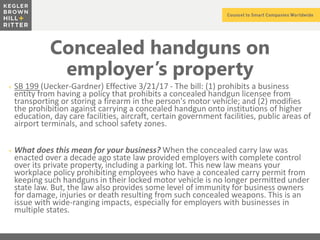

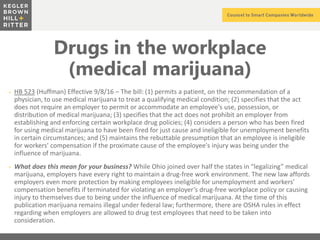

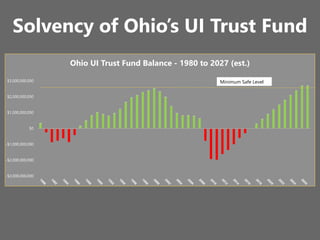

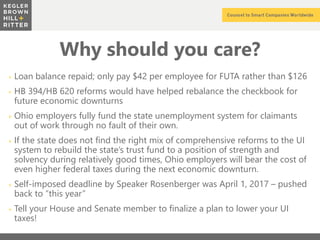

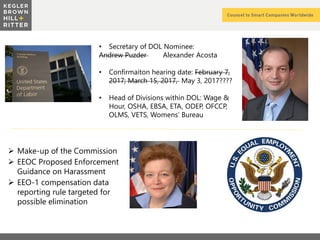

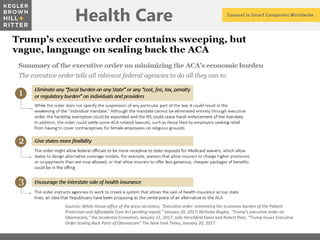

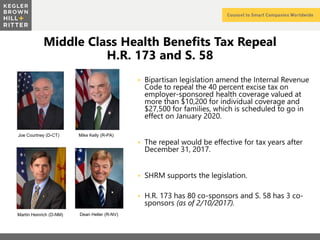

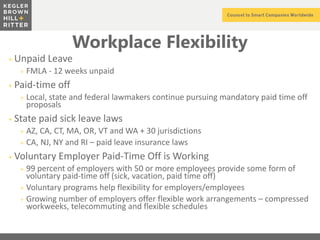

The document presents an overview of recent legislative changes impacting the HR profession in Ohio, particularly in areas such as concealed carry laws, medical marijuana, healthcare mandates, and unemployment compensation. It emphasizes the importance of advocacy for HR professionals to adapt to these changes and educate employees on the implications of new laws. Additionally, it discusses the need for ongoing reforms in unemployment compensation and healthcare policies to maintain a stable workforce and reduce employer burdens.