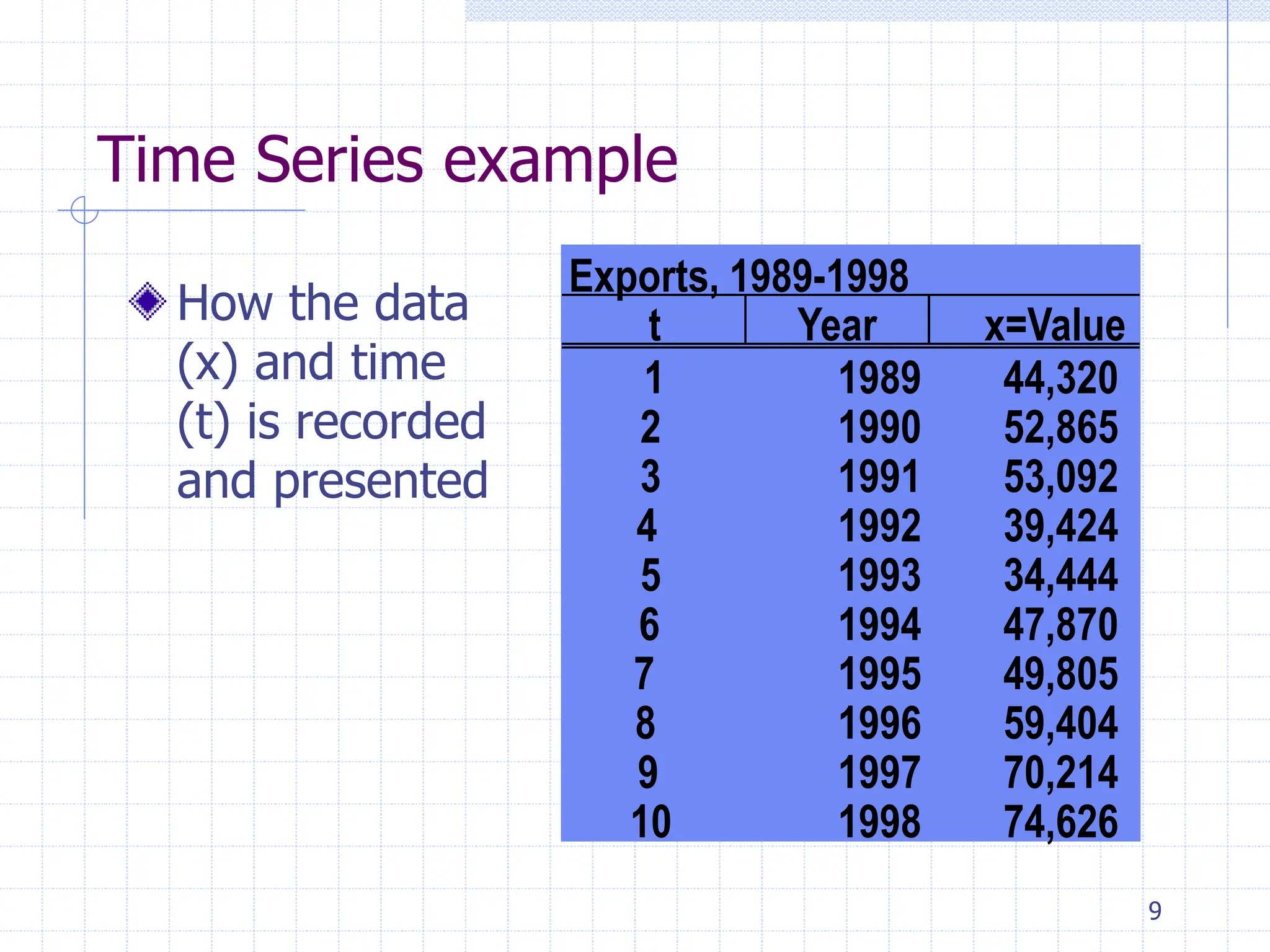

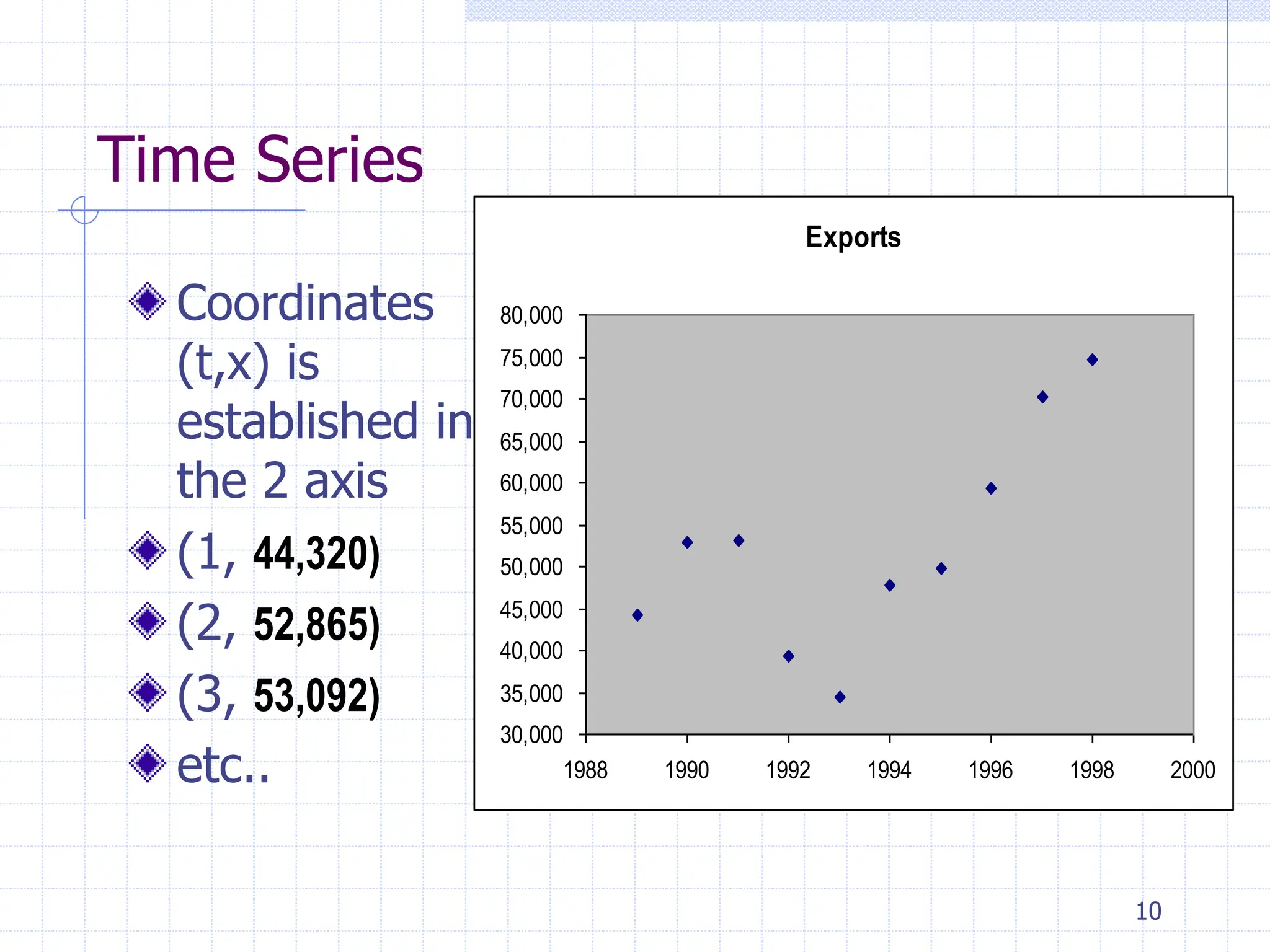

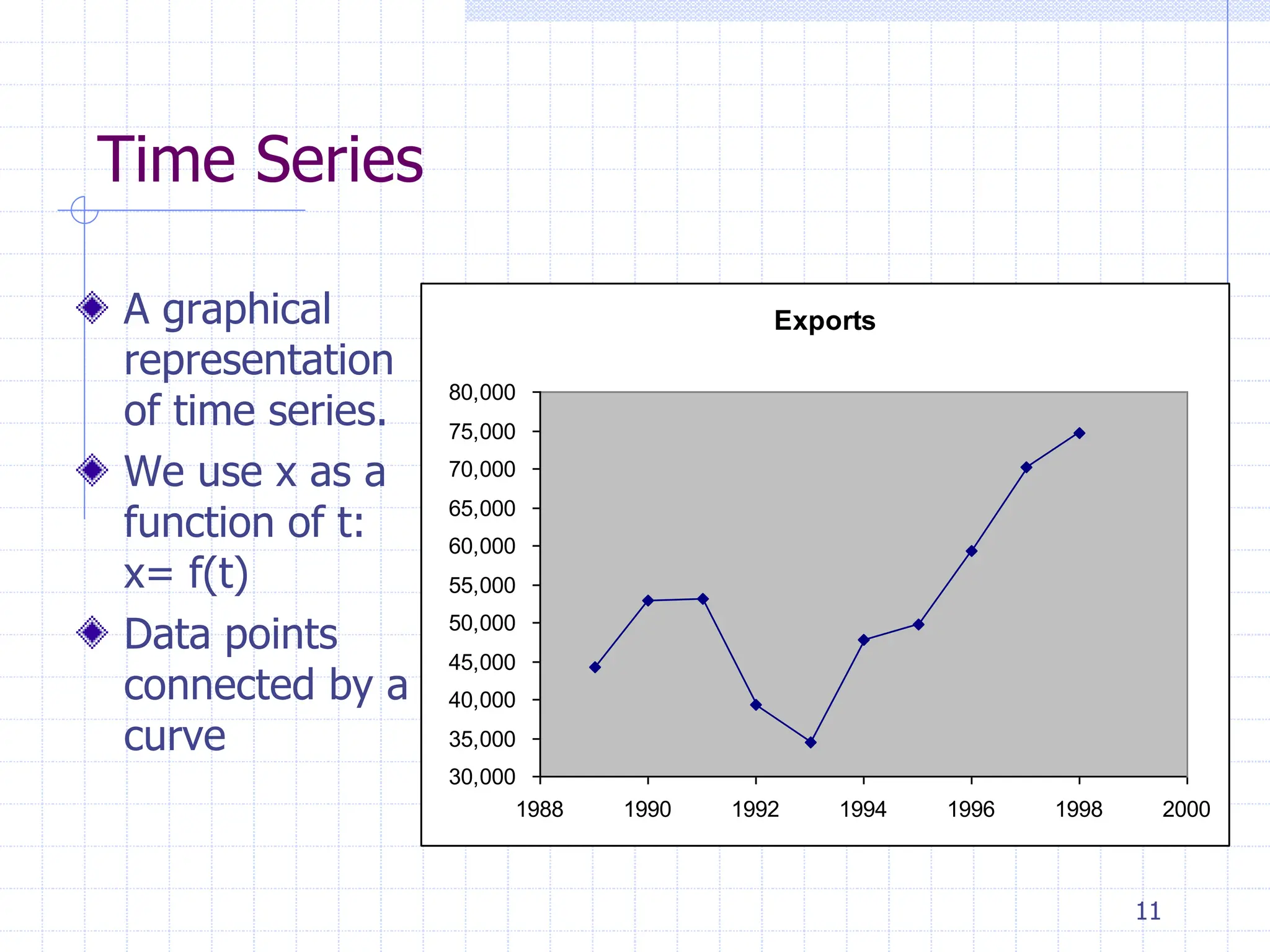

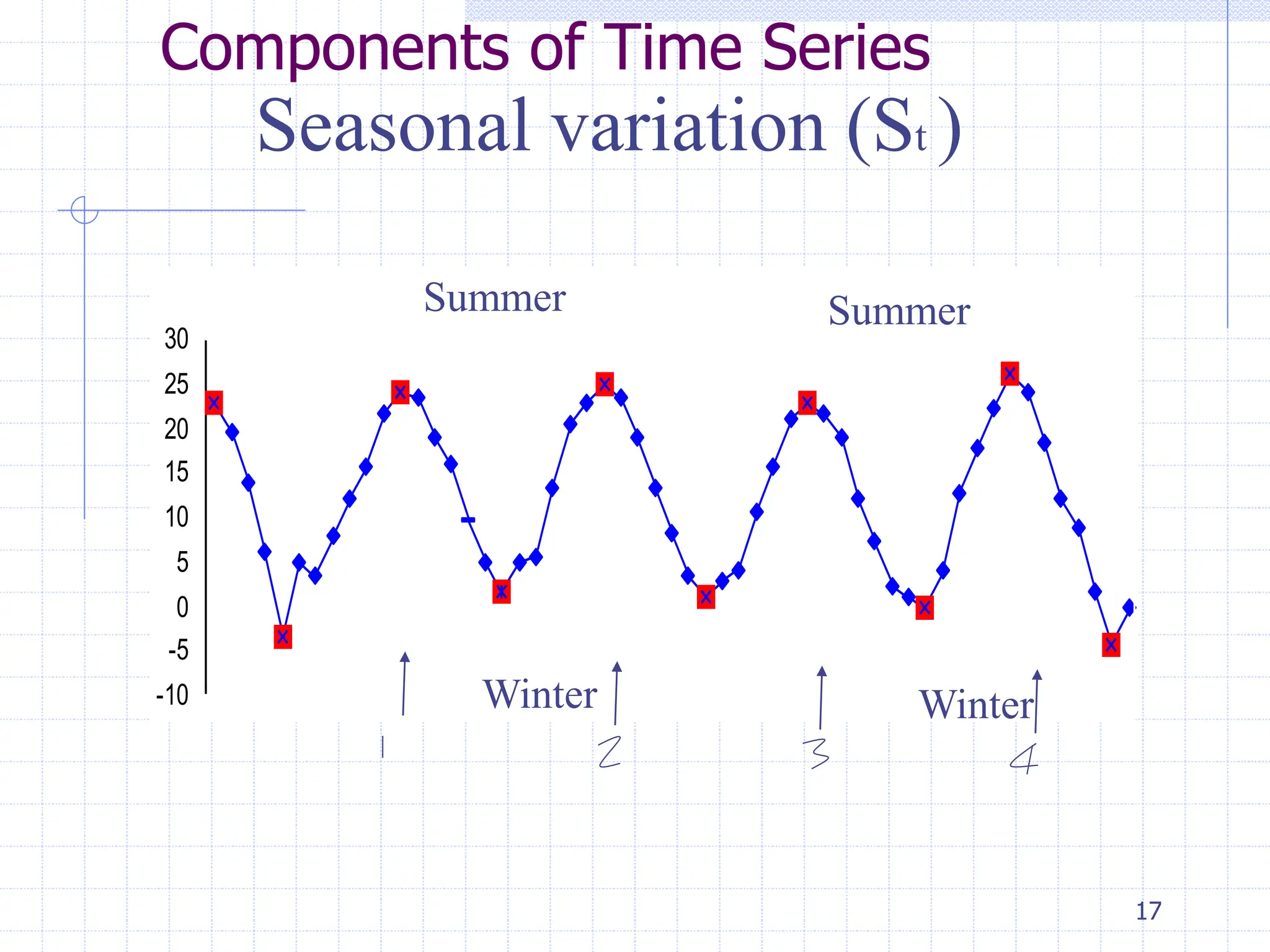

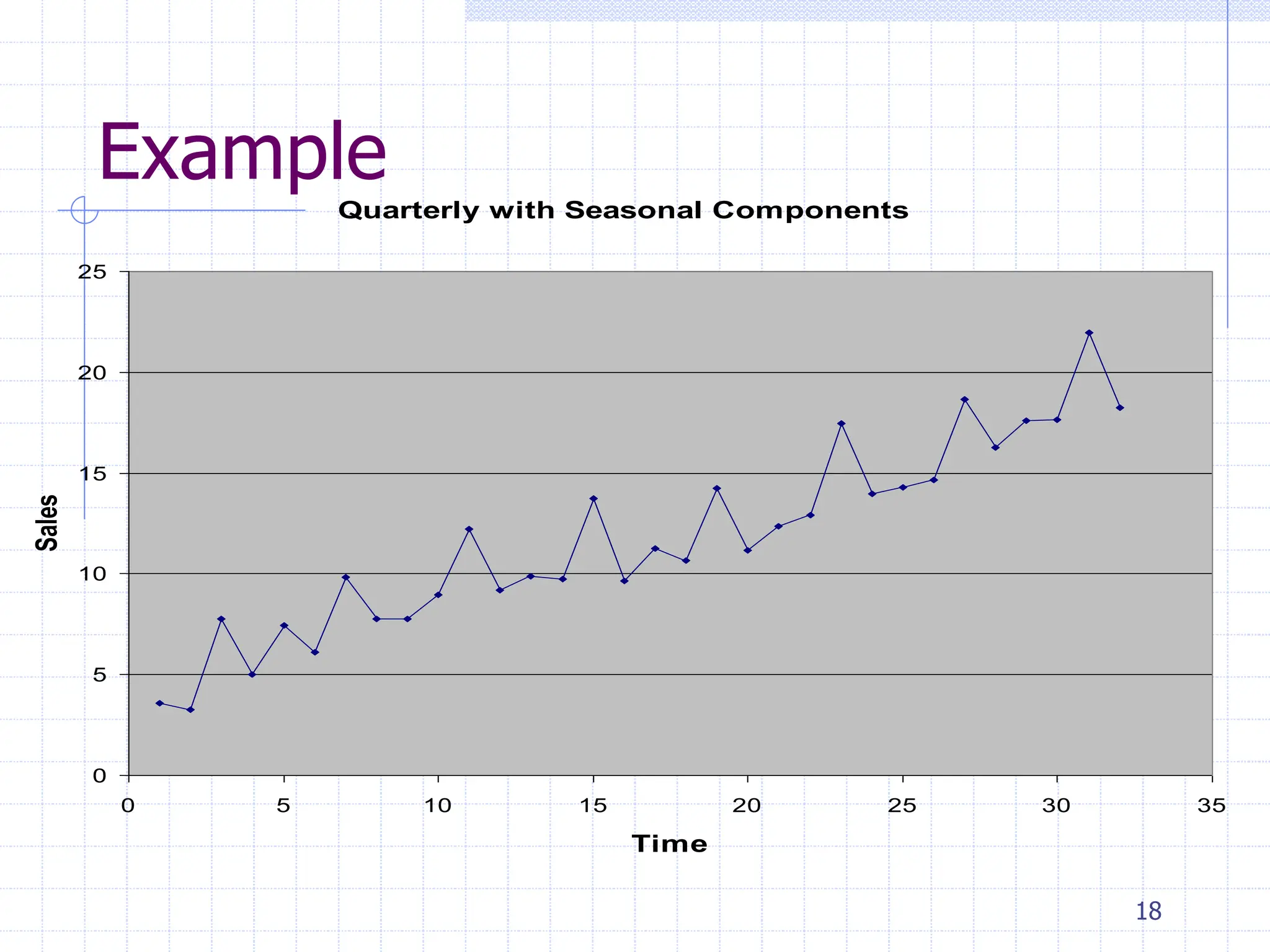

