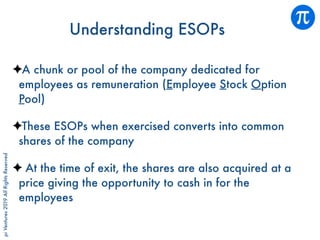

This document discusses employee stock ownership plans (ESOPs), including:

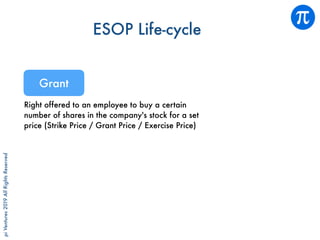

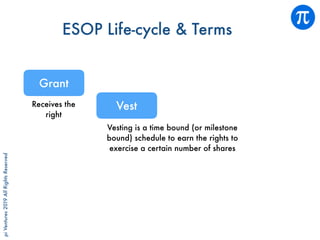

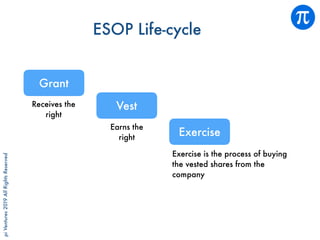

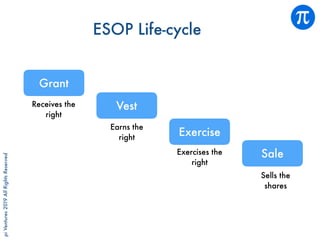

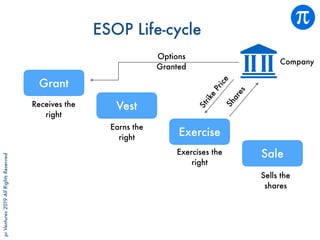

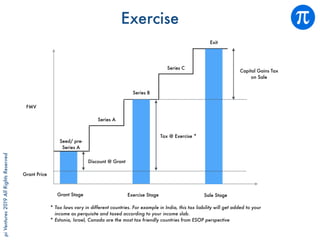

- The key stages of an ESOP including grant, vesting, exercise, and sale

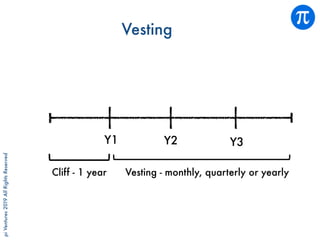

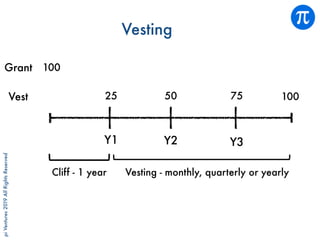

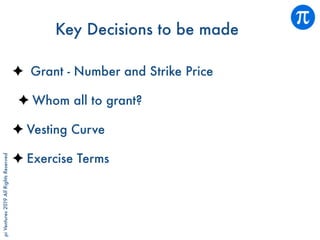

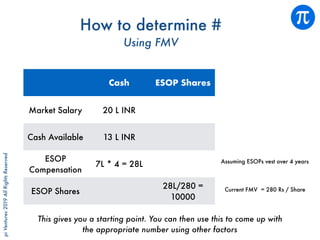

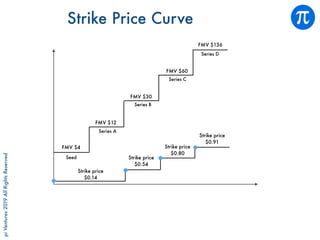

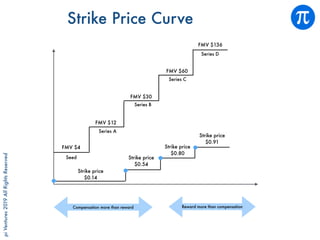

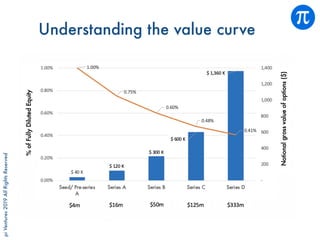

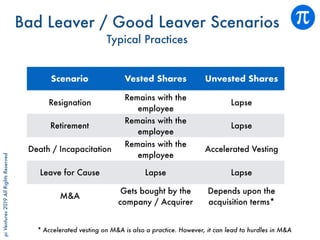

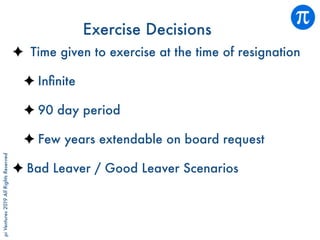

- Factors to consider when designing an ESOP like number of shares to grant, strike/grant price, and vesting schedule

- Implementing an ESOP through steps like designing the plan, communicating to employees, and issuing grant letters

- Additional considerations for founders like their agreement, equity treatment if leaving, and more

The document provides an overview of ESOPs to help understand how they work and what goes into designing and implementing an effective ESOP for a company and its employees.