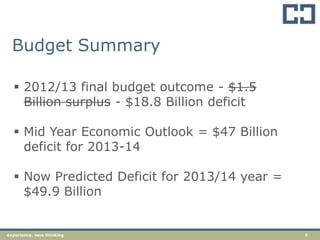

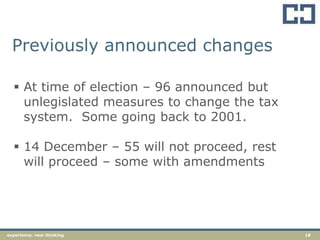

The document provides an overview and summary of the 2014 Australian Federal Budget. Key points include:

- The budget deficit for 2013-2014 is projected to be $49.9 billion.

- For 2014-2015, the deficit is projected to be $29.8 billion with large infrastructure spending.

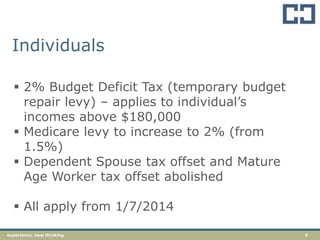

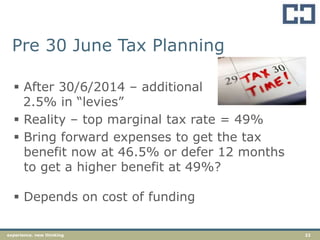

- Individual tax changes include a 2% deficit levy on incomes over $180,000, an increase to the Medicare levy, and changes to family benefits.

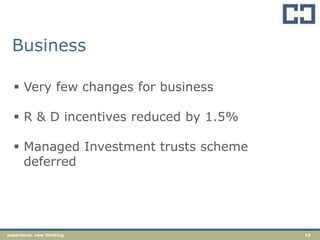

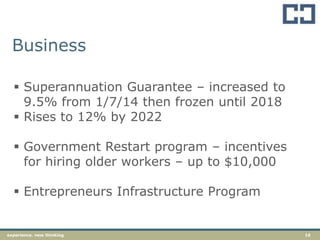

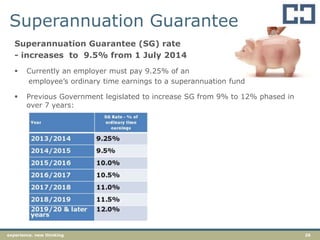

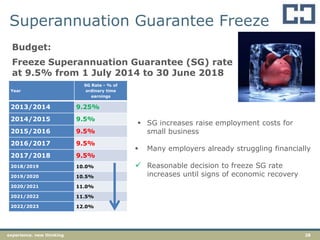

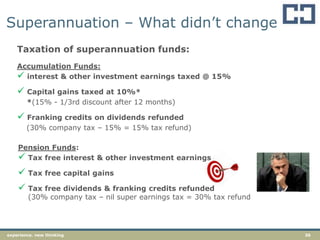

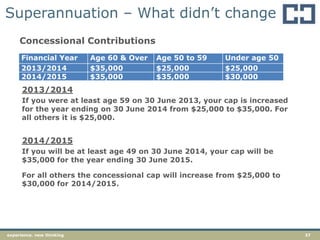

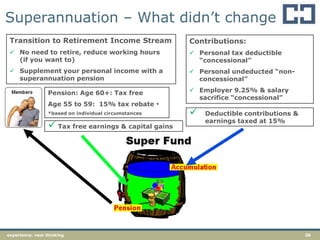

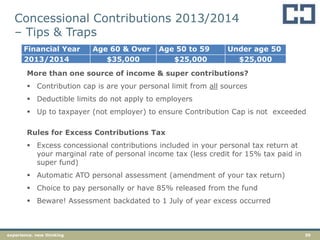

- Few changes were made for businesses, but superannuation guarantee increases are frozen until 2018.

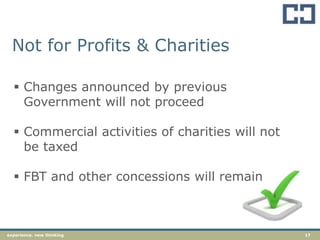

- Charities will see no changes to their tax concessions.

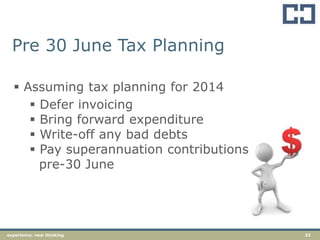

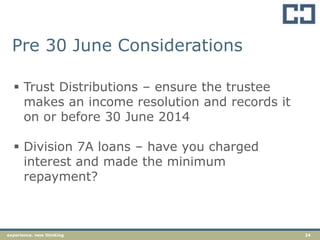

- The document recommends tax planning opportunities before June 30th given