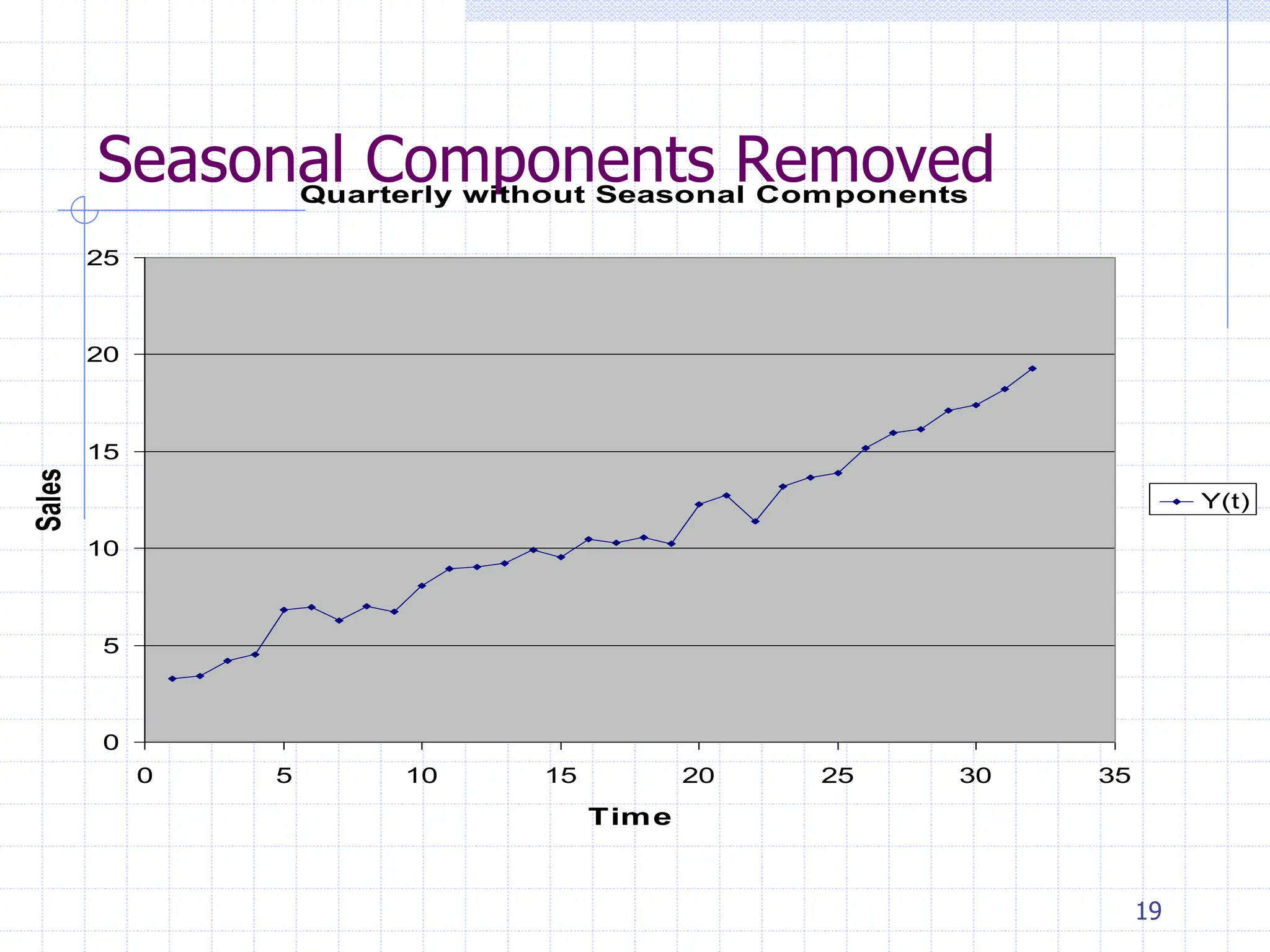

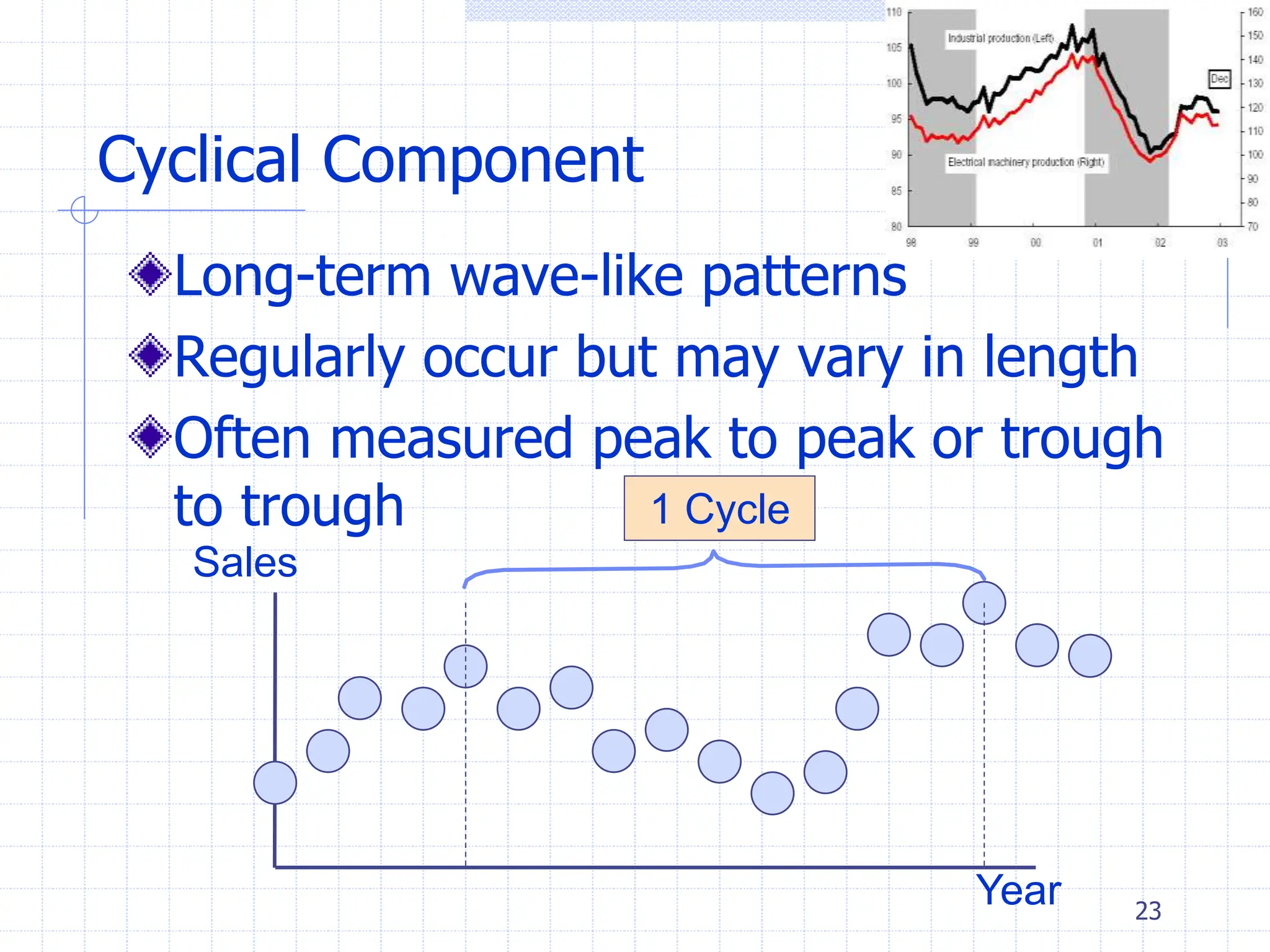

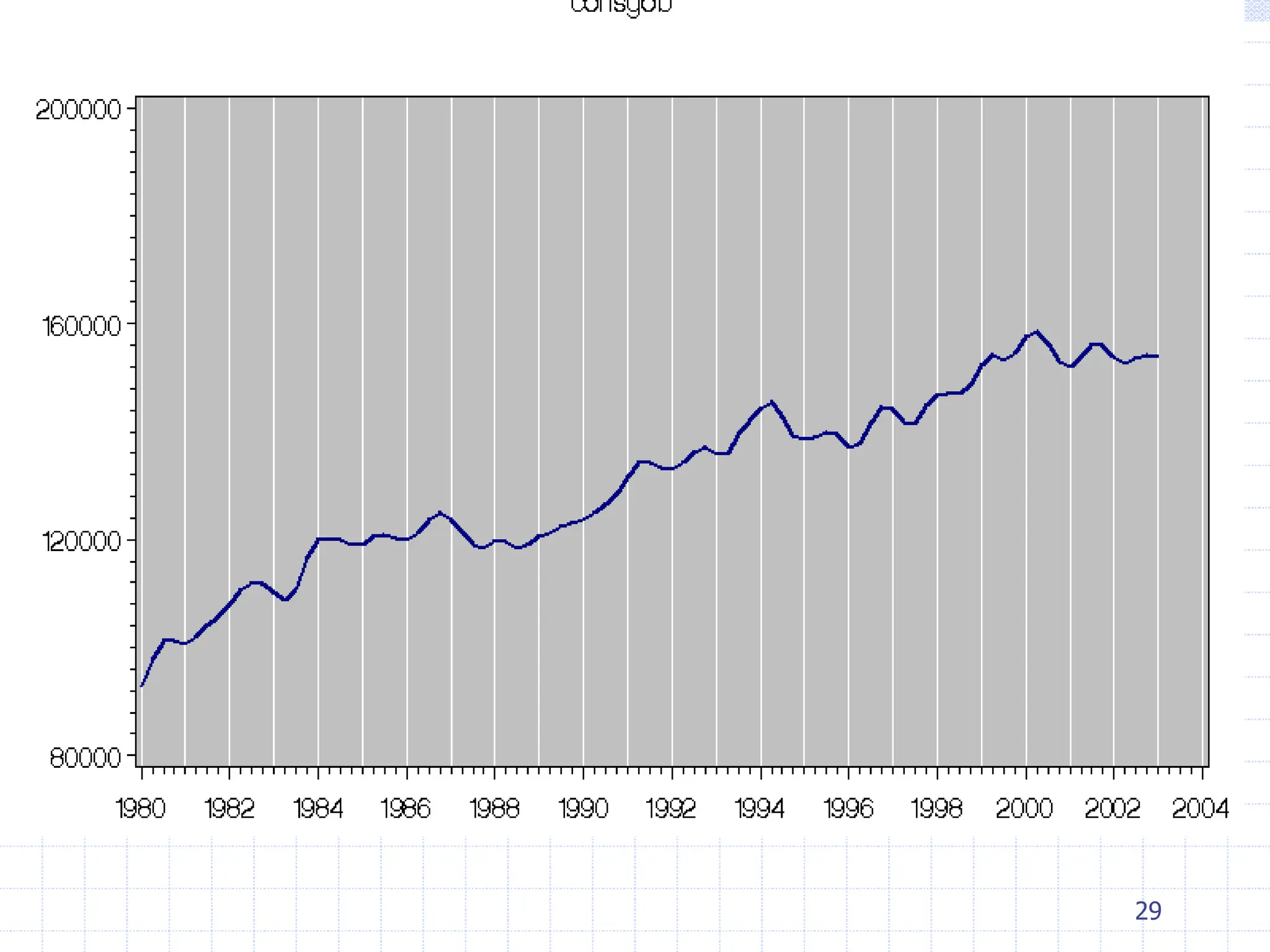

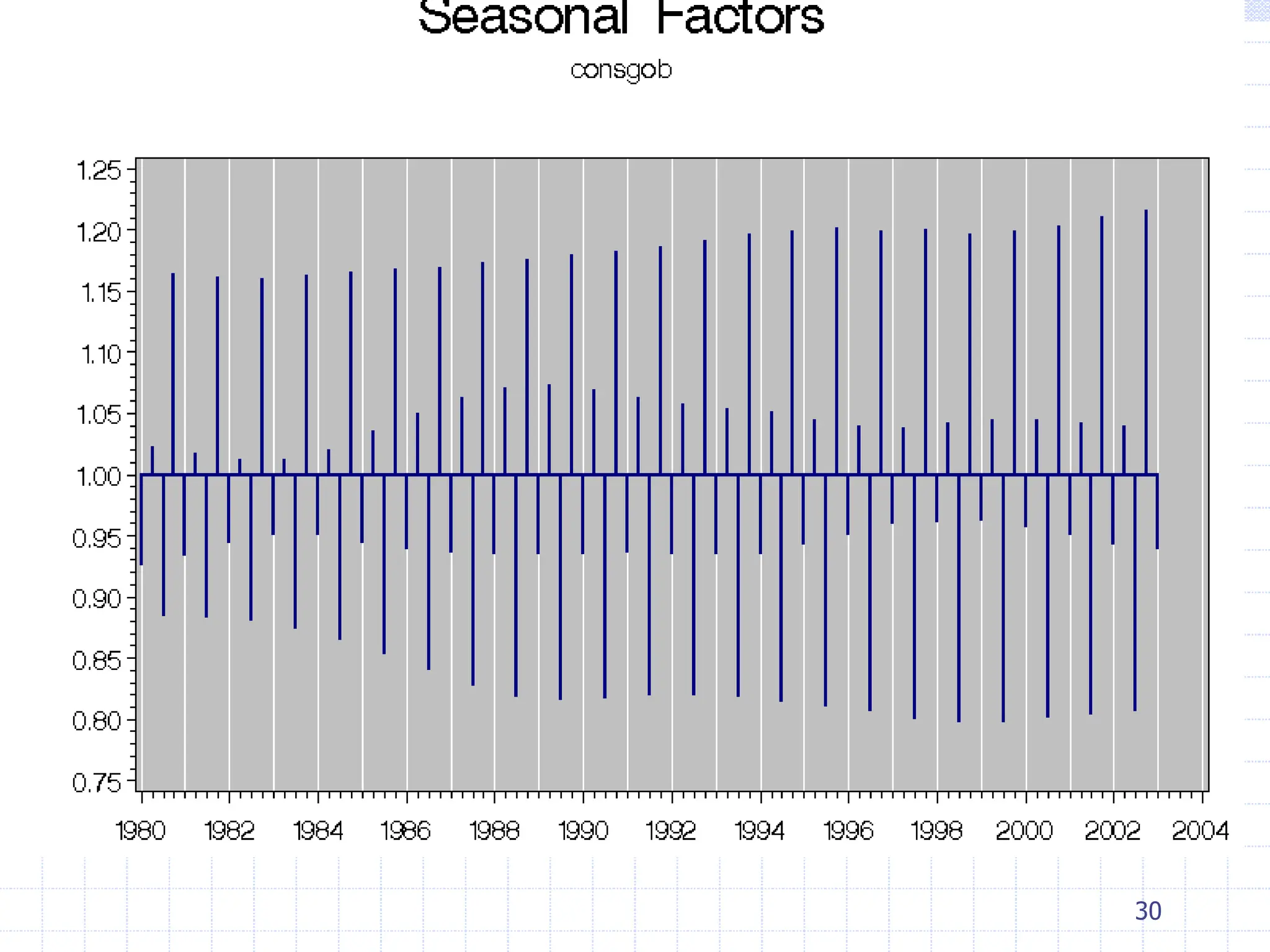

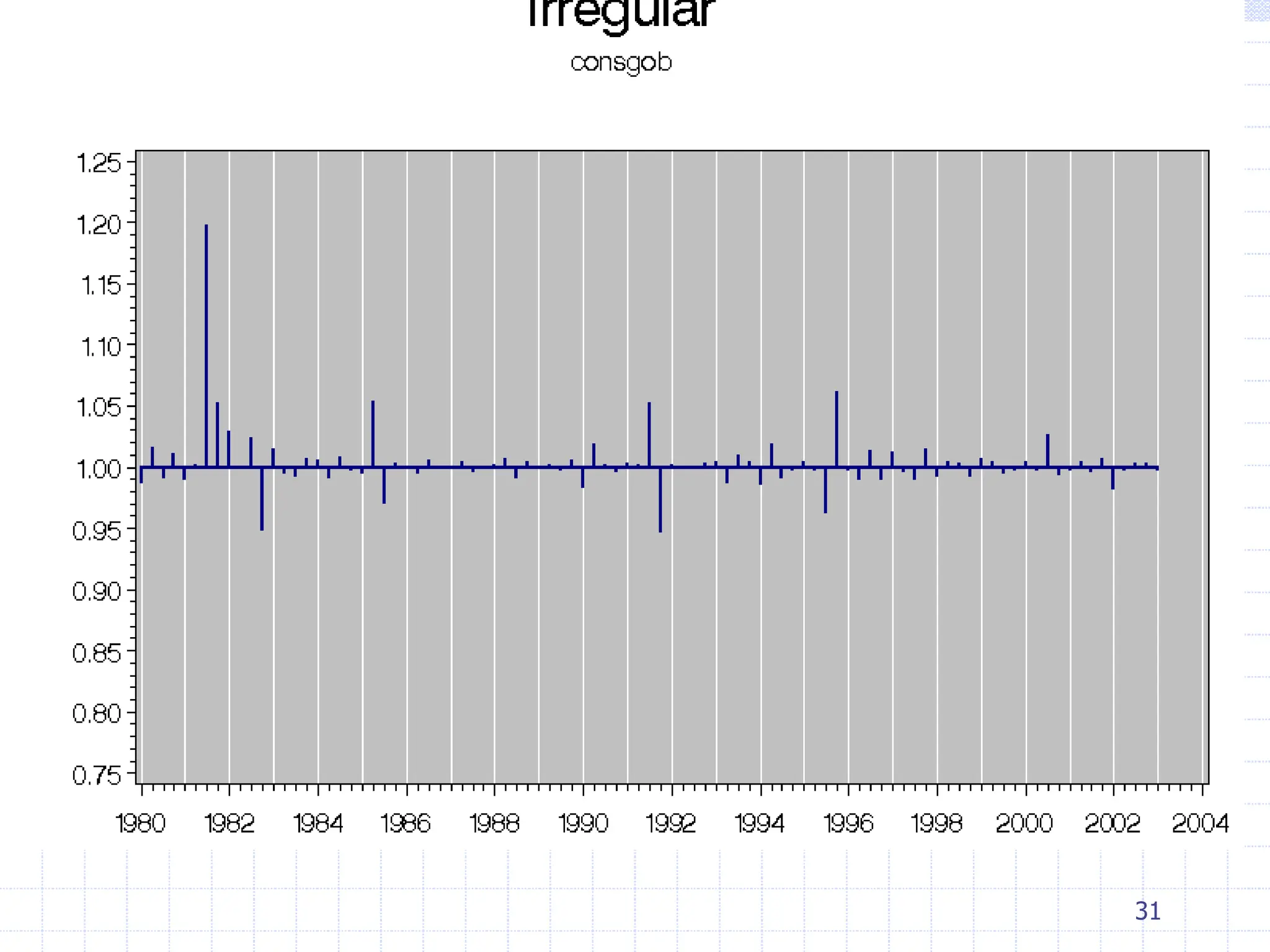

