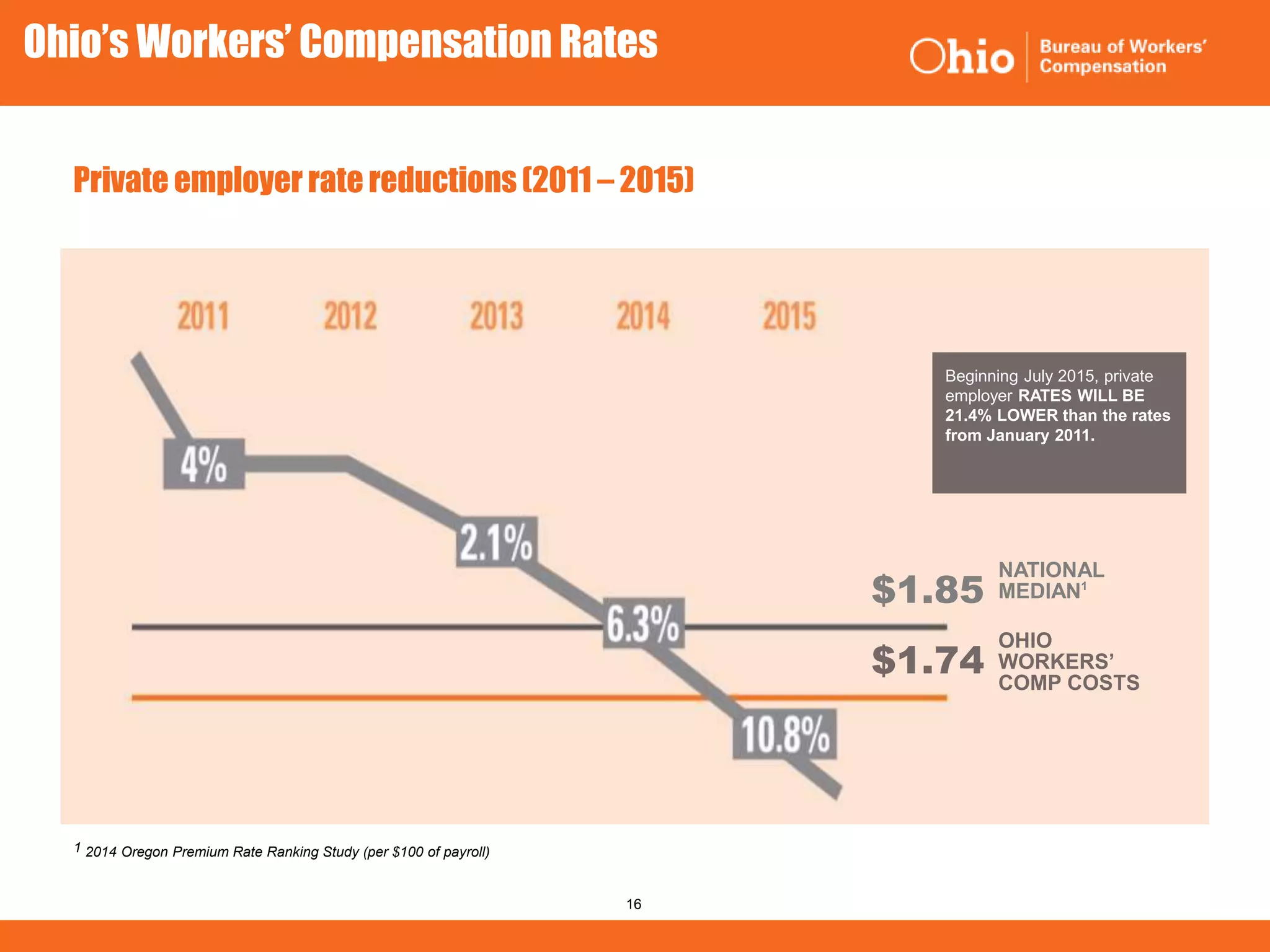

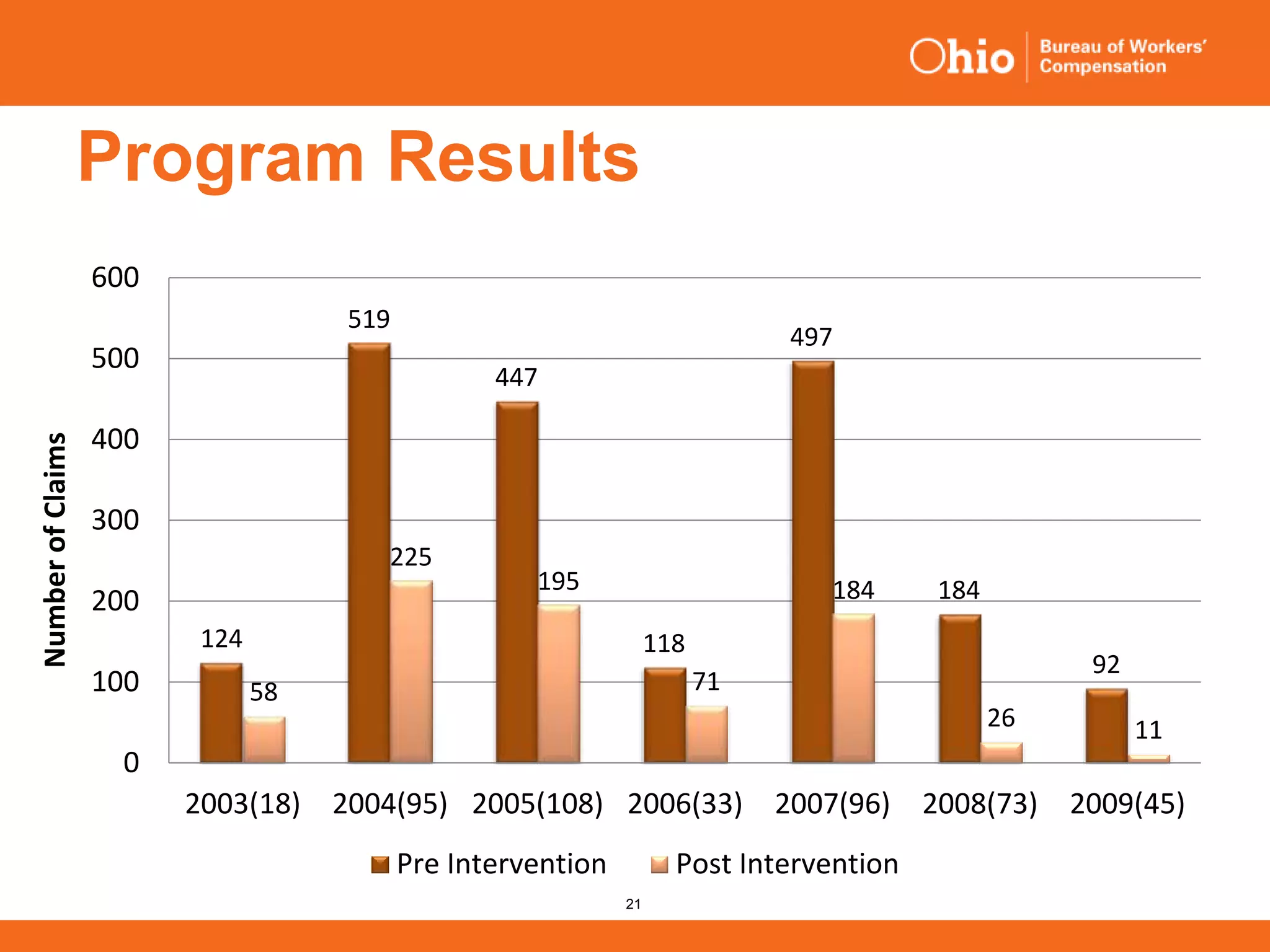

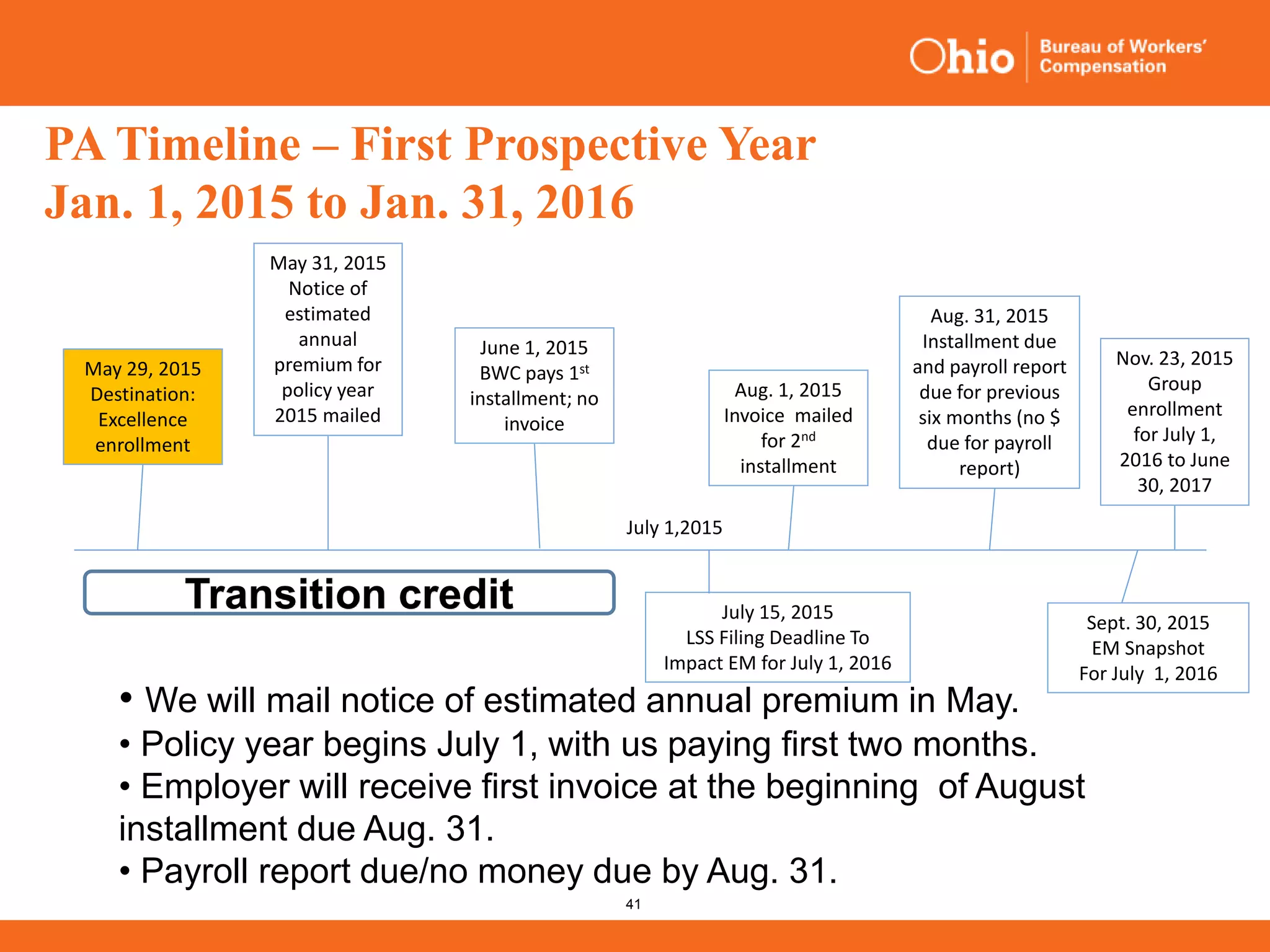

