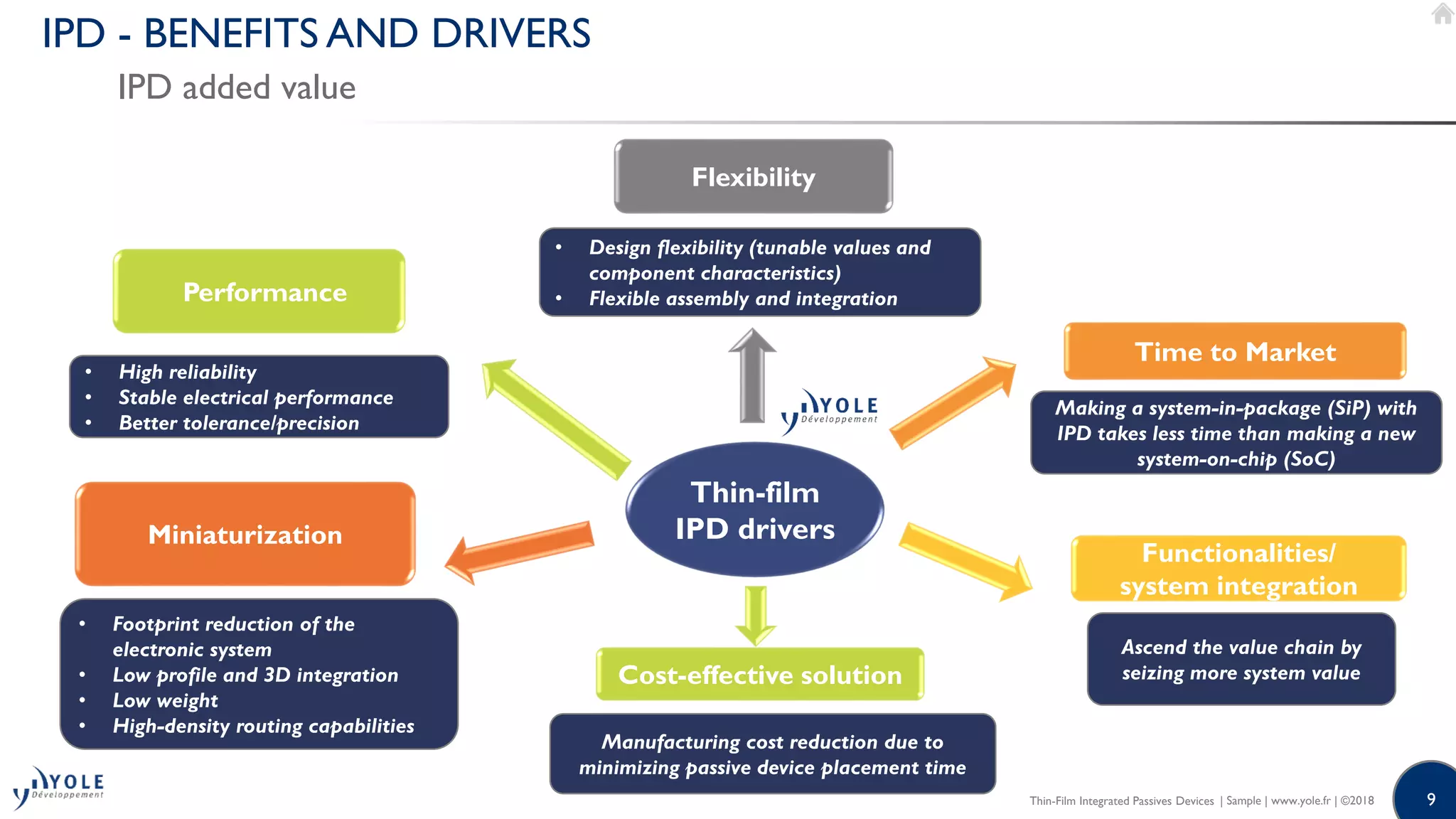

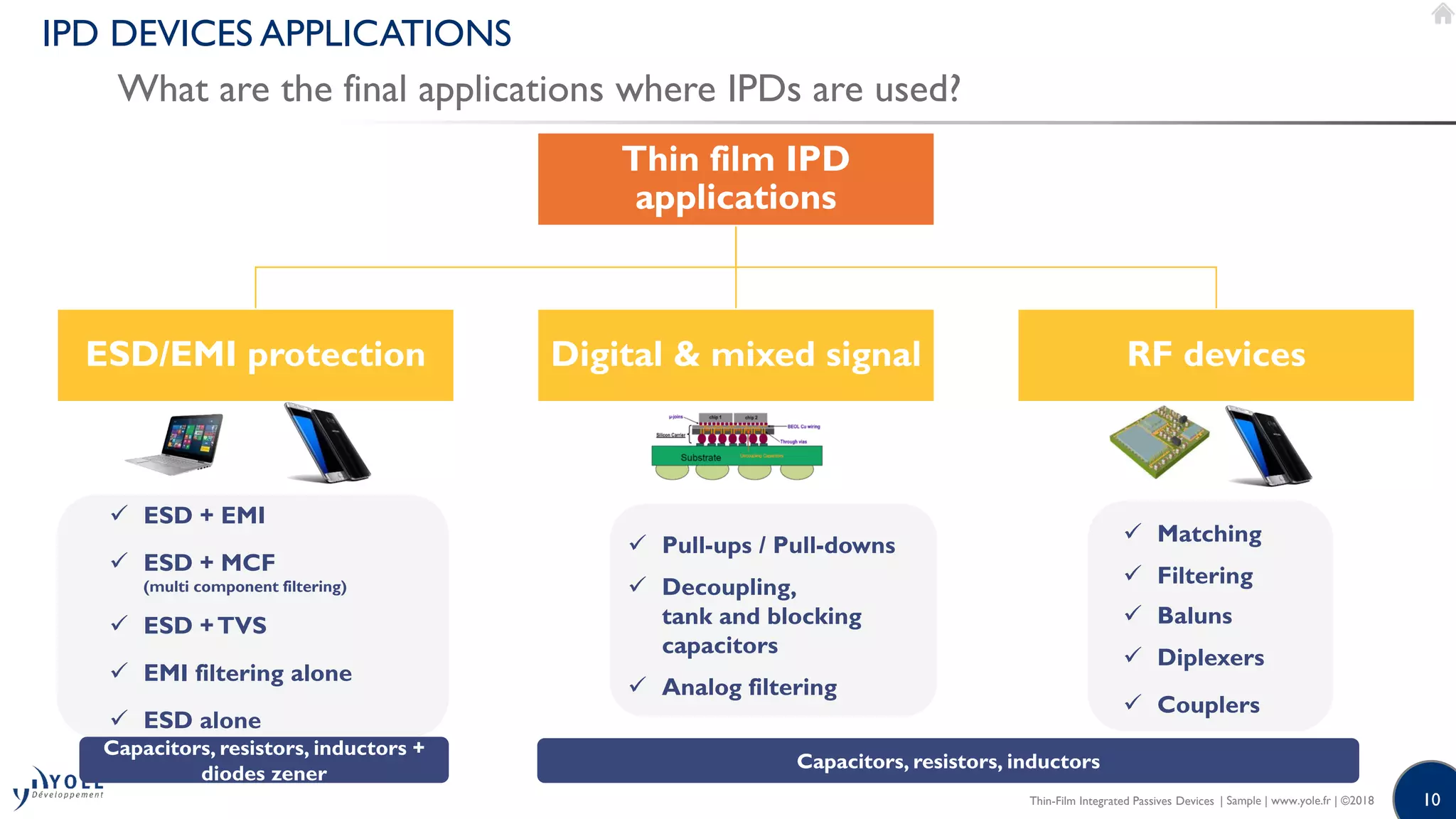

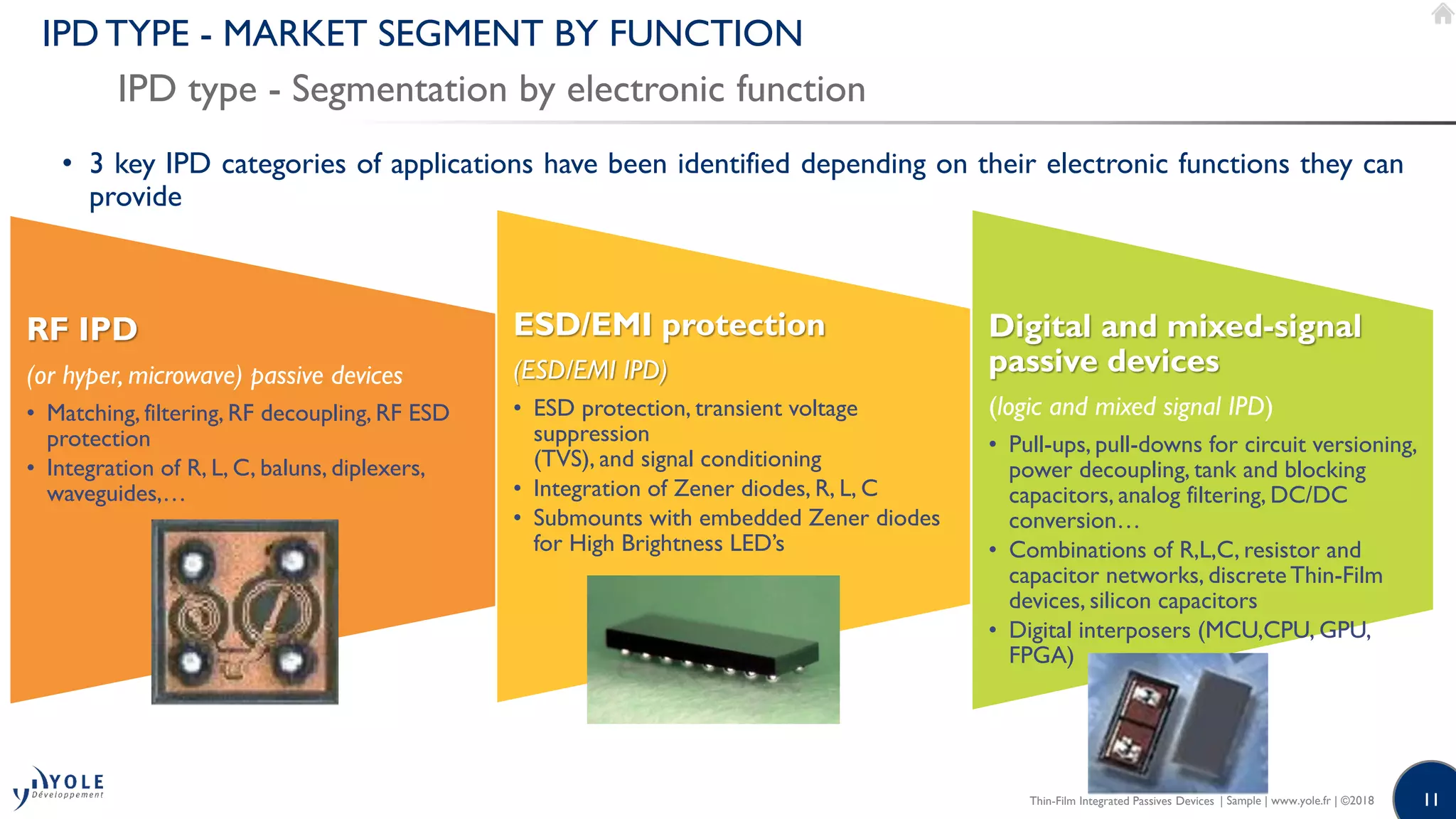

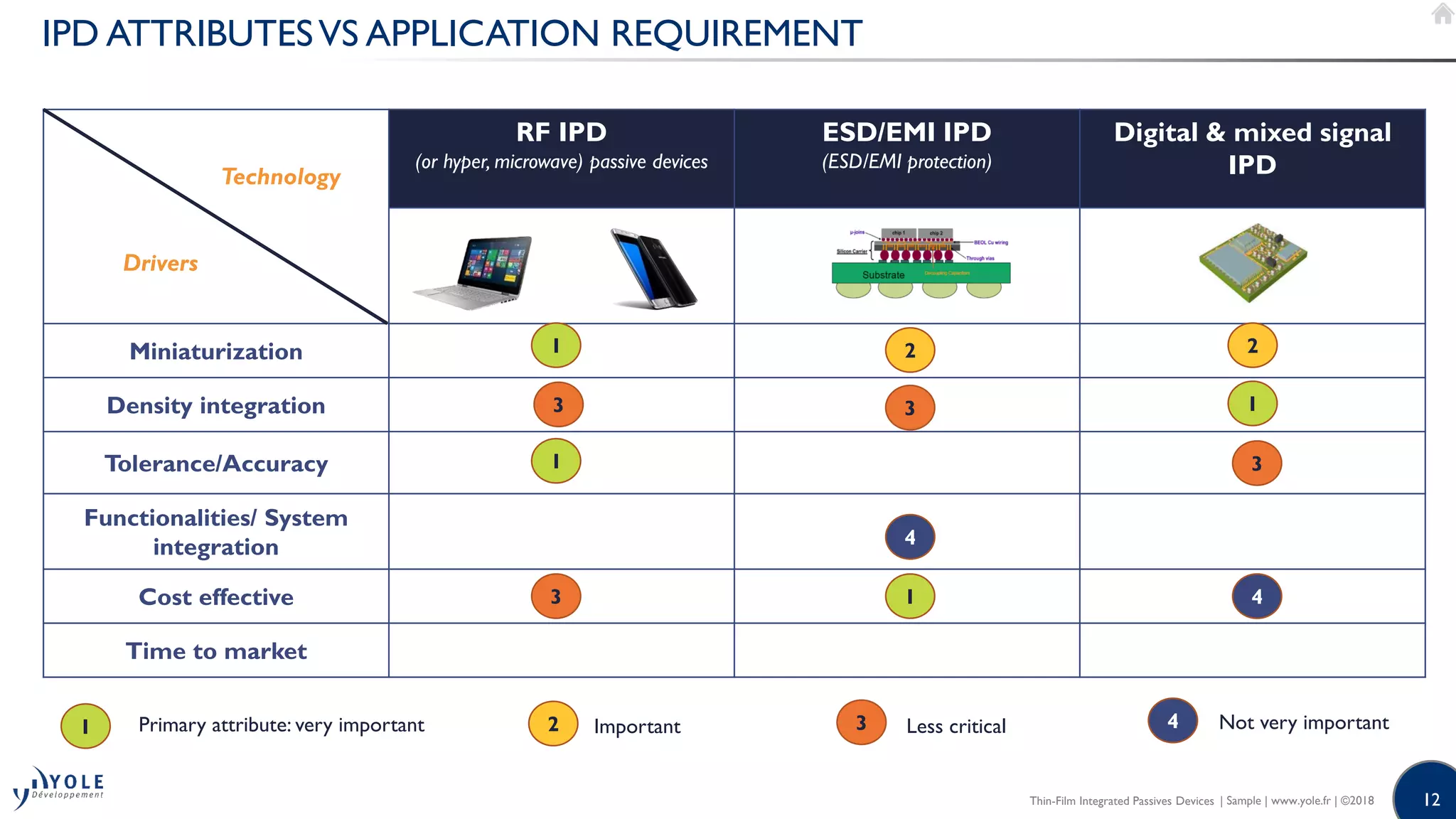