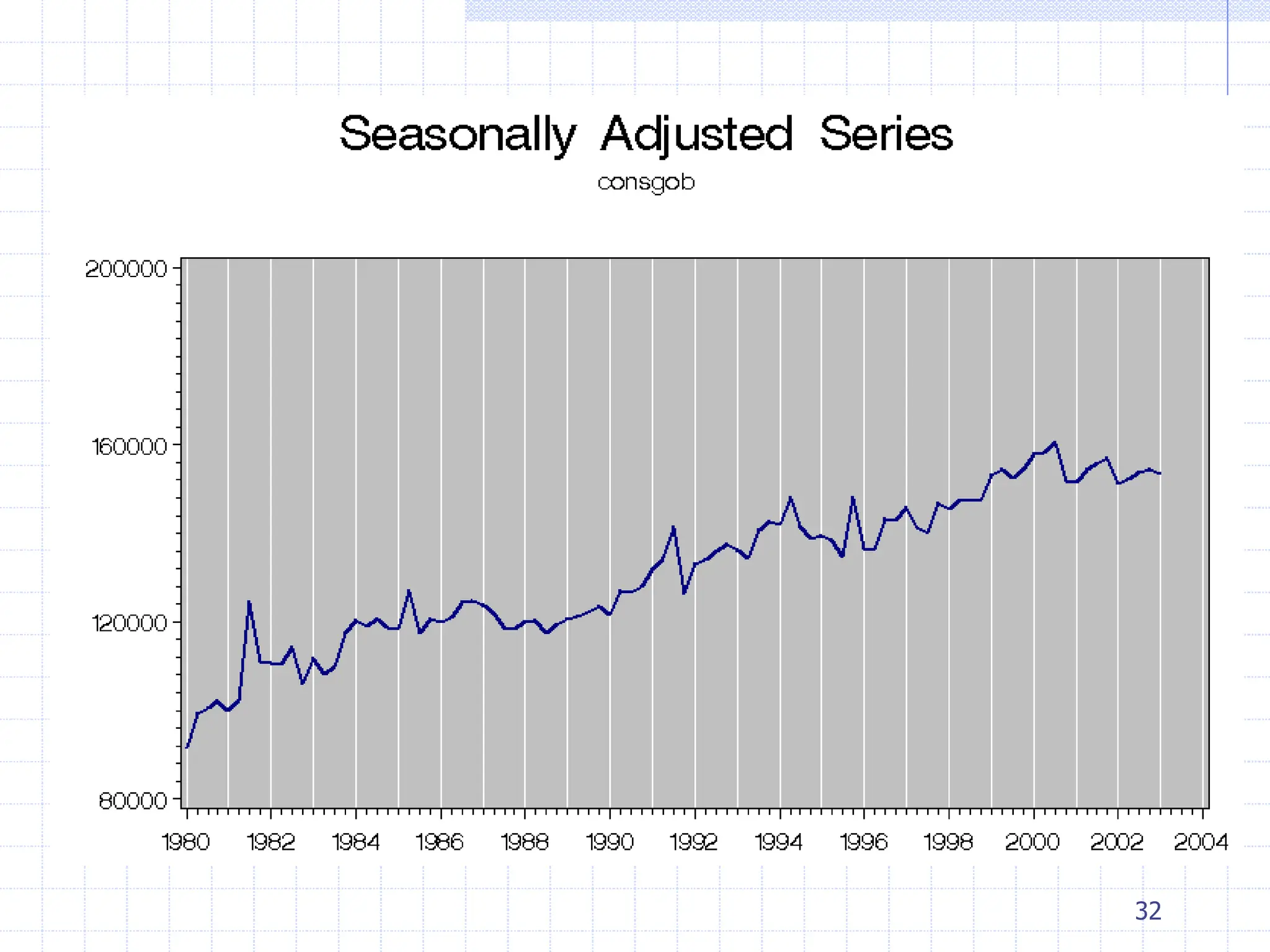

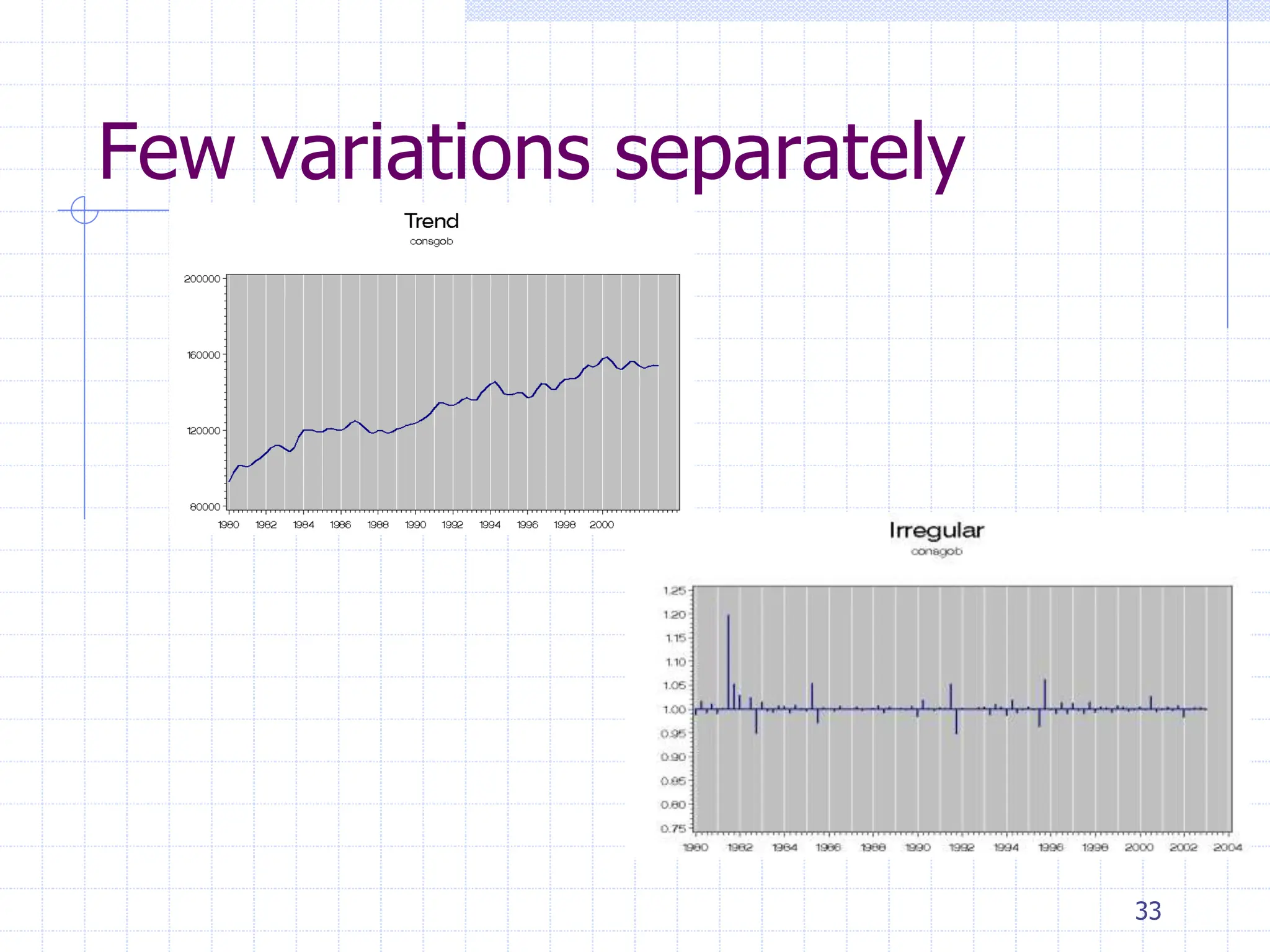

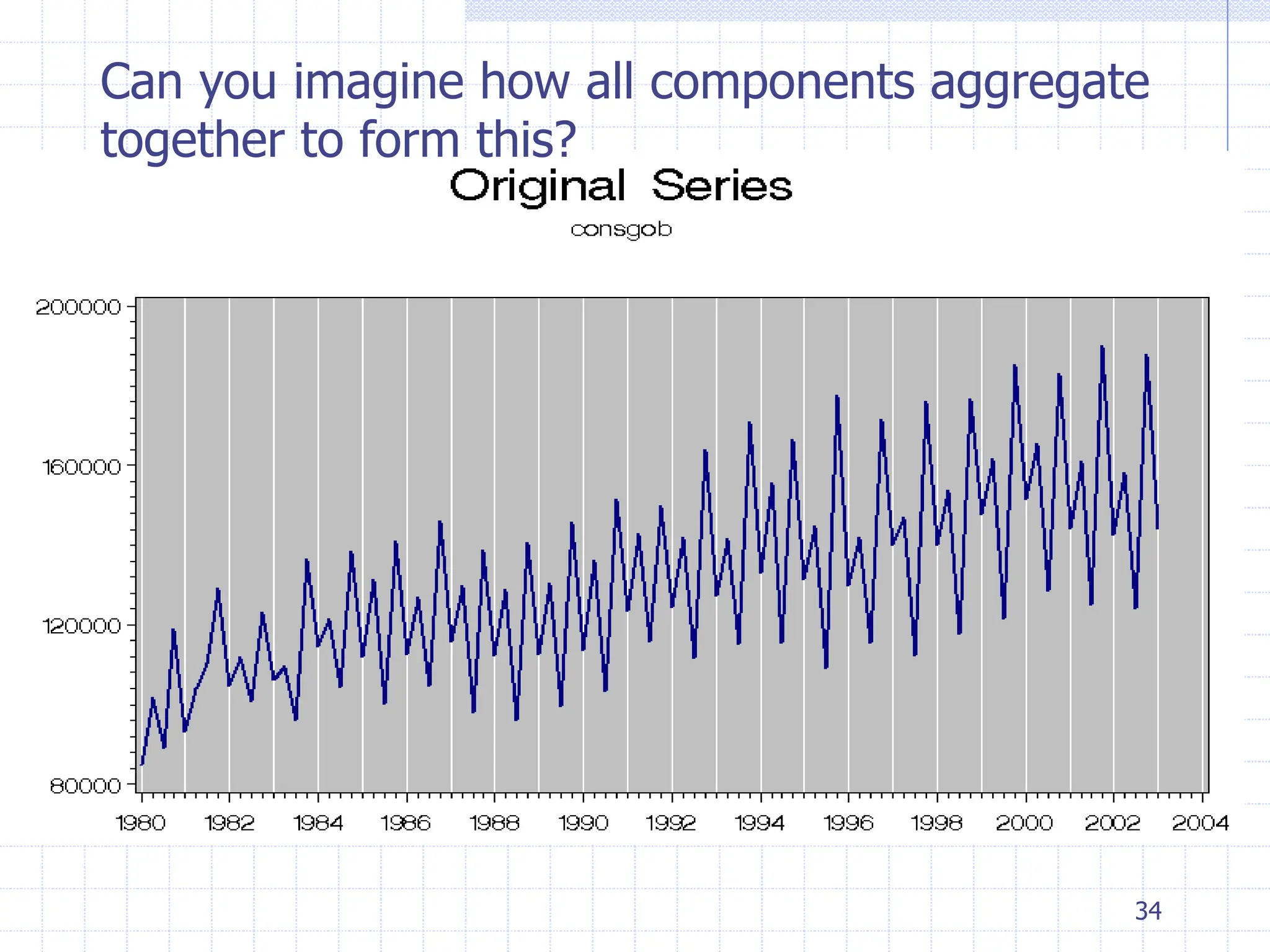

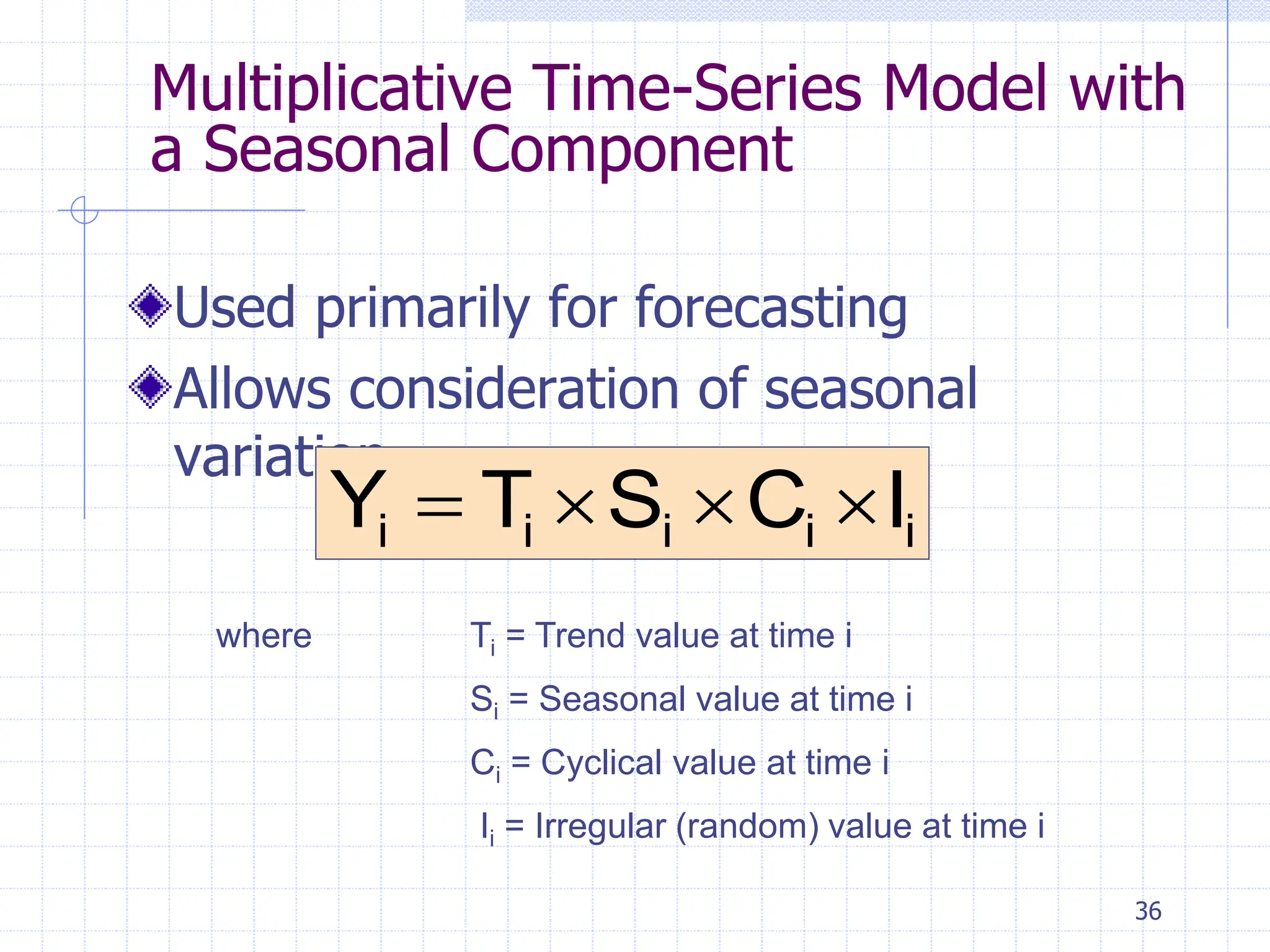

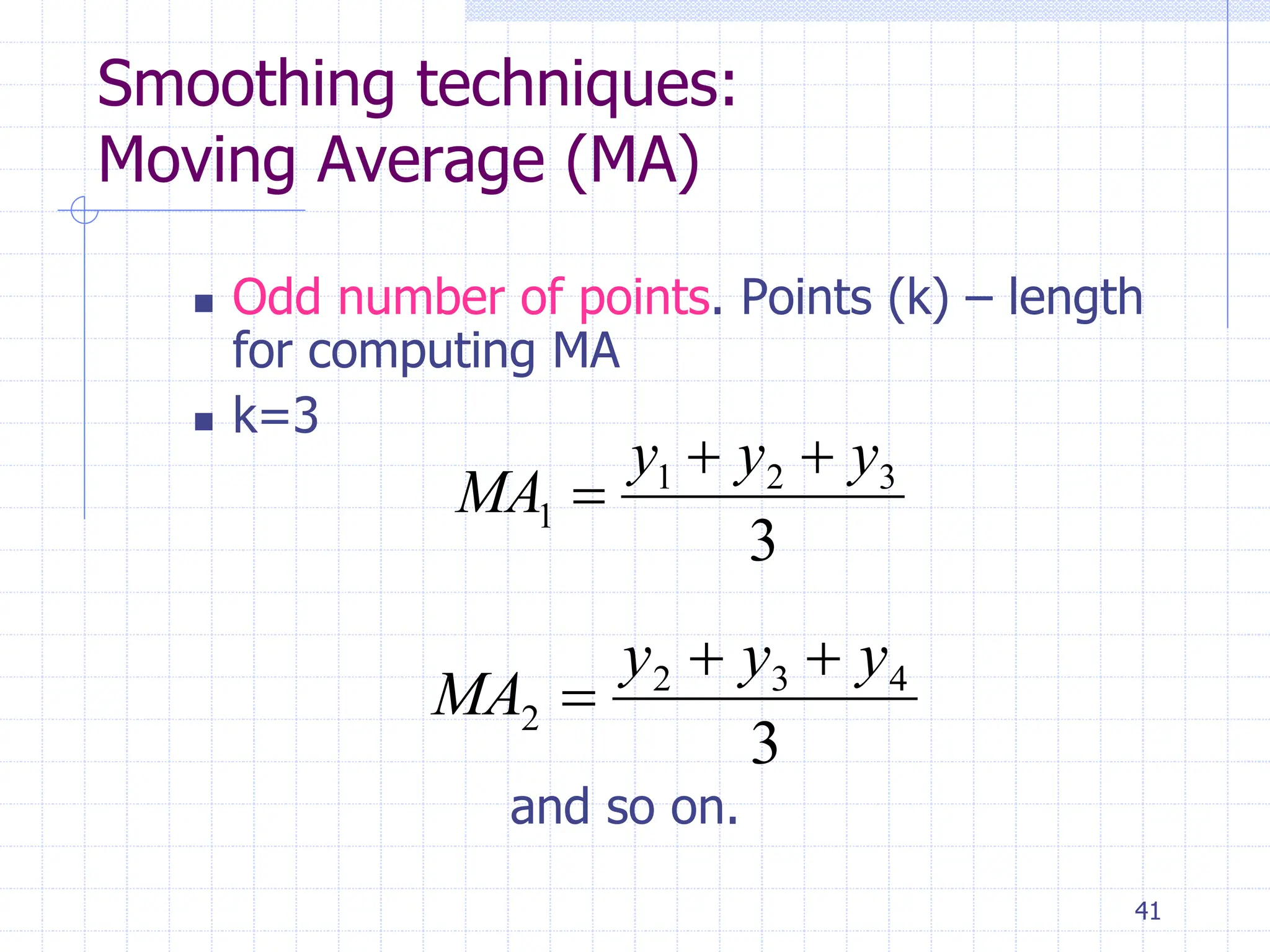