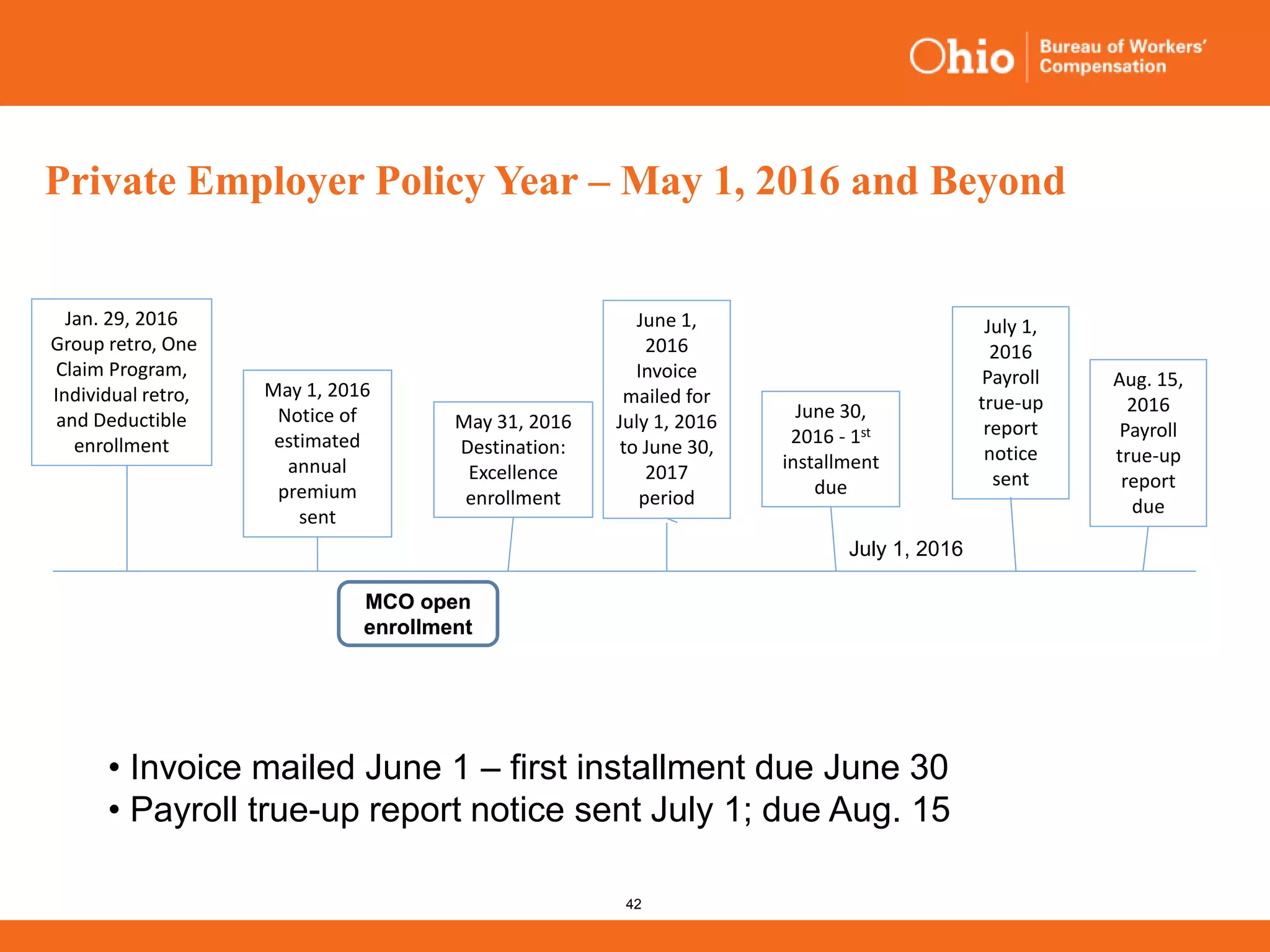

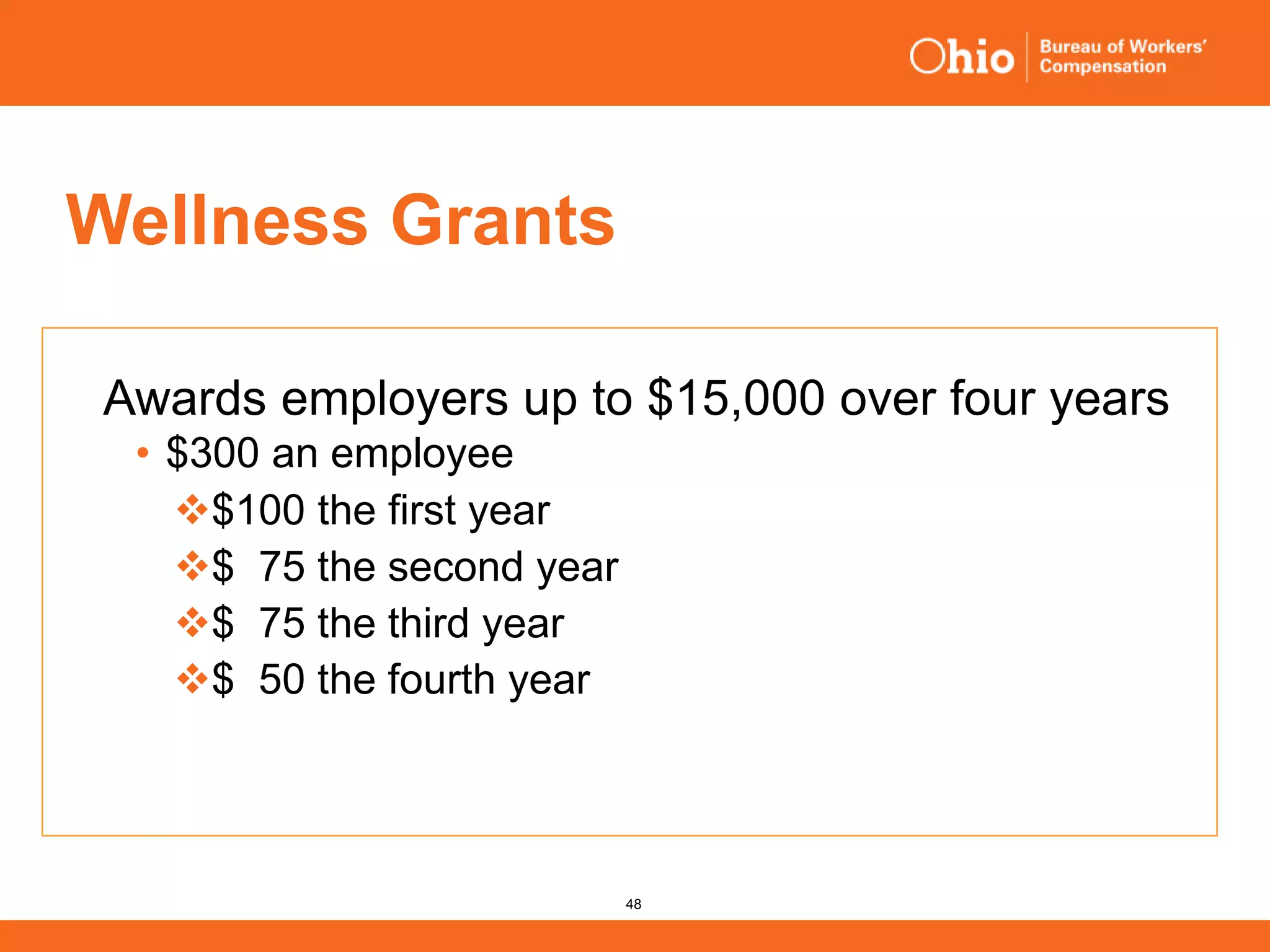

