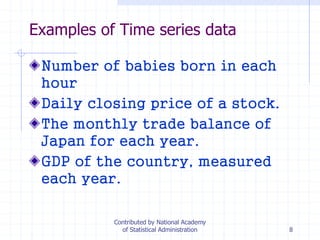

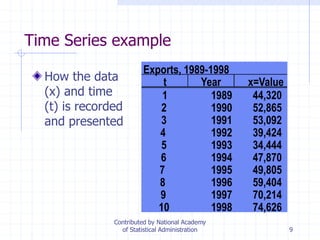

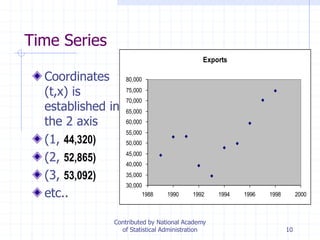

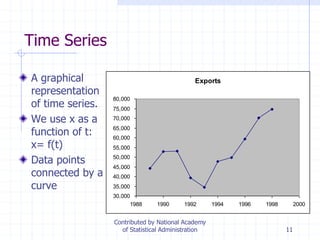

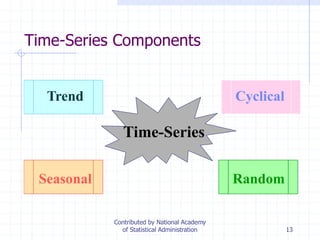

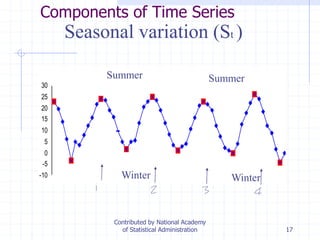

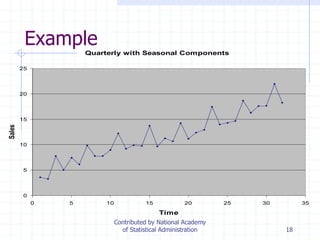

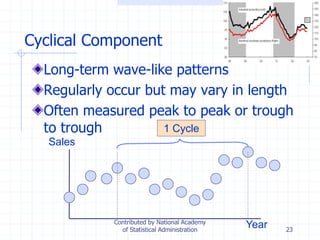

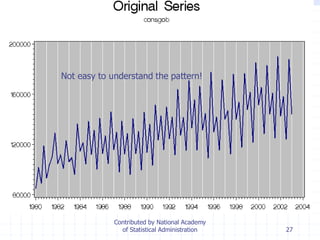

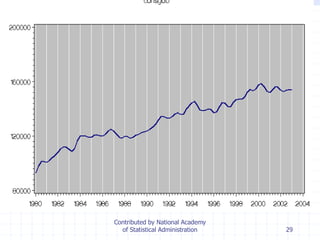

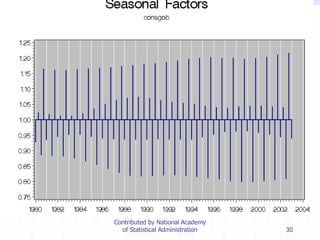

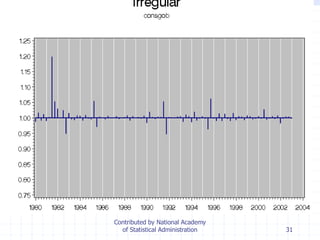

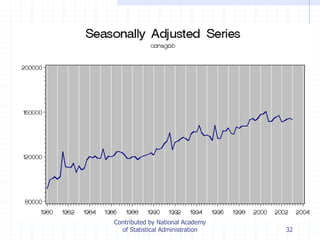

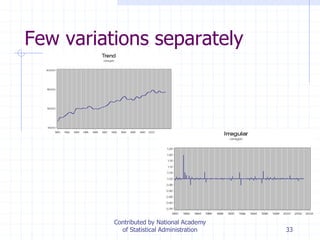

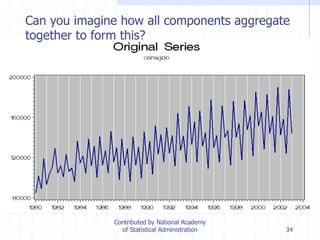

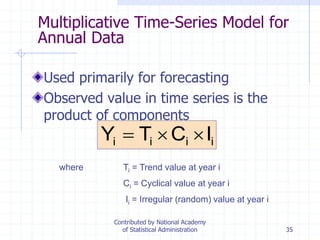

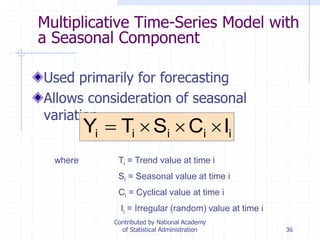

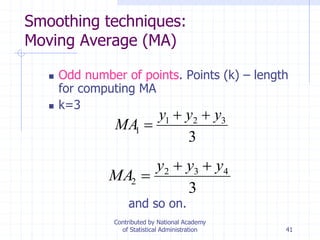

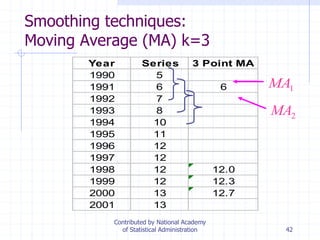

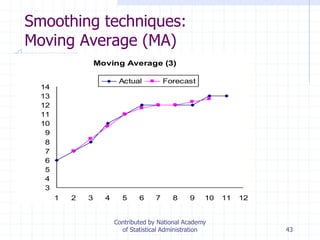

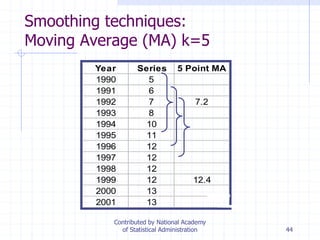

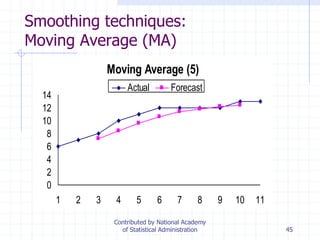

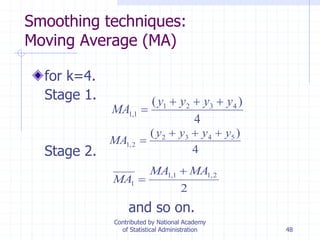

