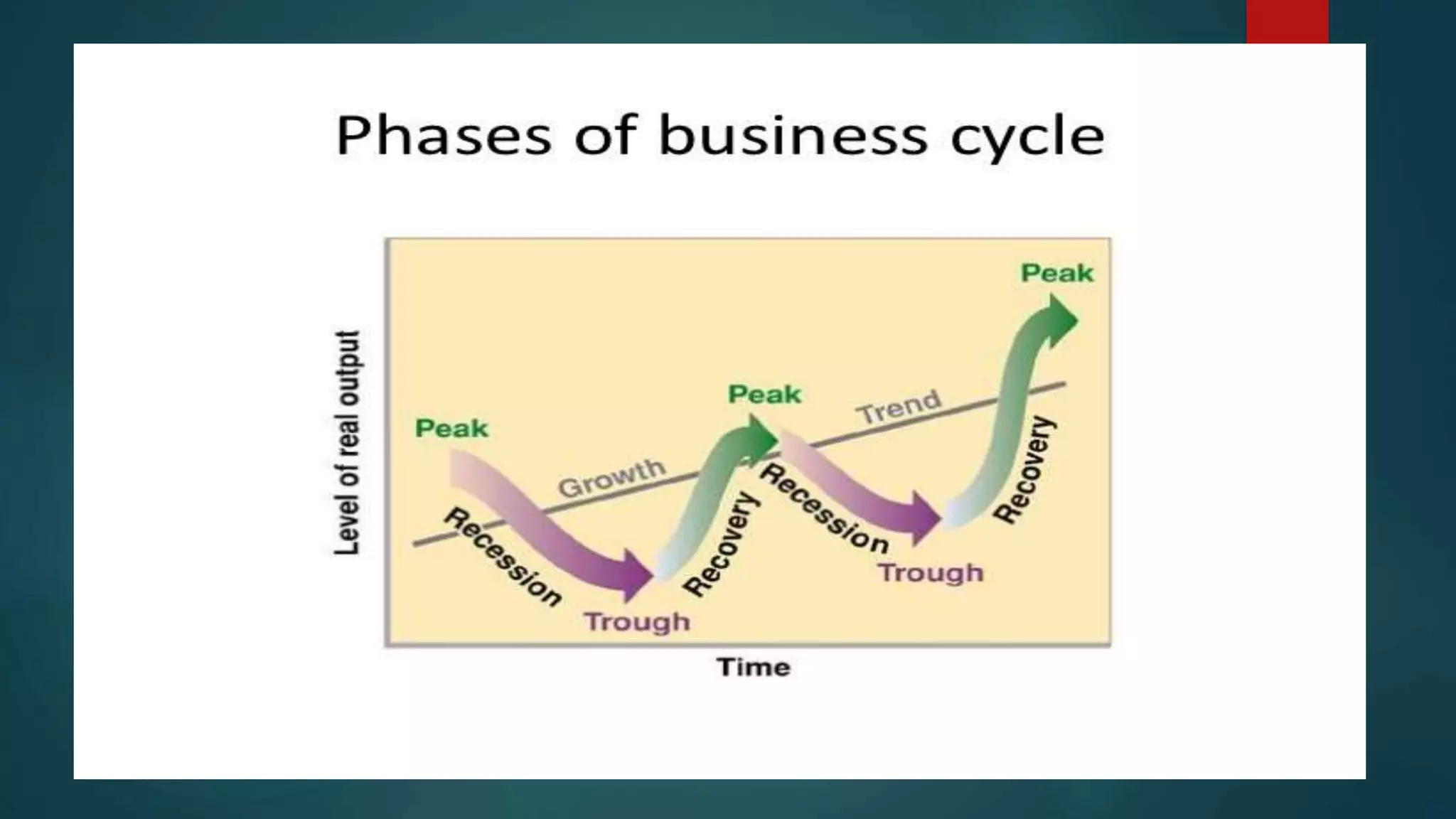

The document discusses the business cycle, which refers to periodic expansions and contractions in economic activity. It describes the four phases of a business cycle as the economic boom, recession, depression, and recovery. A recession is defined as two or more consecutive quarters of declining GDP, while a depression is a more severe recession. The characteristics of each phase are also outlined, such as high output and employment in a boom and rising unemployment and falling incomes in a recession. Theories like Keynesian and real business cycle theory are mentioned as explanations for business cycles.