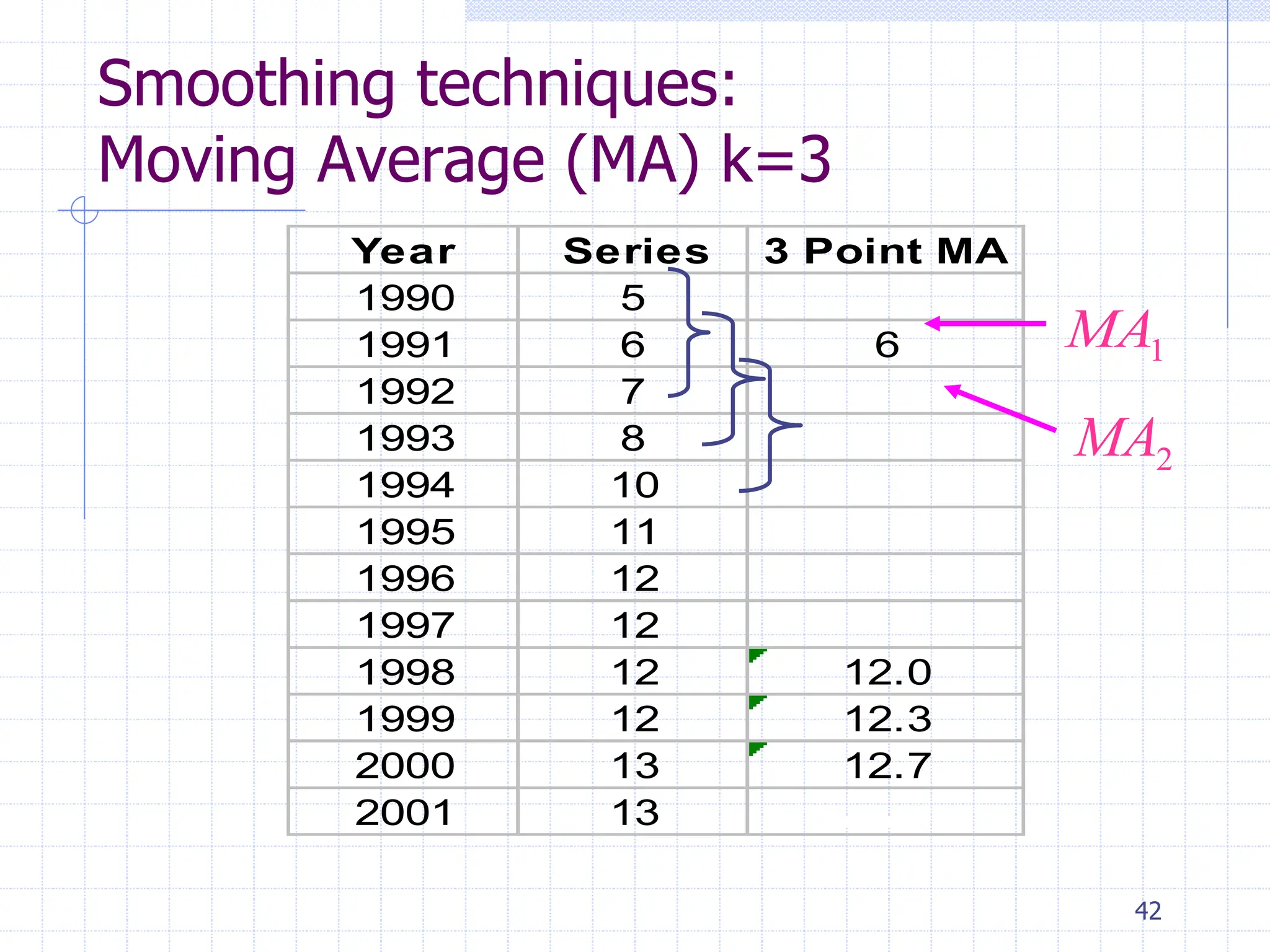

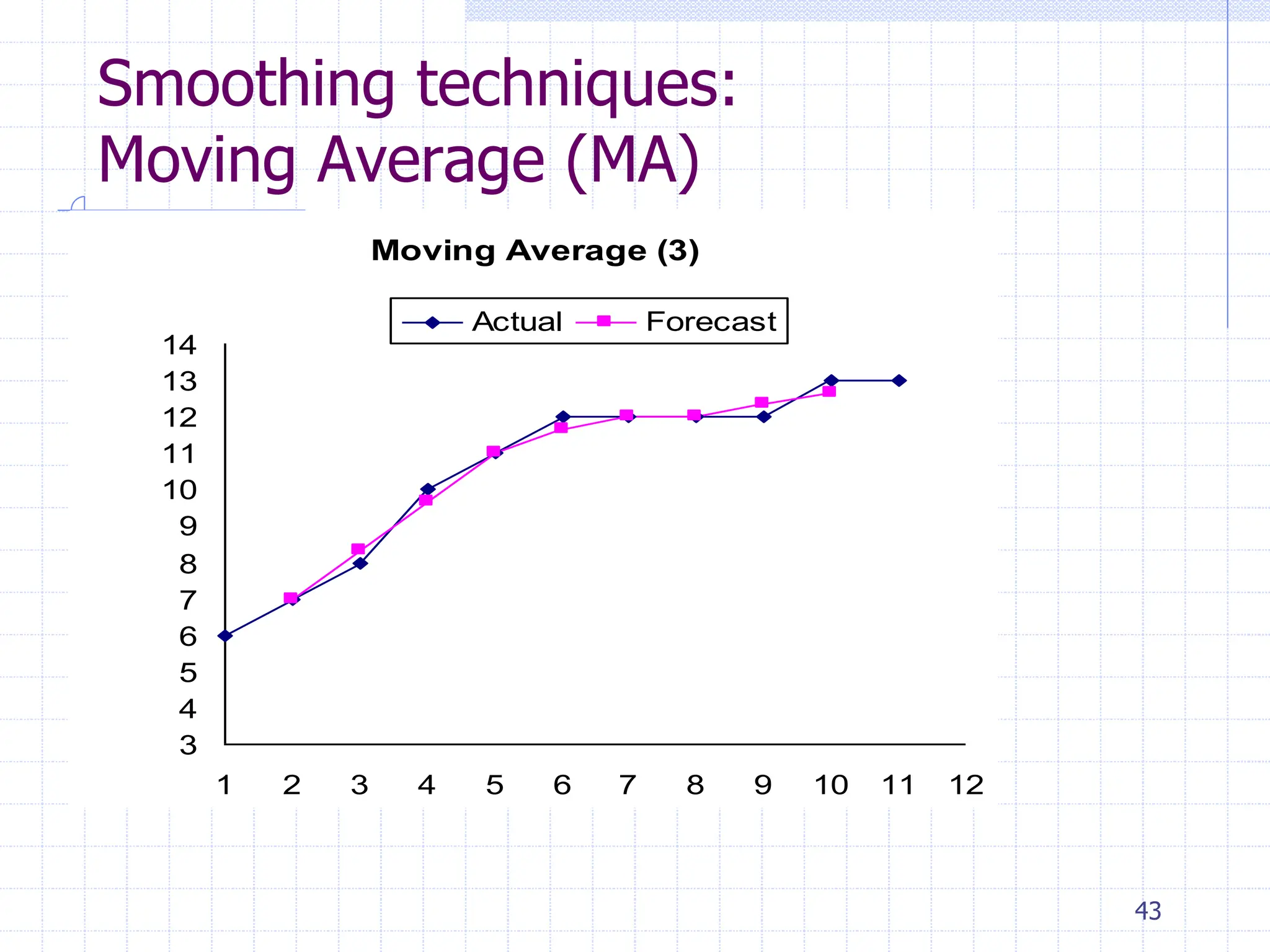

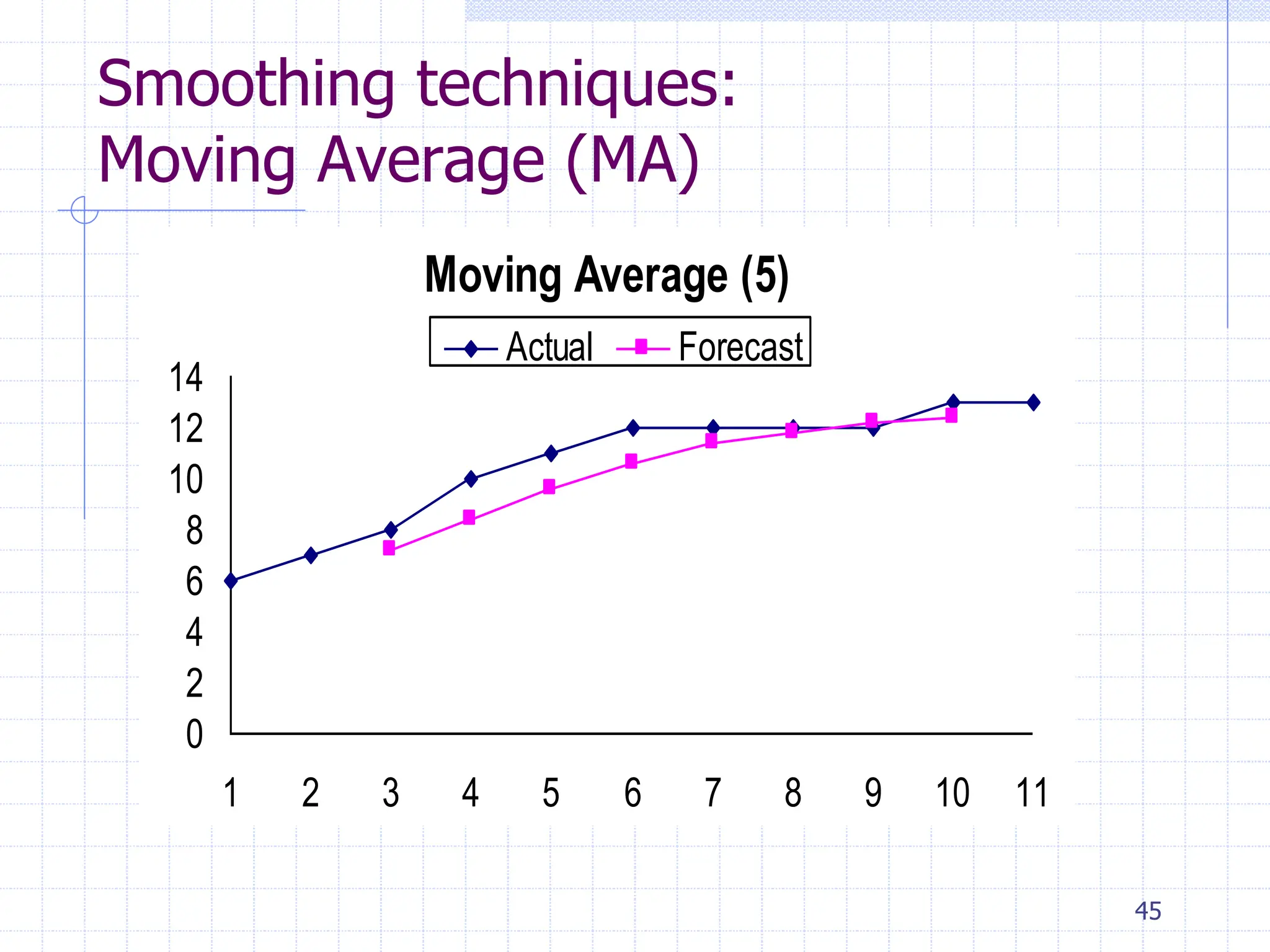

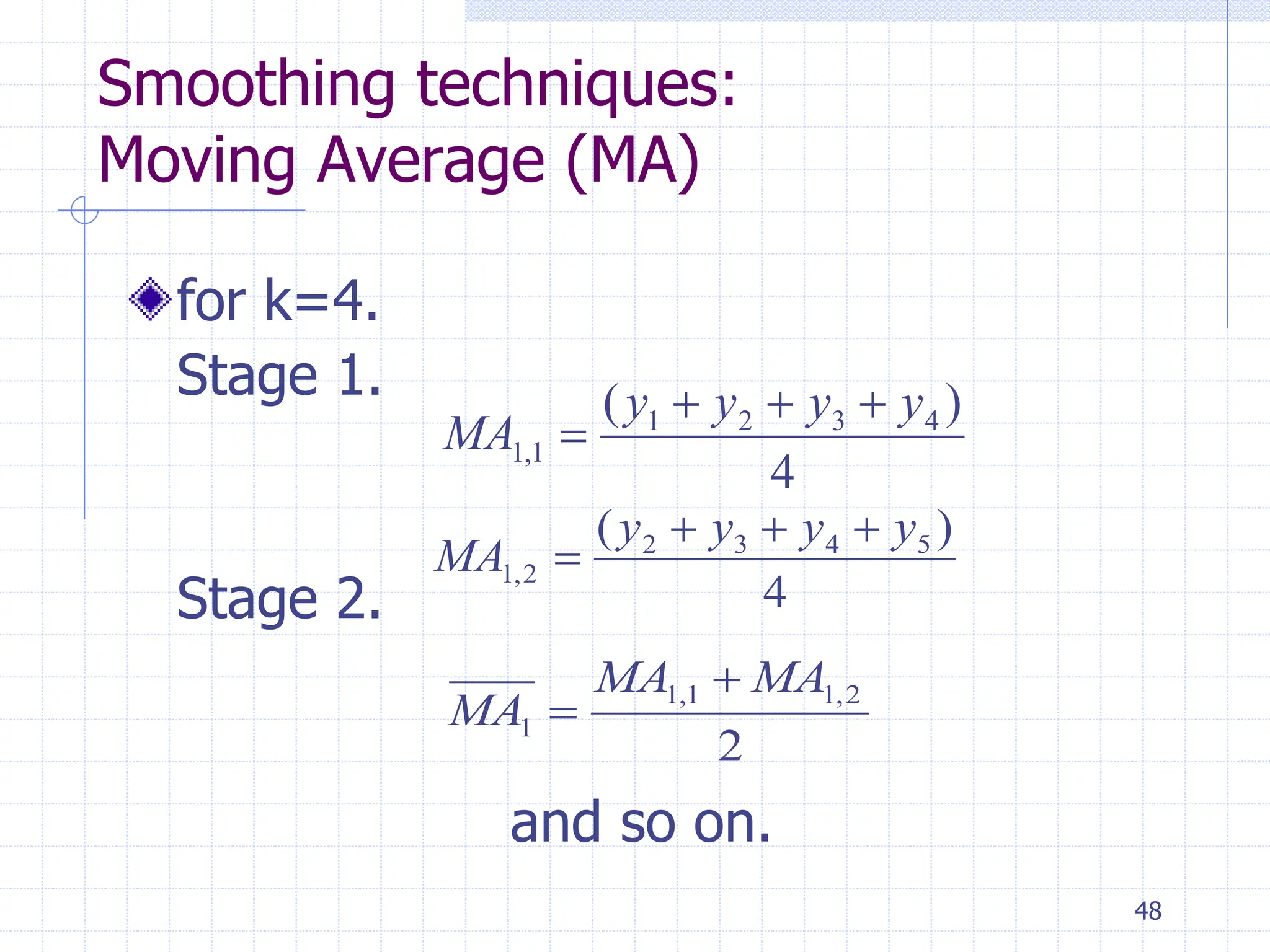

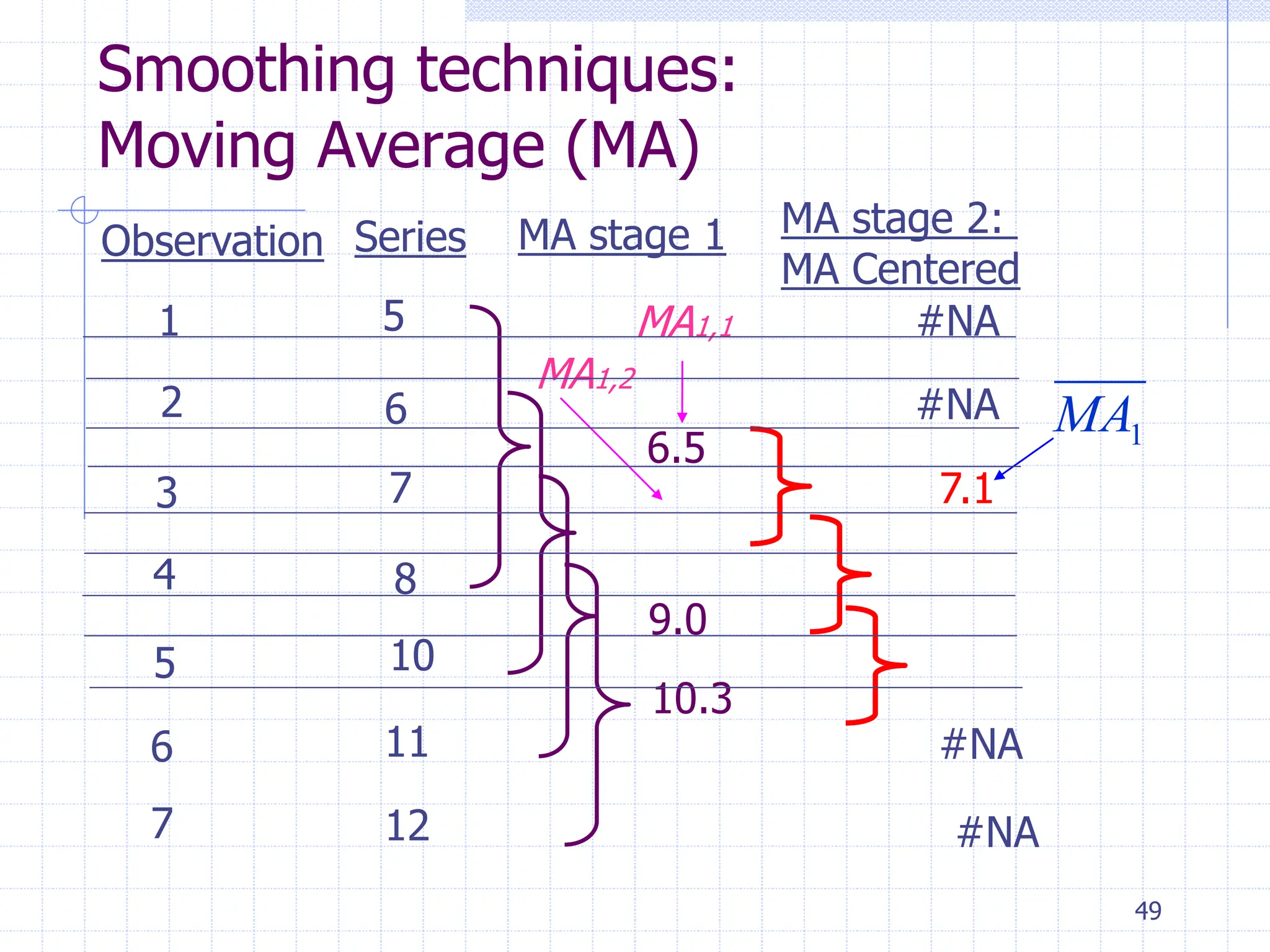