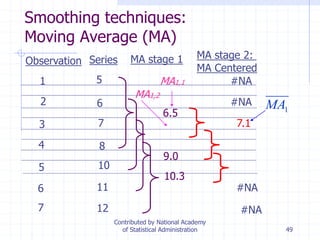

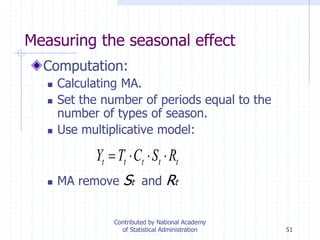

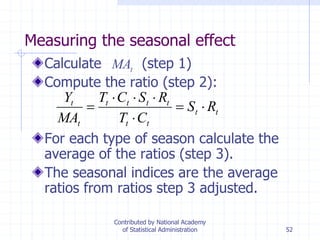

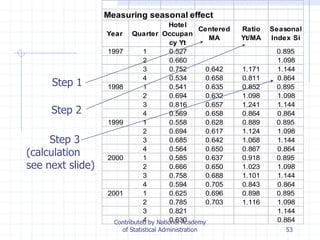

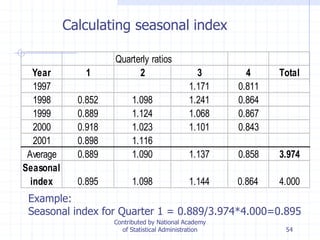

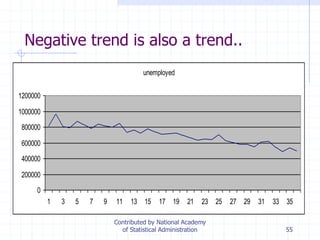

The document provides an overview of time series analysis. It defines a time series as numerical data obtained at regular time intervals that can be analyzed to describe patterns, fit models, and make forecasts. Time series are different from other data because observations are not independent. The document discusses the key components of time series, including trend, seasonal variation, cyclical variation, and irregular variation. It also covers techniques for smoothing time series data, such as moving averages, and measuring seasonal effects through seasonal indices. The overall goal of time series analysis is to understand and separate out the different variations in a time series to better predict future trends.