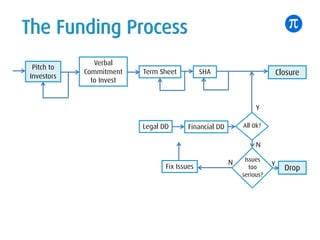

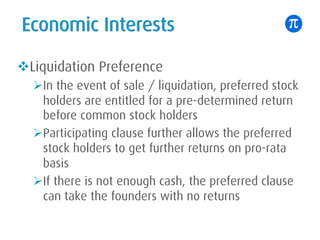

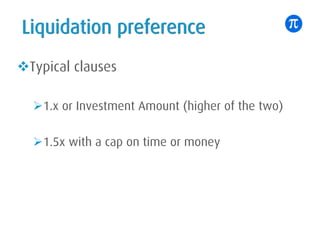

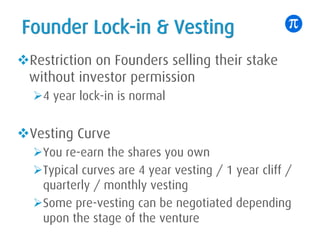

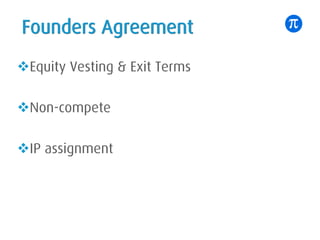

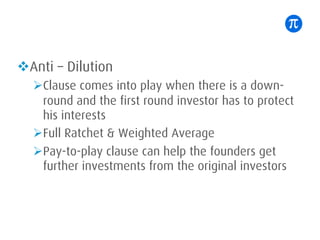

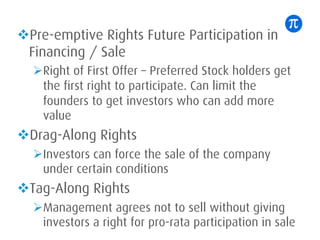

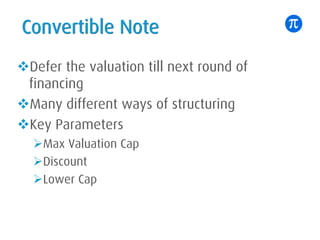

This document discusses key terms in a term sheet for startup funding. It explains typical funding stages from seed to series C and outlines economic and control interests that need to be negotiated between common stockholders and preferred stockholders. Key terms discussed include valuation, liquidation preference, founder lock-in, vesting, anti-dilution, preemptive rights, tag along rights, and exit rights. Economic interests focus on how liquidation preferences work and examples are provided. Founder lock-in and vesting curves are also explained.

![Example

Liquidation

Preference

Basic Share (CR) Participating Share (CR) Total (CR)

Simple

Prorating 10CR [20% of 50CR] NA 10CR

1x 5CR 9CR [20% of 45CR] 14CR

1.5x 7.5CR 8.5CR [20% of 42.5CR] 16CR

2x 10CR 8CR [20% of 40CR] 18CR

vAmount Invested = 5CR @ 20CR pre-money

vInvestors hold 20% stake

vCompany exited at 50CR](https://image.slidesharecdn.com/termsheets-fundamentals-200514002707/85/Term-Sheets-Fundamentals-8-320.jpg)

![Example

vAmount Invested = 5CR @ 20CR pre-money

vNumber of shares before series A = 1M

Stake 20% [5CR / 25 CR]

Number of Shares Issued 250K

Price / Share 200 INR [5CR / 250K]](https://image.slidesharecdn.com/termsheets-fundamentals-200514002707/85/Term-Sheets-Fundamentals-20-320.jpg)