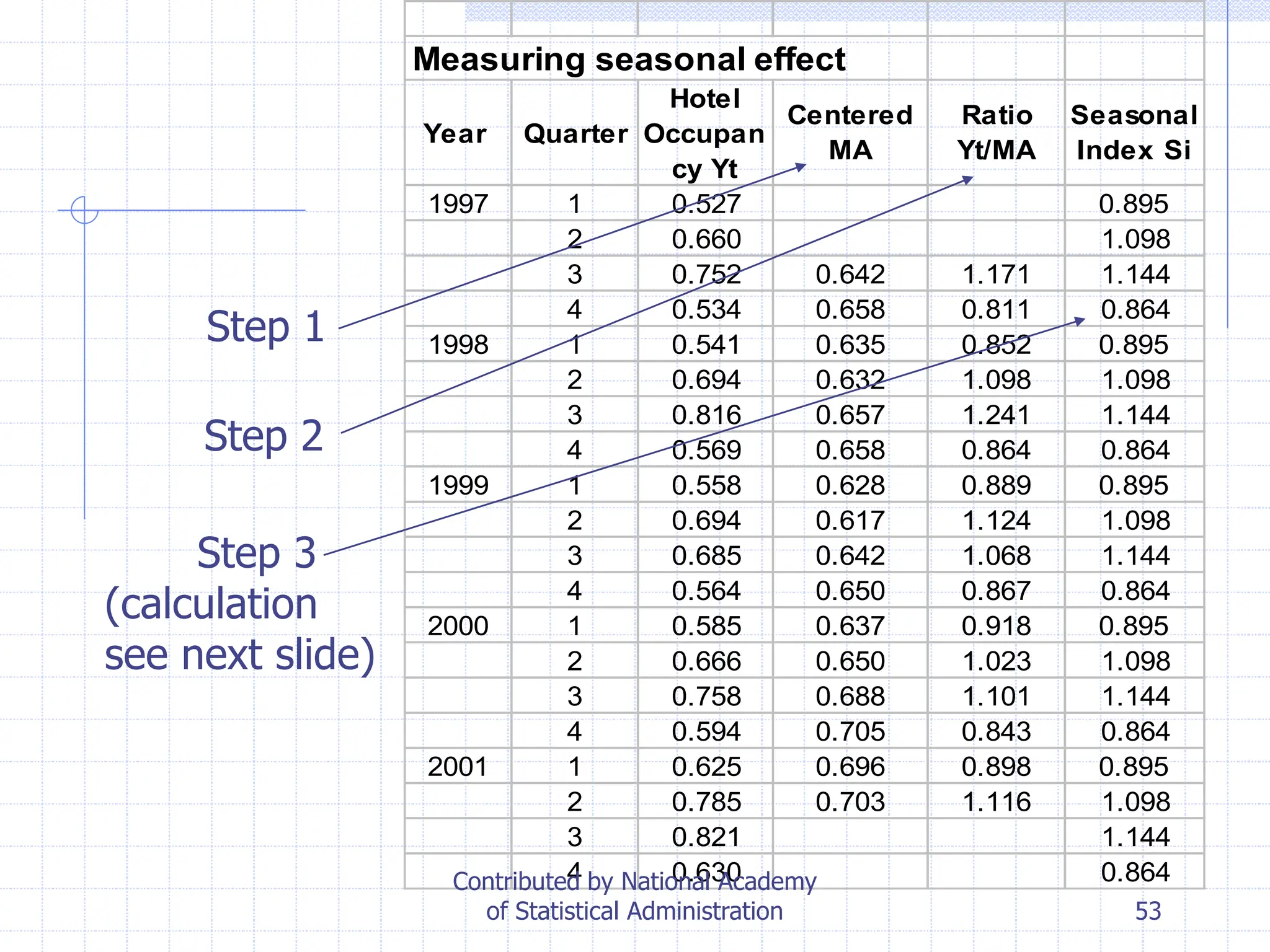

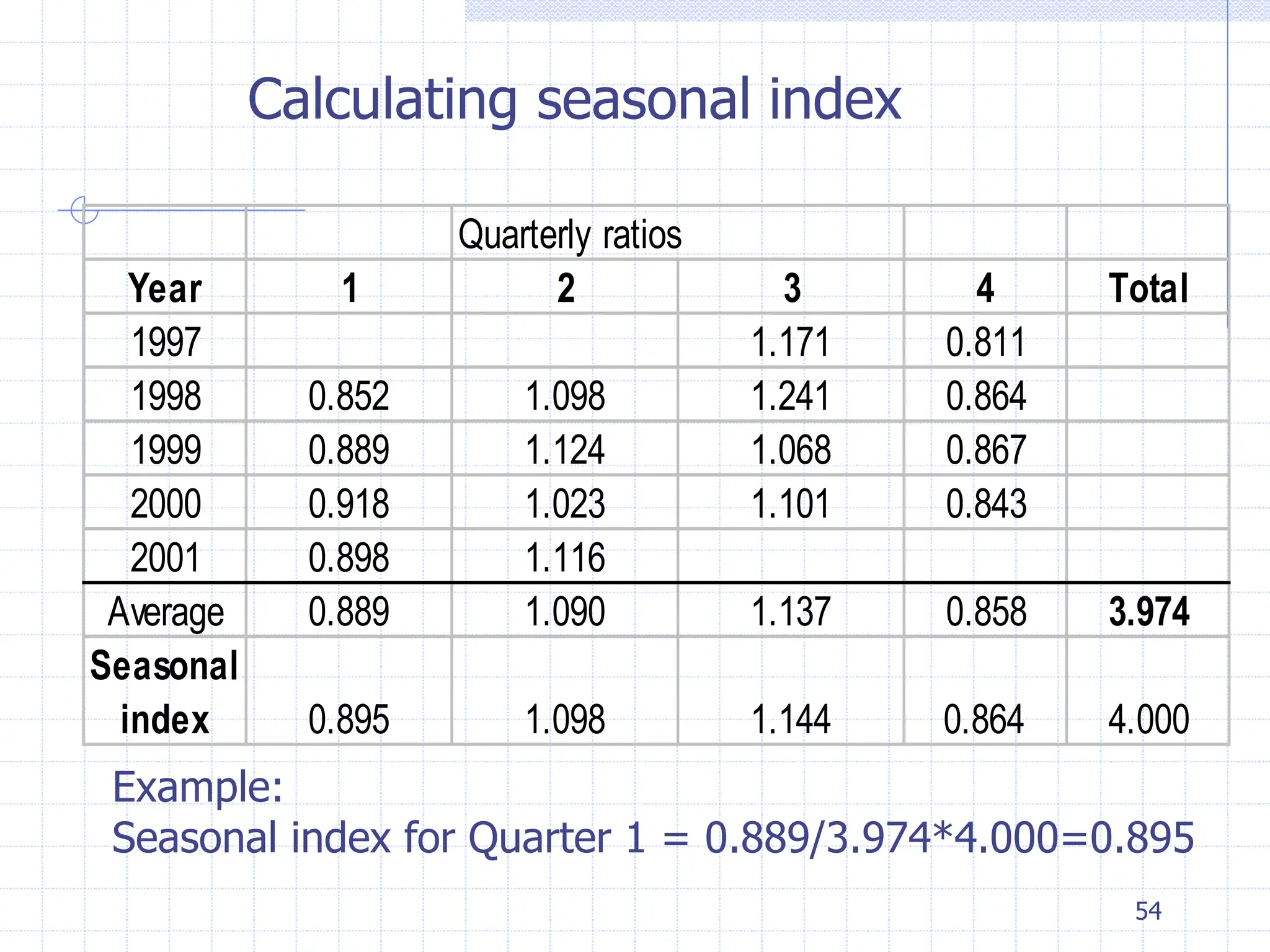

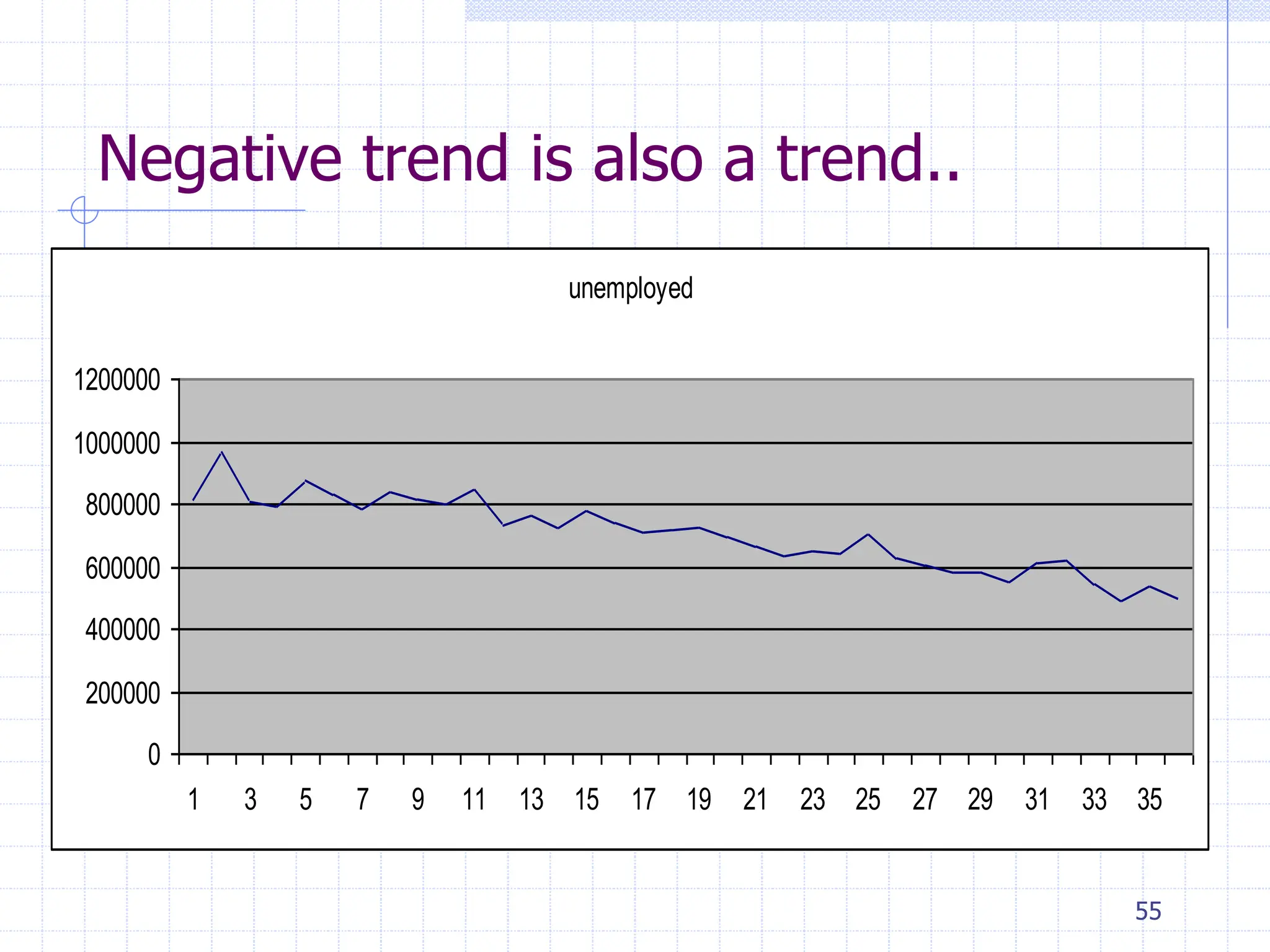

This document provides an overview of time series analysis. It defines a time series as numerical data obtained at regular time intervals that occurs in many domains like economics, finance, and environment. Time series data are different from other data as they are not independent and have large sample sizes. The key components of a time series are the trend, seasonal variation, cyclical variation, and irregular/random variation. Decomposition methods are used to separate out these components. Smoothing techniques like moving averages are employed to better understand the overall patterns in time series data. Seasonal indices are calculated to measure the degree to which different seasons vary from each other.