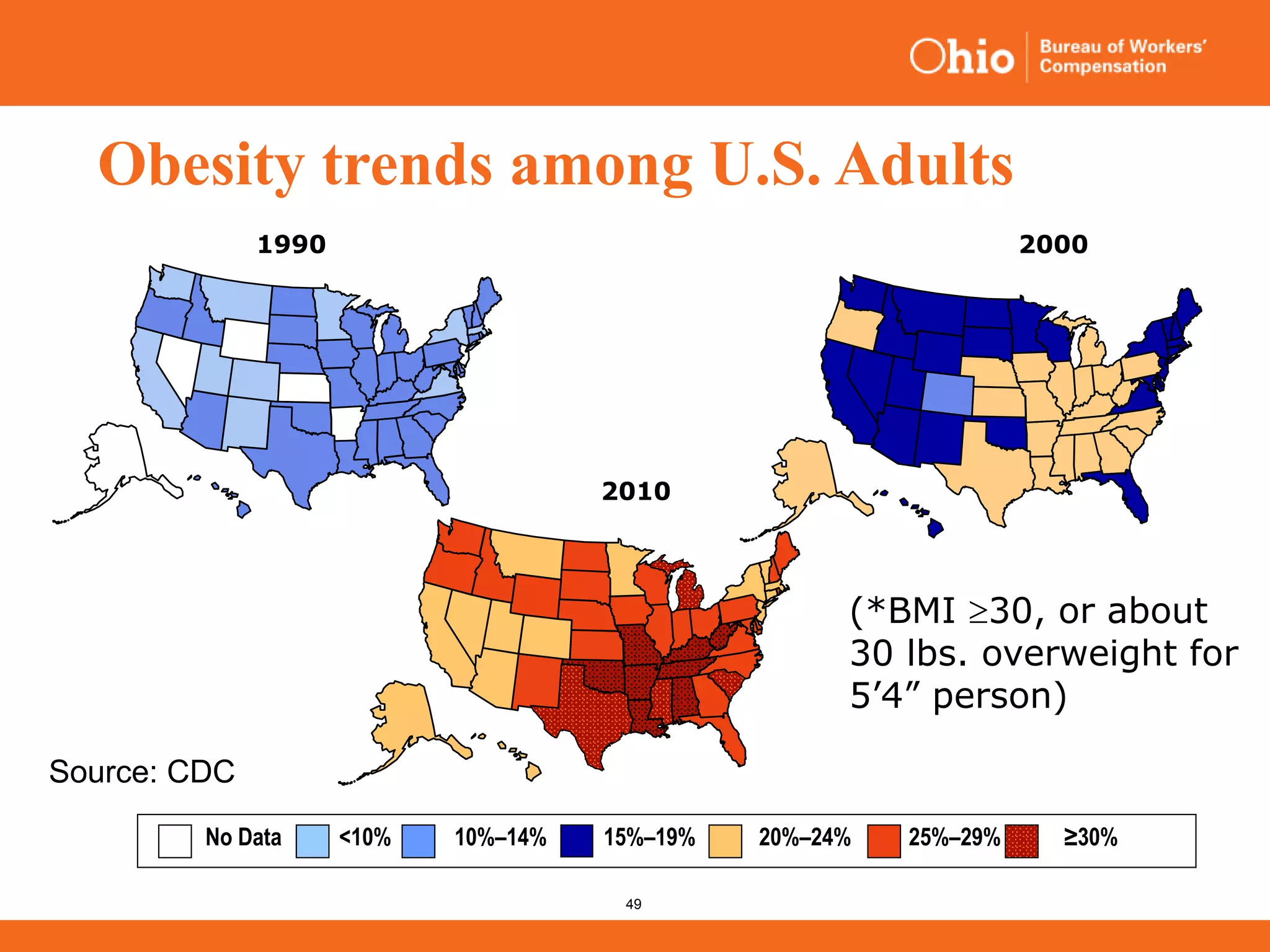

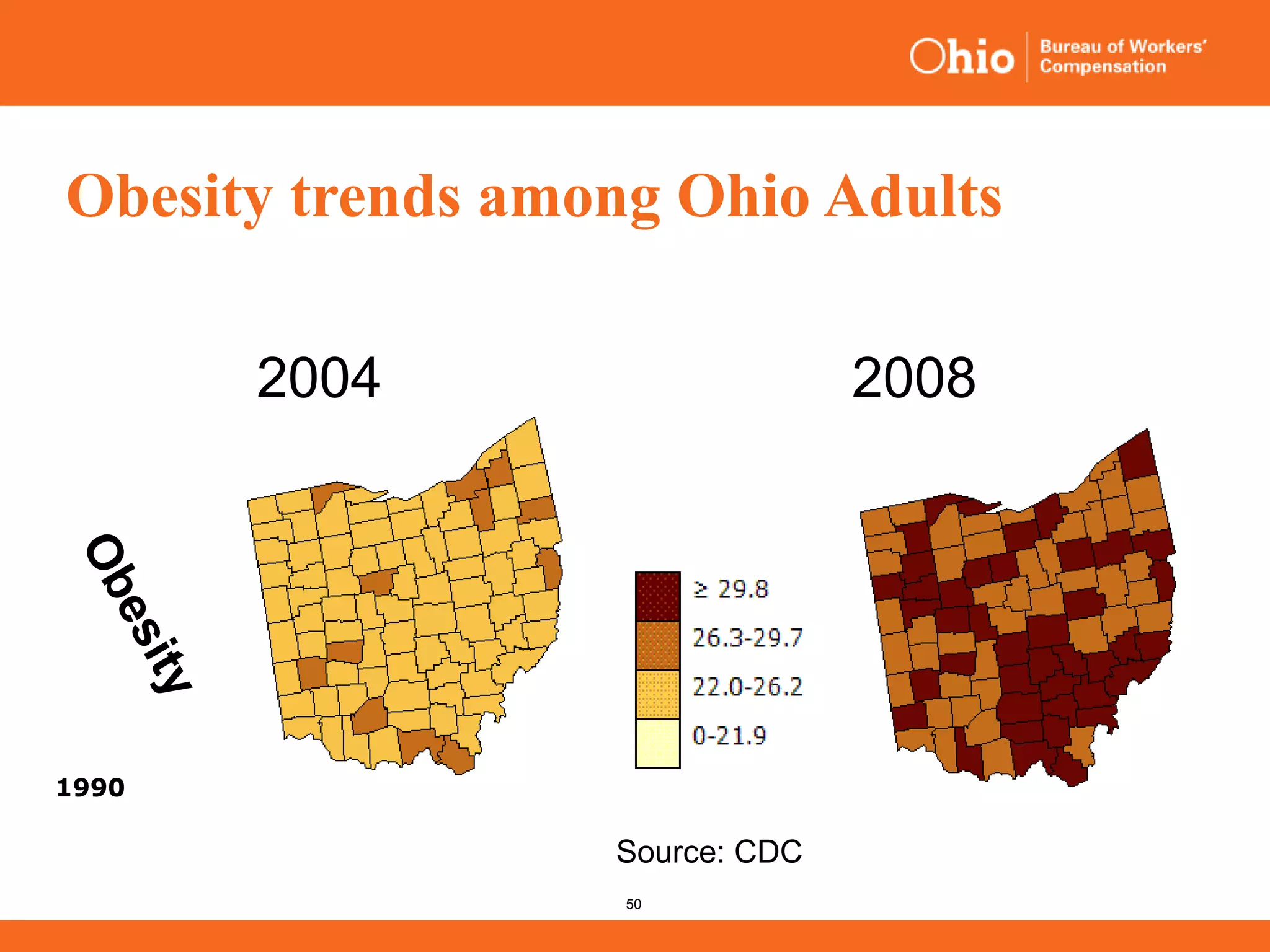

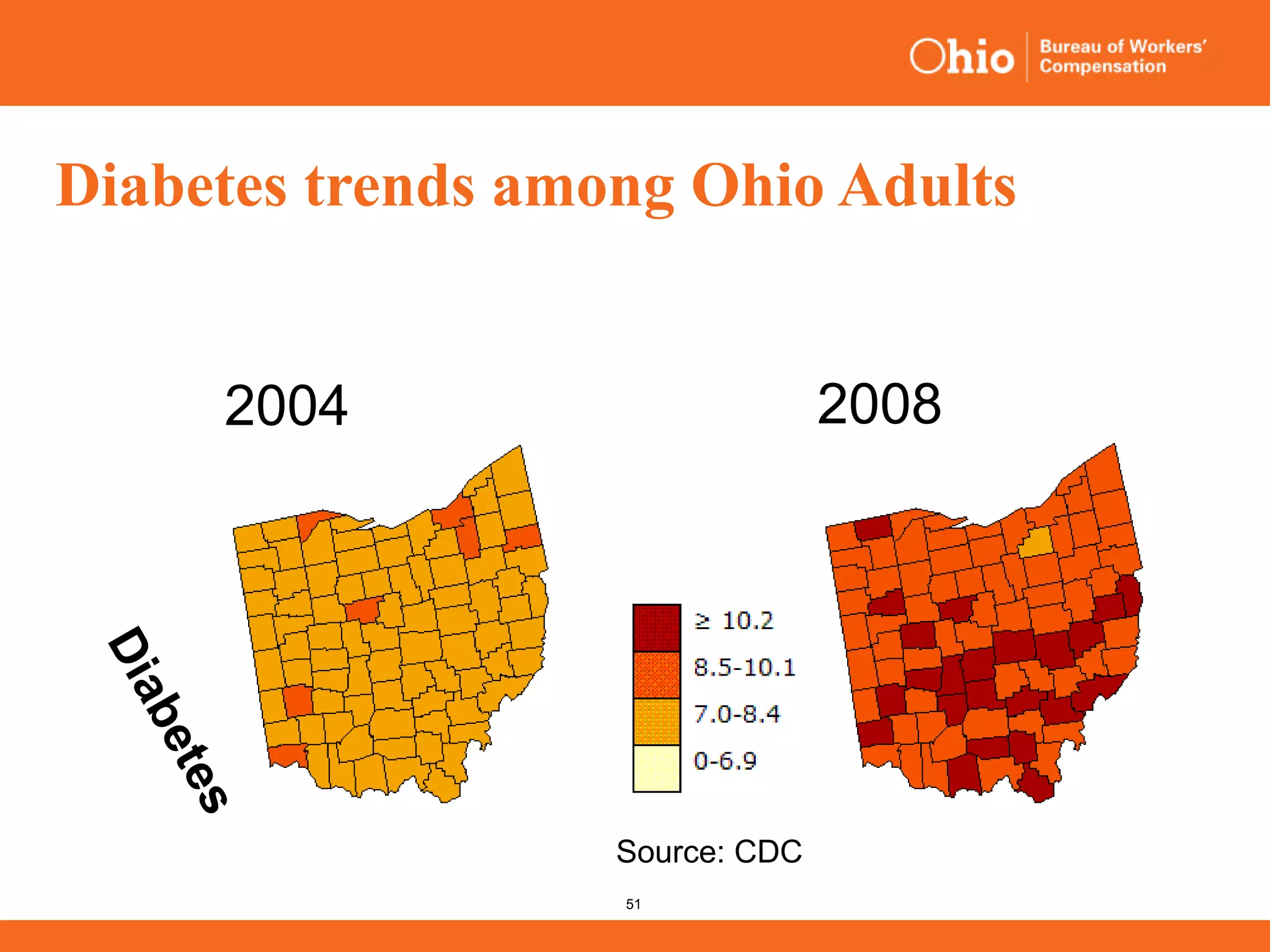

