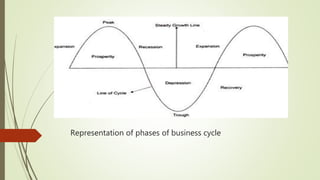

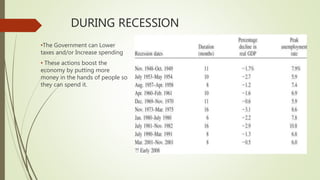

The document discusses the business cycle, which consists of periodic expansions and contractions in economic activity over time. It describes the four phases of the business cycle: expansion, peak, recession, and trough. Government uses fiscal and monetary policy tools to try to stabilize the economy during fluctuations. The business cycle affects many countries as their economies are linked through trade. While the cycle causes instability, it is an inherent part of economies with private property and competition.