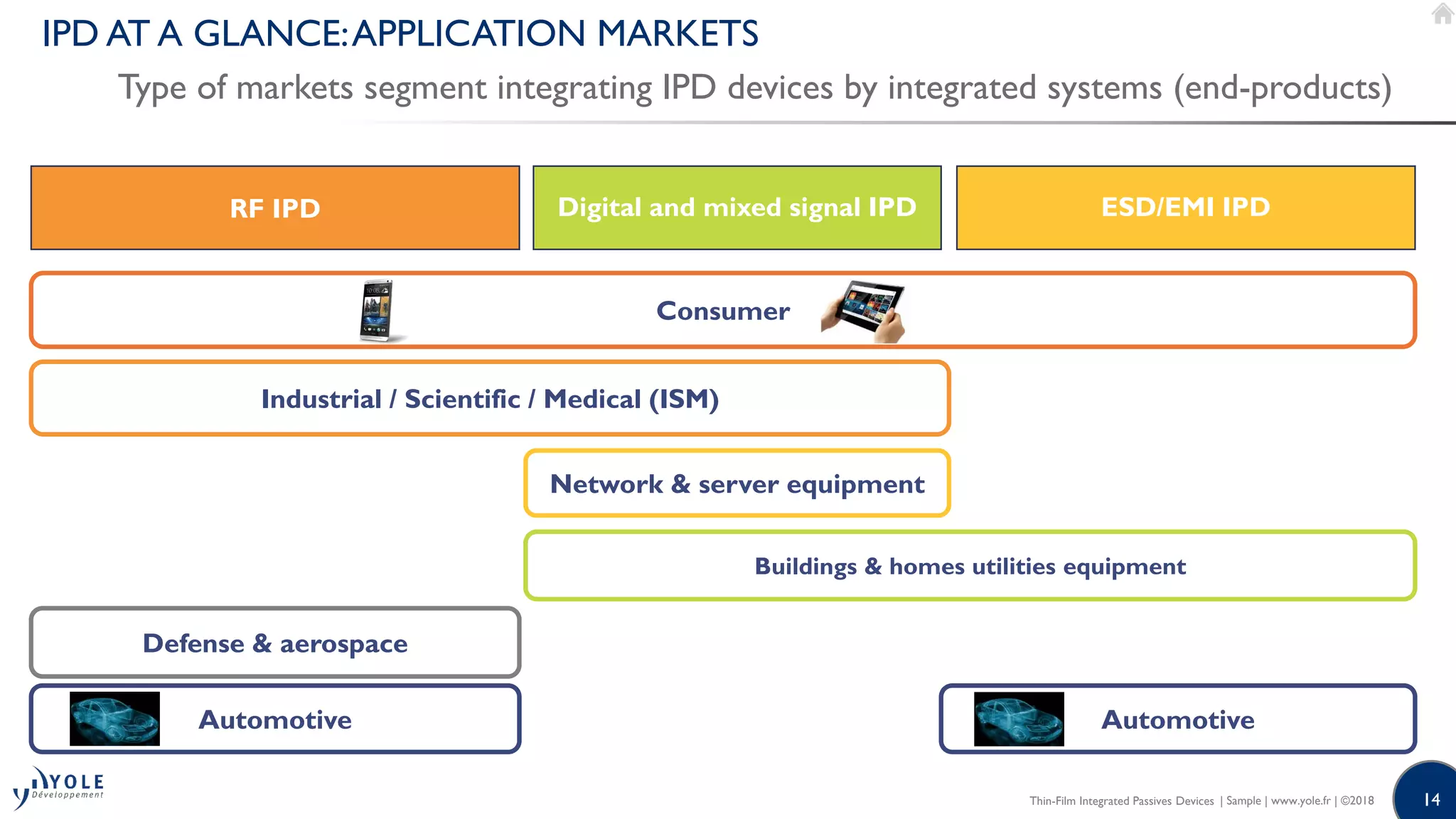

The document details Yole Développement's analysis of thin-film integrated passive devices (IPDs) for semiconductor applications, focusing on technology trends, market forecasts, and applications through 2022. It outlines the key benefits, market segmentation by application areas such as RF, ESD/EMI, and digital mixed-signal, and discusses the challenges and competitive landscape faced by IPD manufacturers. Additionally, the report provides an overview of substrate types used in IPD manufacturing and the growth of IPDs driven by miniaturization and integration in consumer electronics.