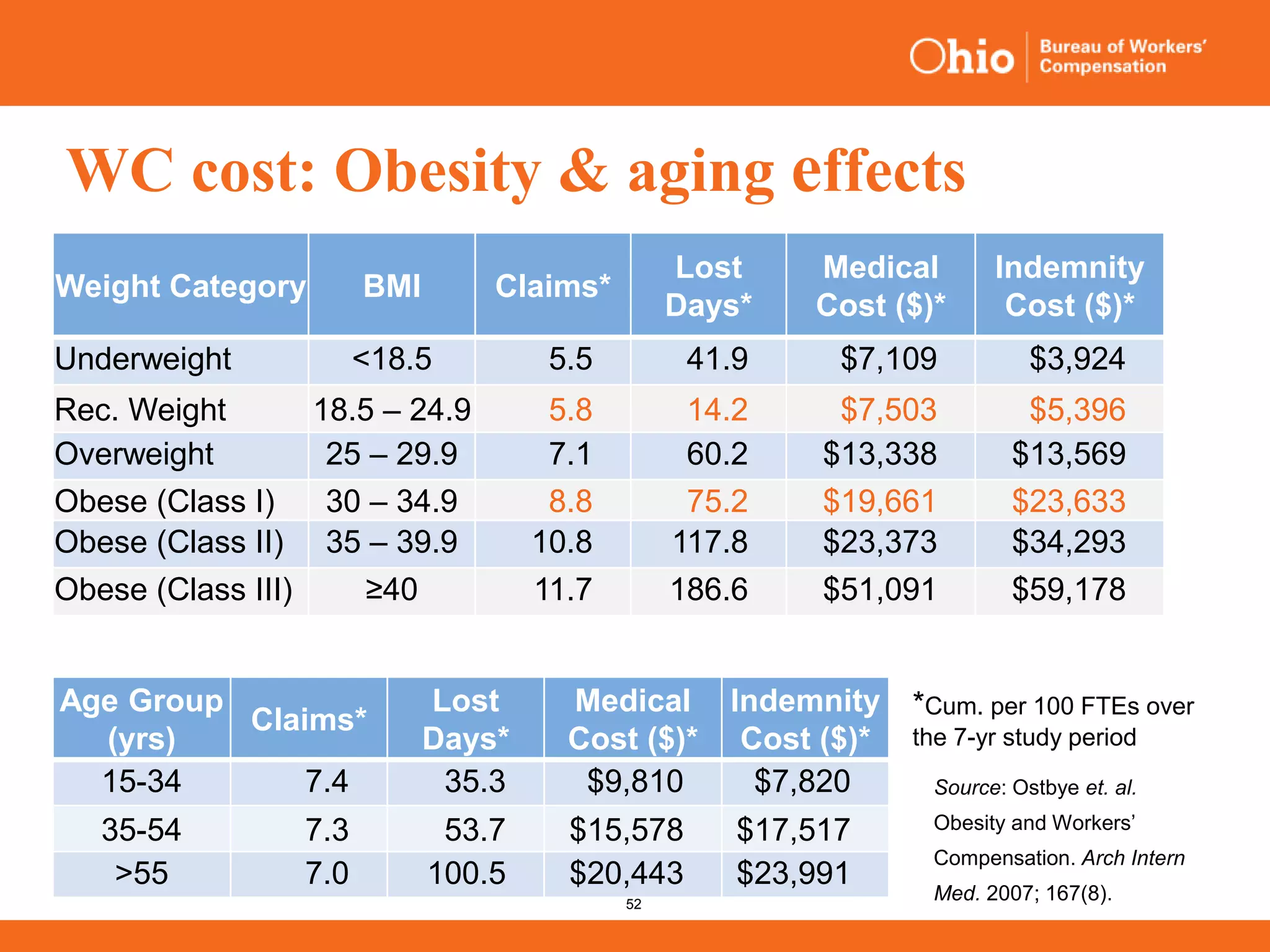

The document provides an overview of the Bureau of Workers' Compensation (BWC) in Ohio, detailing its accomplishments, such as rate reductions for private employers and increased safety grants since 2011. It introduces a new prospective billing system aimed at improving financial management and compliance while streamlining processes for employers, with a transition starting July 1, 2015. Additionally, it discusses the BWC's initiatives for safety and wellness, alongside legislative updates regarding coverage for out-of-state employees.